Bulk Buys: Iron ore prices push $US150 per tonne, coal markets await fresh China quotas

Iron ore cannot be shipped to China quick enough as spot prices touch an eight-year high. Image: Iron ore ship, Getty

- Iron ore fines prices traded this week at $US147.50 per tonne, up $US15.20 per tonne on week

- Hard coking coal prices were up $US2.60 this week at $US92.60 per tonne at Queensland ports

- China’s reinforcing bar price is at $US611.35 per tonne, down $US6.70 per tonne on a week ago

Iron ore prices closed in on $US150 per tonne this week — their highest in eight years — as China’s galloping demand for the commodity required for its steel sector outpaced available supply.

Spot prices leapt $US15.20 on-week to $US147.50 per tonne ($198.90/t), and are their highest since early 2013 — although from that peak they did go on to decline to a decade-low of $US41 per tonne in early 2016.

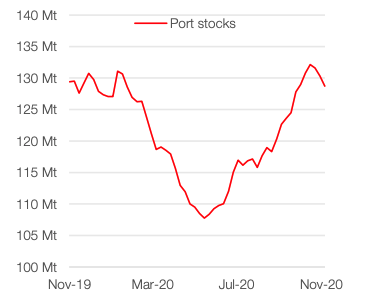

“The lift in prices was linked to another decline in China’s iron ore port stockpiles,” said Commonwealth Bank of Australia analyst Vivek Dhar.

Stocks of iron ore at Chinese ports have had three weeks of decline, as steel companies unable to import enough cargoes dig into port-side stocks instead.

China’s infrastructure-led recovery has resulted in the Asian country consuming three-quarters of available iron ore in the international seaborne market this year.

“The fall in China’s port stockpiles mostly reflects China’s strong steel demand,” said Dhar.

A week ago, iron ore cargoes for shipment to China were trading around $US132.30 per tonne, Metal Bulletin said.

On the supply side of the market, a slow down in iron ore shipments from Brazil and Australia is supportive of high prices.

“We still think that iron ore prices still have a good chance of averaging $US90 per tonne by Q4 2021, despite near term prices likely to stay high in the short term,” said Dhar.

Higher iron ore prices bite into China’s steel industry profits

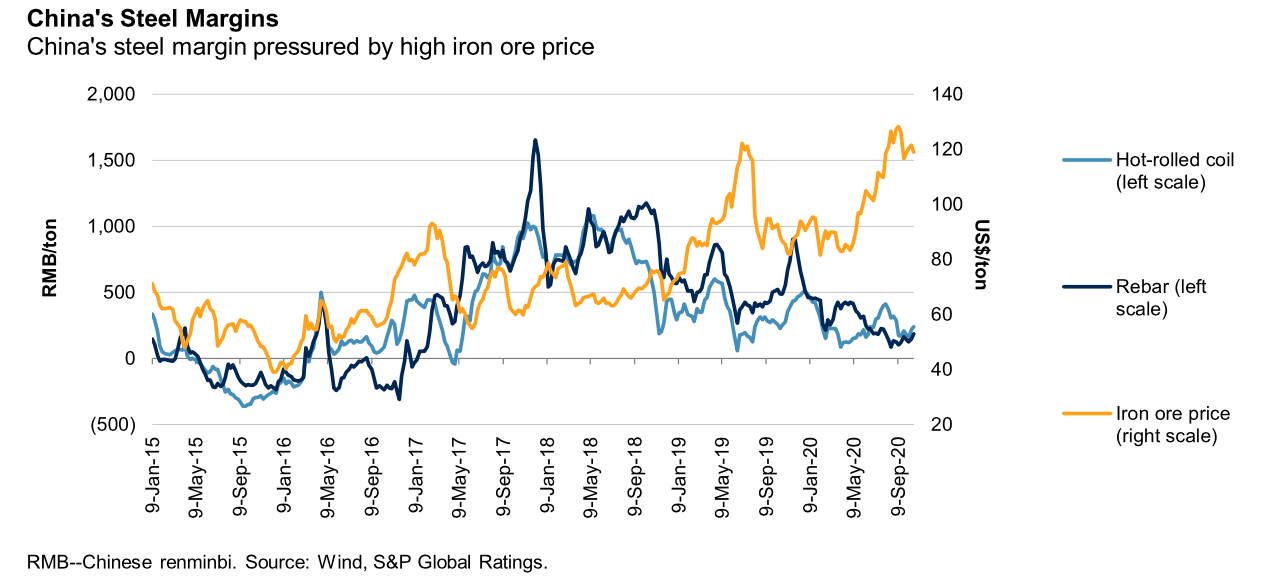

Profit margins for Chinese steel mills remain under pressure, with a second weekly fall in steel reinforcing bar prices, as iron ore prices continue to soar.

