Centaurus determines sustainable nickel sulphide project following scoping study at Jaguar

Pic:Getty

Independently run scoping study demonstrates potential for sustainable, long-life, low-cost nickel sulphide extraction at 100%-owned Jaguar Project in Carajas Mineral Province.

The results of the study showed the capability of the project to generate strong financial returns from the production of Class-1 nickel for global markets. Importantly, the findings also supported the delivery of economic and social benefits to the region.

Centaurus Metals Limited (ASX: CTM) was buoyed by the completion of the positive scoping study, which was completed just 18 months after acquiring the Jaguar Project, reflecting the project’s outstanding fundamentals.

Managing director, Mr Darren Gordon, said: “The Base Case Scoping Study reveals a project with compelling economics combined with an ability to deliver significant social benefits to the local community in which the Company plans to operate, over a long period of time.”

Base Case Scoping Study

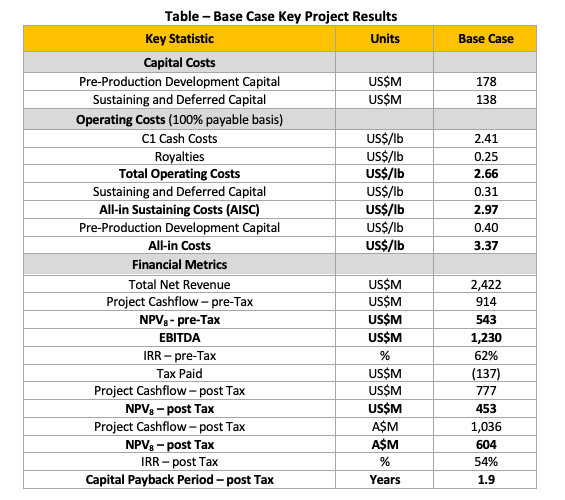

The study evaluated open pit and underground mining over an initial 10-year mine life which would deliver nickel sulphide feed to a 2.7 million tonnes per annum (Mtpa) conventional nickel flotation plant to produce approximately 20,000 tonnes of recovered nickel metal per year.

The price assumption for this study was U$16,530/tonne potentially delivering net revenue of U$2.42 billion and a post-tax internal rate of return (IRR) of approx. 54%.

As well as the promising returns based off the parameters of the study, the Jaguar Project is positioned for long term nickel production due to a number of other exclusive factors. Power generation at the project is set to be delivered through renewable sources within the local power grid, with the processing of sulphide ore rather than laterites lowering the company’s carbon footprint.

Strong social programs within the local communities focused on health, sanitation and water quality have been implemented, as have strong protocols to protect against COVID-19. The project is likely to require a construction workforce of up to 1000 people which will stimulate local economy and drive indirect employment and business opportunities. Centaurus has already awarded 80% of exploration and development work to local contractors.

The recently executed land possession agreement, announced by Centaurus last week will significantly de-risk future project development activities, with a further two agreements currently in negotiation.

Outlook

Following the scoping study results, Centaurus is committed to a Pre-Feasibility Study based on the Base Case conventional flotation option.

The company is also close to completing a value-added scoping study option that is evaluating processing the nickel concentrate using a hydrometallurgical process (POx) to produce nickel metal. The review of these two studies will allow an informed decision as Centaurus move the project forward to the Definitive Feasibility stage.

“Our goal is to transform Centaurus into a new-generation nickel sulphide mining company in Brazil, capable of delivering more than 20,000 tonne per annum of Class-1 nickel sulphides to global markets for many years to come. The scoping study clearly shows that Jaguar has all the attributes required to achieve this goal, and to do so in a sustainable and responsible manner that ensures we meet the highest possible ESG standards,” Gordon continued.

Previously, Centaurus identified significant upside out of the Jaguar project, with the latest results of the scoping study continuing to support this confidence. Four diamond drill rigs are already in operation with a reverse circulation drill set to arrive in coming weeks. The addition of this rig will continue exploration activity on multiple greenfield targets.

Centaurus expects to complete 65,000m of drilling in 2021.

This article was developed in collaboration with Centaurus Metals Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.