Bulk: Allegiance is paying $1 for a $250m coking coal operation, sort of

Pic: Getty/ Amanda Edwards / Stringer

Coal hopeful Allegiance (ASX:AHQ) will pay $1 for the shiny, (almost) production ready New Elk coking coal operation in southeast Colorado, US.

A cheap entry into coal production has worked well for small cap guys like Stanmore Coal (ASX:SMR) and Terracom (ASX:TER), which each paid a nominal $1 for the mothballed Isaac Plain and Blair Athol mines in 2015 and 2017, respectively.

READ: Stanmore continues to surprise after $1 coal mine purchase

Stanmore is up over 1000 per cent since mid-2015, while Terrcom has enjoyed a 620 per cent gain since mid-2016.

New Elk was operated between 1951 and 1970 and then mothballed due to low steel prices. A failed attempt to bring it back into production in 2011 saw a refurbished New Elk return to care and maintenance in 2013.

Allegiance first floated the game changing acquisition in mid-2019 and, following a very positive feasibility study on a project restart, has decided to officially push the button.

READ: Producers play a different tune as coal climbs out of the crapper, again

Of course, that $1 purchase price doesn’t tell the whole story.

Allegiance will need to arrange an initial $US11m ($16.1m) debt repayment to the seller comprising cash and shares.

The remaining $US30m owed to the seller will be repaid through mine earnings until the loan — interest free for a term of 10 years — is repaid in full.

To get the low cost 3-million-tonne-a-year mine up and running again will cost $US55m, according to the November feasibility study, but Allegiance reckons it can trim this back further.

Subject to raising the start-up capital and completing the acquisition, the planned date for commencement of production is early Q3 2020.

This could be a gamechanger for Allegiance if all goes according to plan.

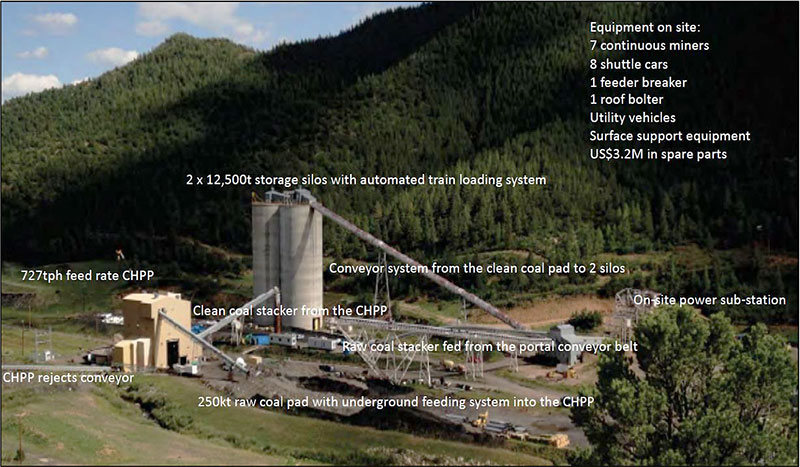

“The mine is permitted, and it is built,” managing director Mark Gray says.

“To construct the mine today would require at least $US250m in capital. The acquisition terms represent a wonderful opportunity for Allegiance.

“However, prior to committing to acquire the mine, we undertook a feasibility study in relation to a high productivity room and pillar underground mining operation. The results of that study were outstanding, convincing the directors to commit to acquire the mine.

“I am now pleased to report a binding agreement has been concluded subject only to Allegiance raising the start-up capital in respect of which discussions are advanced with a broad range of equity and debt investors.”

NOW READ: Barry FitzGerald — How Allegiance stacks up against Gina Rinehart’s new coal venture

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.