The price of steel reinforcing bar (rebar), which is used in construction, dipped $US6.70 over the week to $US611.35 per tonne.

Rebar prices had touched $US629.20 per tonne in late November, and have lost $US17.85 over the course of two weeks.

Chinese steel industry margins are expected to remain under pressure for the rest of 2020, before improving in 2021, said S&P Global Ratings in a report.

“We believe steel margins will be under pressure for the rest of the year, given elevated iron ore prices, before improving in 2021 based on what we assume will be moderating iron ore prices,” said S&P Global Ratings.

The analysts expect steel mills in China will be able to pass through some of their higher input costs to their steel customers.

“Major steel mills have remained profitable this year, although profitability is weaker than in 2019,” the report said.

“We believe the government will adhere to supply-side reform and that further consolidation of steel mills will provide some support for Chinese steel margins,” it added.

Although, the ratings agency said a renewed spread of the COVID-19 virus could knock off course China’s strong economic recovery from the pandemic.

“The key risk is a new wave of infections leading to further economic lockdowns that would dampen demand,” said S&P Global Ratings.

“In that case, we may see similar trends as in February and March, when production remained generally flat but demand slumped, which resulted in surging steel product inventories that required steel mills to fund working capital needs.”

The report added that because China’s steel industry is focused on servicing its domestic market, it is unlikely to be affected by global trade disruptions.

“Exports account for only about 5 per cent of China’s steel production, so tariffs have not been a material factor,” said the report.

Environmental policy in China to tackle air pollution from industry is expected to lead to the phasing out of less efficient steel mills.

“Apart from environment-focused action to tackle emissions and climate change, we believe the government will continue to tighten emission standards as a way of supply-side reform to phase out steel mills that are unable to keep up with new requirements, therefore upholding the healthy development of the industry,” added S&P Global Ratings in its report.

ASX iron ore company share prices

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| TI1 | Tombador Iron | 0.054 | 35 | 80 | 157 | $39.9M |

| LCY | Legacy Iron Ore | 0.008 | 33 | 0 | 167 | $43.7M |

| MGX | Mount Gibson Iron | 0.9 | 20 | 33 | 9 | $1.0B |

| MGT | Magnetite Mines | 0.012 | 20 | 33 | 221 | $34.3M |

| FEX | Fenix Resources Ltd | 0.21 | 19 | 60 | 432 | $89.5M |

| FMG | Fortescue Metals Grp | 21.24 | 17 | 28 | 114 | $65.9B |

| ADY | Admiralty Resources. | 0.015 | 15 | 15 | 88 | $17.4M |

| CIA | Champion Iron Ltd | 5.13 | 14 | 34 | 106 | $2.5B |

| MIN | Mineral Resources. | 34.92 | 8 | 33 | 126 | $6.6B |

| SRK | Strike Resources | 0.14 | 0 | 33 | 159 | $35.8M |

| MAG | Magmatic Resrce Ltd | 0.18 | 0 | -20 | 0 | $30.3M |

| EUR | European Lithium Ltd | 0.045 | -8 | 15 | -44 | $34.1M |

Shree Minerals (ASX:SHH) said in an update this week that it is advancing its Nelson Bay River iron ore project in north-west Tasmania.

The project is for direct shipping ore that was produced at Nelson Bay River until the mine was placed into care and maintenance in June 2014.

The mine’s temporary closure was caused by a sharp fall in iron ore prices, although prices have improved significantly since that time.

The project is within an established area for iron ore mining that includes operating mines such as Grange Resources (ASX:GRR) Savage River operation.

Production from the Nelson Bay River mine up to its mothballing was 180,000 tonnes that was shipped from the Burnie port.

The company said the demand outlook for iron ore has remained favourable given significant government stimulus globally.

“Any near term supply response is expected to be limited, particularly with little latent capacity left at major iron ore exporting ports and railways in Australia,” said the company in its update.

Indian steel mills step into coking coal market

Indian steel mills have stepped into the spot coking coal cargo market to replace buyers from China, leading to a slight uplift in market prices.

Chinese buyers have stepped back from the seaborne market for Australian coking coal, as their year-end quotas on coal imports dampen demand.

“The current price level for premium hard coking coal is acceptable for Indian steel mills, who have been making good margins,” reported Metal Bulletin.

For standard-grade hard coking coal for spot shipment from ports in Queensland, prices are around $US92.60 per tonne this week.

Trades for premium quality hard coking coal for January shipment from Queensland were heard in the market at $US102 per tonne, unchanged on week.

A trader told Metal Bulletin there appeared to be a relative shortage of standard-grade hard coking coal in the seaborne market.

Prices for North American coking coal traded to China have increased to $US180 per tonne as buyers in China rebalance their purchasing behaviour.

