Bulk Buys: Sunny outlook stays for iron ore, coal shippers guess on timing of Chinese buyers’ return

Sunny outlook stays for iron ore prices, coal shippers guess on timing of Chinese buyers’ return. Image: Getty

- Iron ore fines prices traded this week at $US165.05 per tonne, down $US5.50 on a week ago

- Hard coking coal prices were $US13.50 higher on-week at $US118.25 per tonne at Queensland ports

- China’s reinforcing bar price is at $US660 per tonne, and steady on a week ago

China-bound cargoes of iron ore stepped down from their nine-year high of $US170.55 per tonne reached last week to $US165.05 per tonne ($213.50/tonne) this week.

The traded price includes bulk vessel freight costs to destination ports and shipping costs have been rising partly because of delays in unloading coal cargoes at Chinese ports.

Futures prices for iron ore were trading at a slight discount to physical cargo prices, with the Singapore Exchange’s February contract at $US162 per tonne, Wednesday.

Market analysts are expecting China’s demand for iron ore to stay robust in 2021, with some anticipating further price rises for the steel-making ingredient.

“Five years of mining sector deleveraging and capital discipline from 2015-2020 and a lack of high-quality greenfield projects across most commodities sets this next cycle up as more of a supply-side driven rally as global demand recovers from the COVID-19 pandemic,” analysts at US investment bank Goldman Sachs said.

Shipments of iron ore from Australia’s north west ports have been running at record levels recently in the absence of any disruption from severe weather events such as cyclones.

A potential tropical cyclone that appeared to be forming off WA’s Pilbara coast last week failed to materialise and was downgraded to a low pressure storm at the weekend.

Some flooding and road closures were expected in the Pilbara region from the storm which passed by without any significant impact.

In the 2020 year, 874.2 million tonnes of iron ore was shipped from WA’s Pilbara ports, up 3 per cent on 2019’s volume of 849 million tonnes.

BHP and Rio Tinto target higher ore shipments in 2021

Rio Tinto (ASX:RIO) is forecasting higher shipments of its Pilbara iron ore product in 2021 of between 325 million to 340 million tonnes, according to its latest production report.

This indicates a rise of up to 9 million tonnes at its upper forecast range on the 331 million tonnes of iron ore Rio Tinto shipped in 2020.

“First ore from the Robe River joint venture sustaining production projects (West Angelas C, D and Mesa B, C and H at Robe Valley) is still expected in 2021,” the company said.

Adding: “Gudai-Darri (formerly Koodaideri project) progress continues with production ramp-up on track for early 2022.”

Approximately 30 per cent of iron ore sales for Rio Tinto were on a free-on-board price basis, and 70 per cent were sold on a delivered basis that included freight costs.

BHP (ASX:BHP) also made record shipments of iron ore in the 2020 year of 288 million tonnes, according to its latest operations report released last week.

The iron ore producer has reiterated its production guidance for the June 2021-ended financial year at between 276 million and 286 million tonnes.

“Production in the March 2021 quarter is expected to be impacted by planned ore handling plant maintenance across the mines and continued Mining Area C and South Flank tie-in activity,” said BHP.

The company restarted in December pellet production in Brazil operated by its Samarco joint venture with Brazilian miner Vale, and is expected to add up to 8 million tonnes of annual production capacity.

Iron Road to produce pellets product using green hydrogen

ASX iron ore company, Iron Road (ASX:IRD), is developing a green hydrogen project for iron ore pellet production in South Australia’s proposed Cape Hardy port.

The project could serve as a prototype for green hydrogen projects in Australia’s iron ore sector as it moves from the drawing board and into reality over the next few years.

Hydrogen Utility (H2U), a developer of green hydrogen projects in Australia, is a partner in the project, as is Japanese engineering and technology company Mitsubishi Heavy Industries.

The company’s chief executive Larry Ingle told Stockhead about the project and the reasons underlying Iron Road’s investment in green hydrogen.

Iron Road is in good company when it comes to using hydrogen in its production process, as Fortescue Metals Group (ASX:FMG) and GFG Alliance are following a similar path.

FMG’s chairman Andrew Forrest outlined his company’s plans for zero-carbon steel production in a groundbreaking speech at the weekend that was televised on ABC TV.

FMG plans to have Australia’s first green steel pilot plant up and running in WA’s Pilbara region in the next few years. It will be powered by green electricity, both wind and solar.

Fellow billionaire industrialist Sanjeev Gupta and his GFG Alliance group plan to produce green steel in a modern facility at the Whyalla steelworks in South Australia that will initially run on natural gas, and later hydrogen.

