Bulk Buys: Iron ore prices capped by fall in China’s steel market, coking coal weakens further

China has curbed its steel production to tackle air pollution concerns. Image: Getty

- Iron ore fines prices traded this week at $US163.60 per tonne, $US10.90 lower on a week ago

- Hard coking coal prices were $US7.85 lower on-week at $US108.65 per tonne at Queensland ports

- China’s steel reinforcing bar price is $US5 lower this week at $US725 per tonne

A step-back in Chinese steel prices this week and air pollution controls on some steel plants in China has exerted some downward pressure on iron ore prices at Chinese ports.

Cargoes of 62 per cent-grade iron ore for delivery to China edged lower to $US163.60 per tonne ($211.20/tonne) this week, according to Metal Bulletin.

This is down by around $US10 per tonne on a week ago, but the current price is still double that of $US80 per tonne from a year ago.

Air pollution concerns for Chinese cities have triggered a government crackdown on emissions from steel plants, which is translating into slacker demand for iron ore, said analysts.

“Premier Li Keqiang said this month the country will act strongly on climate change. As part of this, China pledged to rein in steel capacity this year,” said analysts at ANZ bank.

The steel production centre of Tangshan east of Beijing appears to be bearing the brunt of the pollution control measures which started last week.

“Authorities in Tangshan said they will launch widespread checks of steel mills to improve compliance with recent measures to curb steel output,” said the ANZ bank analysts.

The air pollution controls in China are starting to show up in prices for iron ore futures contracts on the Dalian Commodities Exchange in China.

The exchange’s May-settlement iron ore futures contract traded lower Tuesday at ¥1,030 per tonne ($US158.50/tonne), according to exchange data.

“Iron ore futures extended recent declines, with traders remaining concerned that China will continue to crack down on steel mills violating pollution curbs,” ANZ bank analysts said.

Iron ore quality matters

The issue of curbing air pollution from steel mills in China has put renewed focus on the quality of input raw materials for steel production which can affect plant emissions.

“The typical price benchmark grade for iron ore is 62 per cent iron and for pure iron ore it is 70 per cent iron, with the rest made up of some impurities like silica,” said iron ore market expert and Magnetite Mines (ASX:MGT) director, Mark Eames.

“Brazilian ore tends to be about 65 per cent iron for its top-quality product,” he said. Brazilian ore trades at a premium to Australian ore for this reason.

Cargoes of Brazilian iron ore for delivery to Chinese ports are this week commanding prices of $US189 per tonne, after reaching a record of $US200 per tonne in February.

Some iron ore producers ship product with an iron content of less than the benchmark for which the market charges a discount or price penalty to the benchmark price.

In the 1990s the average grade of iron ore shipped from WA was just over 62 per cent, said Eames.

“It has gone down and nowadays there is only one fines product [from Australia] that is higher than the benchmark,” he said.

Lower grades affect steelmaking process

Any decline in the grade of iron ore shipped to China from Australia can have a significant impact on trade on the steel-making process.

“If you are making steel out of 60 per cent FE iron ore instead of 62 per cent you need 3 to 4 per cent more volume; it is not massive, but it does make a difference,” Eames said.

“Everyone talks about volume, but it is actually iron units that matter to a steelmaker. You need more volume to make up for lower-grade quality in iron ore.”

There is also the issue of supply depletion and grade decline, as company ore reserves fail to keep pace with the sheer scale of larger iron ore miners’ production volumes.

Both BHP and Rio Tinto are switching on new mines in WA later in the year and next, but they are replacements for mines already exhausted rather than additional production.

Rio Tinto and BHP effectively need to build one new mine every year in order to keep up with their current rates of production from their mines and Chinese seaborne demand.

ASX iron ore company share prices

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| LCY | Legacy Iron Ore | 0.016 | 14 | -43 | 1500 | $96.1M |

