Bulk Buys: China’s return supercharges iron ore and steel markets, coking coal still directionless

Chinese buyers have rushed back to the iron ore market post Lunar New Year. Image, coal ship, Getty

- Iron ore fines prices traded this week at $US176 per tonne, up $US9.10 on a week ago

- Hard coking coal prices were $US1.70 higher on-week at $US130 per tonne at Queensland ports

- China’s steel reinforcing bar price is $US33 higher this week at $US700 per tonne

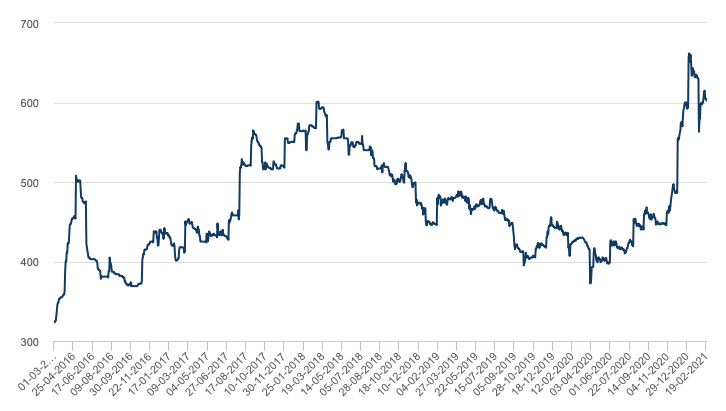

Chinese iron ore buyers have surged back to the spot market this week after the country’s Lunar New Year holiday and their presence was immediately felt in terms of prices which climbed nearly $US10 per tonne on-week.

Bid prices rose for the limited number of available spot cargoes in the market with the result that Australian 62 per cent iron shipments for delivery to China lifted to $US176 per tonne ($222/tonne).

Brazilian iron ore shipped to China had a landed price of $US200 per tonne on a 65 per cent iron content basis, a new price record.

Iron ore cargo prices are likely to stay around current elevated levels for some months based on traded prices for iron ore futures contracts on the Singapore Exchange.

March-settlement futures for iron ore are trading at $US171.50 per tonne while for June settlement the futures price was $US159.60 per tonne, said SGX data.

Record import demand in China

China’s demand for iron ore shipped from Australia and Brazil is running at record levels as the Asian country’s economy recovers strongly from the impact of the COVID pandemic.

Imports of iron ore into China hit a record 1.17 billion tonnes in 2020, a rise of 7.3 per cent on 2019’s import volume of 1.08 billion tonnes, Chinese news site China Daily reported.

Quoting Chinese customs figures, the report said the value of China’s iron ore imports added up to $US127 billion, up 17.4 per cent on year and another trade record.

Australia has a 60 per cent share of the shipment market for China, and Brazil’s market share is about 20 per cent, said the Chinese news website.

This breaks down as 713 million tonnes for Australian iron ore last year, up 7 per cent on 2019, and at 235.7 million tonnes for Brazilian ore, said the South China Morning Post.

The Chinese customs data may understate some of China’s import demand, as according to one Australian miner, the country imported 1.7 billion tonnes of iron ore in 2020.

Chinese steel industry officials have made the case that China’s demand for iron ore imports will decline slightly this year as economic stimulus measures wear off.

Steel mills are also expected to cut back on iron ore shipments in response to Beijing’s edict to reduce steel production, and because of reduced profit margins.

Strong pull on Australian iron ore exports

Other industry experts argue that China’s pull on iron ore imports will stay strong because of momentum in its already high steel production.

“All of the major miners are running systems that are very tight at the moment,” said Magnetite Mines (ASX:MGT) director, Mark Eames.

“When everything is running tight as a drum because you are trying to get every last tonne out to make the margin, and you have not got any spare capacity because of underinvestment, then any operational setbacks will lead to a loss of production,” he said.

Magnetite Mines is developing its Razorback iron ore mine in South Australia which is expected to ship its first cargo in 2024.

Australian iron ore producer Rio Tinto (ASX:RIO) said in an update last week it was maintaining its shipping guidance for Australian iron ore.

The company shipped 331 million tonnes of iron ore from its Pilbara operations in WA last year, and expects to ship between 325 million and 340 million tonnes this year.

The guidance takes into account the start up of the company’s new $US2.6bn Gudai-Darri mine for iron ore in WA in early 2022 with an initial capacity of 43 million tonnes per year.

Rio Tinto shipped 327.4 million tonnes of iron ore in the 2019 year, and realised an average price last year of $US98.90 on a dry metric tonne, free-on-board basis, up 15 per cent on the 2019 average shipping price.

Another Australian iron ore company, Fortescue Metals Group (ASX:FMG) achieved record shipments of 90.7 million tonnes in the December 2020-ended half year.