ASX iron ore company share prices

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| MGT | Magnetite Mines | 0.023 | 64 | 77 | 515 | $ 59,983,416.36 |

| FMS | Flinders Mines Ltd | 1.37 | 38 | 36 | 11 | $ 204,306,778.17 |

| SRK | Strike Resources | 0.25 | 19 | 67 | 372 | $ 63,019,238.34 |

| GRR | Grange Resources. | 0.36 | 14 | 24 | 47 | $ 428,215,318.26 |

| AKO | Akora Resources | 0.45 | 6 | 27 | 0 | $ 23,576,205.33 |

| CIA | Champion Iron Ltd | 5.58 | 3 | 14 | 109 | $ 2,783,964,490.93 |

| MIN | Mineral Resources. | 37.57 | -2 | 5 | 116 | $ 7,325,126,938.84 |

| FMG | Fortescue Metals Grp | 23.83 | -4 | 1 | 91 | $ 77,897,812,425.40 |

| LCY | Legacy Iron Ore | 0.033 | -6 | -3 | 1550 | $ 206,158,871.06 |

| MGX | Mount Gibson Iron | 0.905 | -7 | -3 | -4 | $ 1,162,198,834.44 |

| FEX | Fenix Resources Ltd | 0.24 | -8 | 9 | 329 | $ 117,965,619.20 |

| MAG | Magmatic Resrce Ltd | 0.15 | -9 | -12 | -42 | $ 28,065,474.72 |

| ADY | Admiralty Resources. | 0.015 | -12 | 15 | 150 | $ 17,387,020.49 |

| EUR | European Lithium Ltd | 0.086 | -14 | 83 | -5 | $ 61,107,141.23 |

| TI1 | Tombador Iron | 0.086 | -14 | 41 | 294 | $ 62,519,792.16 |

Steel rebar prices in China steady ahead of Lunar holiday

Steel reinforcing bar (rebar) has steadied this week in the Chinese market at $US660 per tonne and is off from its peak of $US700 per tonne in early January.

Used in construction and infrastructure projects, rebar is a critical steel component and for this reason its price is carefully monitored by industry analysts.

On the London Metal Exchange, prices for its rebar contract for month-ahead delivery peaked around $US660 per tonne in early January.

They were trading at $US630 per tonne this week on the LME, and some market participants suggest their downtrend may continue as construction in China slows for mid-February’s Lunar New Year holiday.

The adjustment in product prices for steel rebar will not be encouraging for Chinese steel producers trying to balance higher input costs in terms of iron ore.

But higher iron ore prices may be here to stay for some time, according to mining analysts who published price outlooks for the commodity this week.

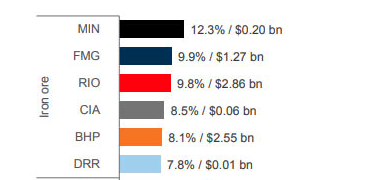

“Buoyant iron ore prices and positive leading indicators (such as relatively low port stocks and positive steel margins) underpin our bullish stance on iron-ore exposure,” analysts at Macquarie bank said in a research note.

The bank’s analysts highlighted Champion Iron (ASX:CIA), Fortescue Metals Group, Deterra Royalties (ASX:DRR), Mineral Resources (ASX:MIN) and Mount Gibson Iron (ASX:MGX) as ASX iron stocks to watch.

Asian buyers flock to Australian ports for coking coal cargoes

Cargoes of Australian hard coking coal for February shipment had a spot price of $US118.25 per tonne at Queensland ports this week, according to Metal Bulletin.

This represents a week-on-week price rise of $US13.50 per tonne on $US104.75 per tonne as Asian steelmakers scramble for this top quality steel-making product.

Steel producers in India and other Asian countries appear to be maximising the opportunity to purchase cargoes while Chinese buyers are thin in presence.

Trades for premium quality Australian hard coking coal cargoes with a March shipment date were heard in the market at $US146.75 per tonne.

The size of the cargoes, Panamax-vessel sized, at 70,000 to 80,000 tonnes suggests they were lifted by non-Chinese buyers.

This is because Chinese buyers prefer larger shipments when it comes to coking coal of about 150,000 tonnes that are dispatched in Capesize vessels.

“Instead of being delivered to China, Australian coal is now finding customers in alternative destinations including India, Pakistan and the Middle East, and traded coal historically delivered into these markets is finding its way into China,” said Whitehaven Coal in a report.

Premium prices paid by China for North American cargoes

Some business was heard transacted by Chinese buyers for North American coking coal shipments for loading in late February at ~$US220 per tonne delivered China price basis.

These transaction prices for North American coking coal represent a premium of $US100 per tonne to comparable cargoes from Australia.