Cargoes of this type of coking coal for delivery to ports in northeastern China were heard at $US154 per tonne, last week.

Import data for China showed the country’s imports of coal dipped 15 per cent in November, on a month-on-month basis.

“Policymakers are reportedly targeting coal imports of ~270 million tonnes in 2020, implying only ~5 million tonnes of coal can be imported in December,” said Dhar at Commonwealth Bank of Australia.

The import quotas remain in place despite rising domestic coal prices in China’s market, as demand outstrips available supply.

“While that would usually give pause to China’s coal import restrictions, we do not think any meaningful policy relaxation is likely for the remainder of 2020,” said Dhar.

China resets its import quotas for all types of seaborne-traded coal starting on January 1, 2021.

The types of coking coal arriving in China next year will show which way the market is moving in terms of supply sources.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| YAL | Yancoal Aust Ltd | 2.62 | 22 | 37 | -11 | $3.2B |

| WHC | Whitehaven Coal | 1.61 | 21 | 47 | -39 | $1.7B |

| SMR | Stanmore Coal Ltd | 0.825 | 17 | 12 | -15 | $205.5M |

| TER | Terracom Ltd | 0.165 | 14 | 14 | -48 | $120.6M |

| NAE | New Age Exploration | 0.013 | 8 | 0 | 333 | $15.4M |

| CRN | Coronado Global Res | 1.12 | 7 | 37 | -42 | $1.6B |

| CKA | Cokal Ltd | 0.075 | 6 | 25 | 63 | $69.3M |

| PDZ | Prairie Mining Ltd | 0.2 | 5 | 5 | -20 | $45.7M |

| AKM | Aspire Mining Ltd | 0.074 | 1 | 6 | -38 | $35.5M |

| BRL | Bathurst Res Ltd. | 0.039 | 0 | -7 | -65 | $66.7M |

| LNY | Laneway Res Ltd | 0.007 | 0 | 0 | 0 | $26.4M |

| PAK | Pacific American Hld | 0.022 | 0 | -15 | -23 | $6.9M |

| AHQ | Allegiance Coal Ltd | 0.054 | -2 | -8 | -61 | $45.8M |

| NCZ | New Century Resource | 0.225 | -2 | 36 | -19 | $278.1M |

| MCM | Mc Mining Ltd | 0.2 | -2 | -13 | -56 | $30.9M |

| BCB | Bowen Coal Limited | 0.047 | -6 | -8 | -18 | $41.7M |

| JAL | Jameson Resources | 0.105 | -16 | -13 | -45 | $33.4M |

| YAL | Yancoal Aust Ltd | 2.62 | 22 | 37 | -11 | $3.2B |

| WHC | Whitehaven Coal | 1.61 | 21 | 47 | -39 | $1.7B |

Atrum Coal (ASX:ATU) gave an update on progress for its Elan project in western Canada, for which an updated scoping study has been commissioned.

The project is located in a large-scale hard coking coal basin near producing mines including Fording River, Line Creek and Elkview.

An earlier scoping study envisaged a hard coking coal mine at Elan for 6 million tonnes per year.

A pre-feasibilty study is expected to be completed for the project in mid-2021, and mining will be on a low-strip open cut basis.

The mine has access to existing rail lines connecting to western Canada sea ports that have spare export capacity for coal shipments.

Product from Elan can be railed to either Vancouver or to the Ridley coal terminals in British Colombia.

The type of coking coal to be mined at Elan is premium-grade with low phosphorus and sulphur content, and could command prices similar to Queensland hard coking coal.

Coking coal futures prices move into contango

Forward prices for Australian coking coal on the Chicago Mercantile Exchange (CME) have gone into steep contango this week.

For January 2021 settlement, the futures price is US$109 per tonne, down $US11 on a week ago.

While for February 2021 settlement the price has risen to $US126 per tonne, despite China’s Lunar New Year holiday occurring in this month.

March 2021 coking coal futures are trading at $US140 per tonne, down $US25 per tonne from a week ago.

For the rest of 2021, forward prices for coking coal average around $US145 to $US150 per tonne, and are similar to levels a week ago.

The shape of the futures market’s forward curve could mean that supply tightness in the market will start to ease next year.

It could also suggest there is less risk of cyclones affecting exports of Queensland coking coal.

Australia’s tropical cyclone season traditionally starts in November and lasts through to April the following year.

The Bureau of Meteorology in its Tropical Cyclone Outlook said it is expecting a higher than average number of cyclones this season.

Cyclones can be devastating to the coal industry in Queensland, as they can result in flooding of rail and mining infrastructure.

Tropical cyclone Debbie in 2017 delayed the export of 15 million to 20 million tonnes of coking coal valued at $3bn.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.