The miner achieved an average price of $US114 per dry metic tonne for its iron ore on a delivered-China price basis including vessel freight, said the company in a report.

ASX iron ore company share prices

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| GRR | Grange Resources. | 0.43 | 8 | 26 | 91 | $515.0M |

| MIN | Mineral Resources. | 39.81 | 7 | 4 | 107 | $7.5B |

| FMS | Flinders Mines Ltd | 1.59 | 6 | 50 | 46 | $261.7M |

| CIA | Champion Iron Ltd | 5.62 | 5 | 1 | 151 | $2.7B |

| MGX | Mount Gibson Iron | 0.92 | 4 | -4 | 15 | $1.1B |

| MAG | Magmatic Resrce Ltd | 0.15 | 3 | -3 | -59 | $25.4M |

| AKO | Akora Resources | 0.385 | 3 | -8 | $19.7M | |

| FEX | Fenix Resources Ltd | 0.245 | 2 | -6 | 410 | $111.4M |

| FMG | Fortescue Metals Grp | 24.89 | 2 | 2 | 122 | $76.2B |

| MGT | Magnetite Mines | 0.026 | 0 | 18 | 596 | $74.3M |

| SRK | Strike Resources | 0.195 | 0 | -24 | 298 | $48.2M |

| TI1 | Tombador Iron | 0.089 | -3 | -1 | 323 | $68.5M |

| ADY | Admiralty Resources. | 0.016 | -6 | 7 | 167 | $17.4M |

| EUR | European Lithium Ltd | 0.064 | -7 | -28 | -25 | $59.3M |

| LCY | Legacy Iron Ore | 0.025 | -11 | -26 | 2400 | $156.2M |

Steel rebar prices trade higher in China

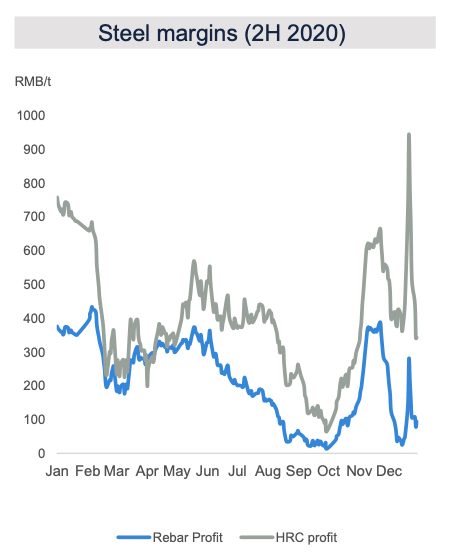

Chinese steel mills have raised their prices for steel reinforcing bar (rebar) after the Lunar New Year holiday as they try to offset rising prices for iron ore.

At the Shanghai trading hub rebar was selling for $US700 per tonne, representing an on-week rise of $US33 per tonne, according to Metal Bulletin.

“More end users returned to the market from their Chinese New Year break, which strengthened demand for rebar significantly,” said MB in a report.

The rebar price at the Shanghai hub is at its highest for two years and sales volumes are running at a rate of 100,000 tonnes per day, said Chinese news site My Steel.

“China’s domestic steel market came to a standstill in early February, as many end users halted their operations and traders closed shop in late January to enjoy a longer break,” it said.

The Asian country produced 21.5 million tonnes of crude steel in the first 10 days of February, before the Lunar New Year holiday, said the China Iron and Steel Association.

The production rate represents an increase of 11 per cent on the corresponding period in February 2020, said the CISA on metals news website SMM.

Domestic steel consumption in China is forecast at 981 million tonnes for 2020, representing a rise of 9.6 per cent on year, said China Daily in a report based on data from the China Metallurgical Industry Planning and Research Institute.

For 2021, China’s domestic steel consumption is forecast to reach 991 million tonnes, a modest 1 per cent rise on last year, said the report.

“Asian steelmaking output ex-China continues to improve as economic stimulus activity drives increased coal demand and consumption in Whitehaven’s key metallurgical coal markets of India, Japan, Korea, Vietnam and Taiwan,” said ASX coal company Whitehaven Coal (ASX:WHC) in a report last week.

In Europe, prices for steel rebar have come off recent highs of $US660 per tonne in January, and are trading at $US602 per tonne, according to London Metal Exchange data.

Queensland coking coal in lacklustre China trade

Hard coking coal shipped from ports in Queensland, Australia, traded $US1.70 per tonne higher on week at $US130 per tonne, according to Metal Bulletin.

“Prices for Australian origin metallurgical coal were weak through the December quarter, however, [they] have sharply increased in recent weeks,” said Whitehaven Coal in its report.