| MGT | Magnetite Mines | 0.03 | 0 | 15 | 903 | $82.8M |

| FEX | Fenix Resources Ltd | 0.235 | -2 | -2 | 535 | $104.6M |

| SRK | Strike Resources | 0.205 | 17 | 5 | 400 | $50.7M |

| CIA | Champion Iron Ltd | 6.02 | 2 | 12 | 262 | $3.1B |

| TI1 | Tombador Iron | 0.076 | 12 | -17 | 261 | $76.5M |

| ADY | Admiralty Resources. | 0.018 | 0 | 6 | 260 | $23.2M |

| GRR | Grange Resources. | 0.53 | -5 | 33 | 203 | $584.5M |

| MIN | Mineral Resources. | 38.97 | 1 | 5 | 167 | $7.4B |

| FMG | Fortescue Metals Grp | 20.67 | -7 | -15 | 108 | $62.7B |

| FMS | Flinders Mines Ltd | 1.3 | -18 | -13 | 83 | $226.4M |

| EUR | European Lithium Ltd | 0.067 | 12 | -3 | 49 | $61.1M |

| MGX | Mount Gibson Iron | 0.89 | 1 | 0 | 36 | $1.1B |

| GEN | Genmin | 0.29 | $82.4M | |||

| AKO | Akora Resources | 0.37 | -5 | -1 | $18.9M | |

| MAG | Magmatic Resrce Ltd | 0.105 | -25 | -28 | -42 | $23.9M |

Steel mills in China return to profit

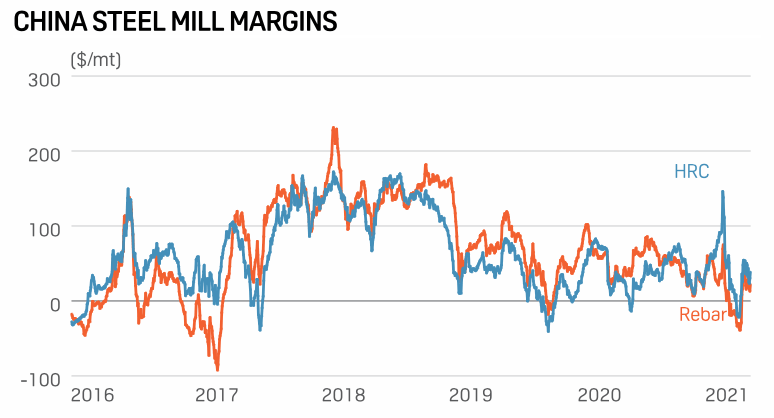

Rising demand for steel products and higher steel prices in China have restored profit margins for Chinese steel producers which had turned negative for a short time.

“Steel mill margins did turn negative for a number of days in January-February, which is usually a key threat to China’s crude steel production,” said analysts at Commonwealth Bank of Australia in a report.

Steel production in China increased in January-February, which is counted as one period because of the effect of the annual Lunar New Year holiday, they said.

The traded price of Chinese reinforcing bar (rebar) at Shanghai’s steel market has declined slightly this week to $US725 per tonne, but is still close to historical highs.

Rebar slipped $US5 per tonne this week, but prices for the steel product which is used in construction projects could be well supported by production curbs in eastern China.

As mentioned earlier, Chinese steel mills are facing a threat of curbs to their production over the coming weeks because of air pollution concerns in Chinese cities such as Beijing.

This could have a knock-on impact on prices and demand for iron ore cargoes from Australia and other countries in the short term, said analysts.

For example, in the steel production centre of Tangshan, production controls have been extended for a third time this year because of pollution controls.

In Europe, prices for steel rebar are still trading above $US600 per tonne, and reached a peak of $660 per tonne in early January and again in early March this year.

This is according to prices for steel rebar futures contracts on the London Metal Exchange which a year ago were trading at $US370 per tonne at the start of the COVID pandemic.

Carpentaria Resources ready to progress Hawsons project

ASX company Carpentaria Resources (ASX:CAP) is in the process of increasing its stake in the Hawsons project for iron ore near Broken Hill in NSW to 93.6 per cent.

The company has its shareholders’ approval to purchase the 24.1 per cent interest in Hawsons owned by its joint venture partner Pure Metals Proprietary Limited.

Carpentaria Resources want to quickly advance the Hawsons project to a bankable feasibility study to “take best advantage of the current and expected future iron ore market boom”, said the company in a presentation.

Hawsons is expected to produce 12 million tonnes per year of its Supergrade iron ore pellet and concentrate product which results in 50 per cent less carbon dioxide emissions in the steelmaking process.

This is because the company’s products are designed for use in direct reduction iron steelmaking which is less emissions intensive than conventional steel blast furnaces.

Carpentaria Resources already has a number of customers for its 70 per cent grade iron ore product including Formosa Plastics, Bahrain Steel, Mitsubishi, Kuwait Steel, Emirates Steel and international trading company Gunvor.