Chinese buyers have been slow to return to the Australian coking coal market and appear to be waiting for an opportune time to do so.

The looming Lunar New Year holiday in China next month means that Chinese steel mills would have prospective interest for March-loading cargoes of Australian coking coal.

China imported 35.3 million tonnes of Australian coking coal in the 2020 year, up 14.7 per cent on year from 30.8 million tonnes in 2019, reported Argus Media.

But the import statistics mask the fact that China’s imports of Australian origin coking coal fell to zero in December as a result of changing buying behaviour.

Chinese steel mills have replaced Australian coking coal with imports from Canada, Russia, Mongolia and the US, and market watchers will be waiting to see if this trend continues.

Timing on Chinese buyers’ return to Australian market

Some market participants are taking comfort in reports that Chinese ports have allowed one or two coal ships to berth and unload their cargoes.

Expectations that this may lead to a clearing of the large backlog of coal shipments queueing off China may be premature, according to reports.

“With authorities signalling that the formal ban will remain in place for the foreseeable future, Chinese buyers of these cargoes have sought to sell them into other markets,” Braemar ACM said in a note to clients.

Data from shipping company Braemar ACM showed nearly 20 Capesize ships and nearly 50 Panamax vessels laden with Australian coal are waiting off Chinese ports.

This volume is equivalent to 6.5 million tonnes of coal, and the waiting ships have been at anchorage off the Chinese coast for 180 days on average.

Futures prices for Australian coking coal have moved roughly $US10 per tonne higher this week, as market participants expect cargo prices to continue to go up.

For March settlement, the CME’s futures contract was trading at $US148 per tonne, a rise of $US16 per tonne, said CME data.

April and May-dated coking coal futures were quoted at ~$US150 per tonne, and rising to $US160 per tonne for end of year settlement.

“We continue to monitor for any potential impacts on volumes from restrictions on coal imports into China,” said BHP in its latest operations report.

BHP’s production of coking coal decreased 5 per cent to 19 million tonnes in the six months ended December 2020, or 34 million tonnes on a 100 per cent production basis.

“Guidance for the 2021 financial year remains unchanged at between 40 million and 44 million tonnes (71 million and 77 million tonnes on a 100 per cent basis), with a stronger second half performance projected in line with our plans,” the company said.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| AHQ | Allegiance Coal Ltd | 0.089 | 24 | 75 | -32 | $ 68,933,796.08 |

| MR1 | Montem Resources | 0.25 | 14 | 4 | 0 | $ 39,133,024.80 |

| JAL | Jameson Resources | 0.11 | 10 | 0 | -41 | $ 33,366,507.90 |

| NAE | New Age Exploration | 0.014 | 8 | 40 | 367 | $ 16,618,425.74 |

| CRN | Coronado Global Res | 1.3 | 4 | 20 | -37 | $ 1,771,364,992.00 |

| PDZ | Prairie Mining Ltd | 0.28 | 4 | 56 | 33 | $ 57,088,772.25 |

| TIG | Tigers Realm Coal | 0.01 | 0 | 11 | 16 | $ 130,535,947.68 |

| ATU | Atrum Coal Ltd | 0.27 | 0 | -7 | -23 | $ 148,065,582.72 |

| LNY | Laneway Res Ltd | 0.007 | 0 | 0 | 17 | $ 30,200,527.46 |

| YAL | Yancoal Aust Ltd | 2.35 | -1 | -3 | -19 | $ 3,155,850,254.43 |

| SMR | Stanmore Coal Ltd | 0.835 | -2 | 5 | -14 | $ 225,789,294.74 |

| CKA | Cokal Ltd | 0.078 | -3 | 13 | 73 | $ 74,891,167.35 |

| TER | Terracom Ltd | 0.155 | -3 | -9 | -52 | $ 113,041,144.50 |

| PAK | Pacific American Hld | 0.025 | -4 | 14 | -3 | $ 7,550,037.60 |

| BCB | Bowen Coal Limited | 0.046 | -4 | 2 | -21 | $ 42,244,301.79 |

| NCZ | New Century Resource | 0.21 | -5 | -5 | -21 | $ 272,233,810.35 |

| BRL | Bathurst Res Ltd. | 0.054 | -7 | 38 | -53 | $ 94,023,568.71 |

| AKM | Aspire Mining Ltd | 0.105 | -9 | 17 | -13 | $ 53,301,883.43 |

| WHC | Whitehaven Coal | 1.56 | -12 | -6 | -36 | $ 1,636,741,107.72 |

| MCM | Mc Mining Ltd | 0.14 | -13 | -26 | -70 | $ 22,390,835.48 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.