Five ships laden with Australian coking coal have reportedly left anchorage and entered Chinese ports to unload their cargoes, said MB in a report.

“But it is uncertain whether those cargoes will be allowed to pass customs,” said the report quoting a market source in China.

ASX bulk commodities carrier Aurizon (ASX:AZJ) said in a market update last week that 53 ships carrying Australian coal were still waiting for berthing slots at Chinese ports.

“Alternative export destinations have been found, however, it has not completely offset the negative impact with 10 million tonnes being redirected to markets outside China,” said Aurizon in a presentation.

Another market source was reported as saying that Beijing may relax its informal import restrictions on Australian coal in the second half of 2021.

Seaborne-traded cargoes of coal from Australia have been subject to import delays since October last year, and many ships have been forced to wait for long periods off Chinese ports.

“China’s restrictions have altered seaborne coal trade flows where, instead of being delivered to China, Australian coal is now finding customers in alternative destinations including, India, Pakistan and the Middle East, and traded coal historically delivered into these markets is finding its way into China,” said Whitehaven Coal.

India’s demand for coking coal has recovered and the south Asian country is a growing destination for the company’s coal, it added.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| WHC | Whitehaven Coal | 1.61 | 6 | 1 | 0 | $1.6B |

| PDZ | Prairie Mining Ltd | 0.28 | 6 | 10 | 44 | $63.9M |

| SMR | Stanmore Coal Ltd | 0.775 | 4 | -8 | -29 | $209.6M |

| AKM | Aspire Mining Ltd | 0.1 | 3 | 0 | -1 | $50.8M |

| CRN | Coronado Global Res | 1.24 | 2 | -3 | -30 | $1.7B |

| JAL | Jameson Resources | 0.096 | 1 | -13 | -54 | $29.1M |

| YAL | Yancoal Aust Ltd | 2.47 | 1 | 3 | -13 | $3.2B |

| BRL | Bathurst Res Ltd. | 0.044 | 0 | -27 | -47 | $73.5M |

| PAK | Pacific American Hld | 0.021 | 0 | -13 | 0 | $7.0M |

| ATU | Atrum Coal Ltd | 0.25 | 0 | -7 | -17 | $145.0M |

| NAE | New Age Exploration | 0.012 | 0 | -14 | 300 | $13.1M |

| TER | Terracom Ltd | 0.14 | 0 | -7 | -70 | $98.0M |

| MCM | Mc Mining Ltd | 0.135 | 0 | -7 | 12 | $20.8M |

| BCB | Bowen Coal Limited | 0.053 | 0 | 18 | -48 | $49.0M |

| NCZ | New Century Resource | 0.19 | -3 | -16 | 0 | $217.8M |

| AHQ | Allegiance Coal Ltd | 0.09 | -6 | 6 | -18 | $76.2M |

| TIG | Tigers Realm Coal | 0.008 | -11 | -20 | 3 | $104.4M |

| CKA | Cokal Ltd | 0.068 | -12 | -16 | 66 | $61.9M |

| MR1 | Montem Resources | 0.175 | -13 | -24 | $29.5M | |

| LNY | Laneway Res Ltd | 0.055 | -15 | -21 | -8 | $20.8M |

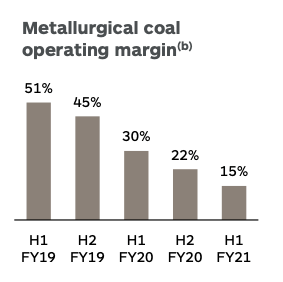

South32 (ASX:S32), which produces coking coal from its Illawarra unit in NSW, said it was seeing increased demand for its coal from India and emerging Asian economies.

“Trade flow disruption has led to higher demand for Australian coal in ex-China markets,” said the company in its results presentation for the December 2020-ended half year.

The company went on to state that 2020 prices for its coking coal shipments had been impacted by the trade issue with China and the Asian country’s weak demand.

South32 said operating costs for its Illawarra coking coal business were forecast at $US74 per tonne for the December 2020-ended half year.

The ASX coal producer has placed its 50 per cent-owned Eagle Downs coking coal project on hold while it considers options for its joint venture interest.

A report in The Australian newspaper last month said South 32 is “set to announce it will not pursue development of the $1.5bn project after considering the results of a feasibility study delivered last year”.

South 32 acquired its half-share in the Eagle Downs project in Queensland’s Bowen Basin coalfield in 2018 for an upfront payment of $US106m.

A further payment of $US27m is due this year under the deal, taking the total sale price to $US133m ($173m).

Eagle Downs was placed into care and maintenance in mid-2015 and a feasibility study had been commissioned by South 32 for its development.

At Stockhead we tell it like it is. While Magnetite Mines is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.