Meanwhile, Strike Resources (ASX:SRK) has made further strides towards production for its Paulsens East iron ore project after receiving a mining permit from WA’s Department of Mines.

The company is also progressing talks with a number of potential offtake partners for the project in WA’s Pilbara region and is finalising its engineering design.

Paulsens East is set to produce 1.5 million tonnes per year of high-grade direct shipping ore that requires minimal processing before cargoes are delivered to port for export.

Strike Resources noted in an update this week that iron ore seaborne prices remain very strong and above the $US100 per tonne assumed for its project’s feasibility study.

The premium paid by customers for lump iron ore compared to fines product has risen to record highs of 50 US cents per dry metric tonne, it said.

“Based on Fe content of 62 per cent for the Paulsens East product, this would imply an uplift of ~$US32 per tonne of lump ore once the Paulsens East lump product is established in the market,” said the company.

Queensland hard coking coal shipments edge lower in weak trade

Prices for hard coking coal shipped from ports in Queensland, Australia, slipped to $US108.65 per tonne this week, according to Metal Bulletin.

Minimal bids were heard in the market from prospective buyers and April shipments of Queensland hard coking coal were offered at just below $US120 per tonne.

Even Indian buyers, who have recently stepped into the void left by absent Chinese buyers, had a very low profile in the seaborne market.

Many consumers of Australian coking coal in India remain fully stocked after booking cheaper cargoes in January then priced around $US100 per tonne, Metal Bulletin reported.

Declining prices for domestic coking coal in China have attracted buyers away from the seaborne market leaving buying interest weak for North American and Australian cargoes.

“Seaborne cargoes [of coking coal] are expensive and we did not use much coking coal from America and Canada previously,” a steel mill source in China told Metal Bulletin.

Premium-grade cargoes of US hard coking coal for April shipment are available in the spot market at about $US210 per tonne, and have been stable at this level for some weeks.

Futures prices for Australian coking coal were trading lower this week at $US110 per tonne for April settlement, down $US10 from Monday, according to Singapore Exchange data.

June-settled futures contracts for Australian coking coal were trading $US3 lighter on day, at $SU128 per tonne, said the Singapore Exchange.

For December 2021 futures contracts, prices were at $US147 per tonne and steady from a week ago.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.014 | 27 | 17 | 600 | $15.9M |

| CKA | Cokal Ltd | 0.07 | 3 | -9 | 159 | $61.0M |

| NCZ | New Century Resource | 0.17 | 0 | -13 | 100 | $202.7M |

| ATU | Atrum Coal Ltd | 0.25 | 0 | 0 | 67 | $145.4M |

| BCB | Bowen Coal Limited | 0.053 | 2 | 0 | 47 | $50.2M |

| PDZ | Prairie Mining Ltd | 0.22 | 0 | -17 | 38 | $50.2M |

| AKM | Aspire Mining Ltd | 0.095 | 0 | -2 | 36 | $48.2M |

| PAK | Pacific American Hld | 0.022 | 5 | 5 | 26 | $7.6M |

| LNY | Laneway Res Ltd | 0.006 | 20 | -8 | 20 | $22.7M |

| YAL | Yancoal Aust Ltd | 2.36 | -4 | -4 | 15 | $3.1B |

| TIG | Tigers Realm Coal | 0.008 | 14 | -11 | 3 | $104.5M |

| WHC | Whitehaven Coal | 1.68 | -2 | 11 | 1 | $1.7B |

| AHQ | Allegiance Coal Ltd | 0.085 | 6 | -11 | 1 | $90.6M |

| MR1 | Montem Resources | 0.16 | 0 | -20 | $31.2M | |

| SMR | Stanmore Coal Ltd | 0.75 | 17 | 1 | -2 | $205.5M |

| CRN | Coronado Global Res | 1.06 | 1 | -13 | -17 | $1.5B |

| JAL | Jameson Resources | 0.105 | 5 | 11 | -19 | $30.3M |

| BRL | Bathurst Res Ltd. | 0.043 | 5 | -2 | -35 | $73.5M |

| TER | Terracom Ltd | 0.084 | 4 | -40 | -56 | $64.8M |

| MCM | Mc Mining Ltd | 0.125 | 0 | -7 | -69 | $19.3M |

At Stockhead we tell it like it is. While Magnetite Mines and Strike Resources are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.