Build Your Own Portfolio – Gold: Experts say look closer at these 8 ASX stocks

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

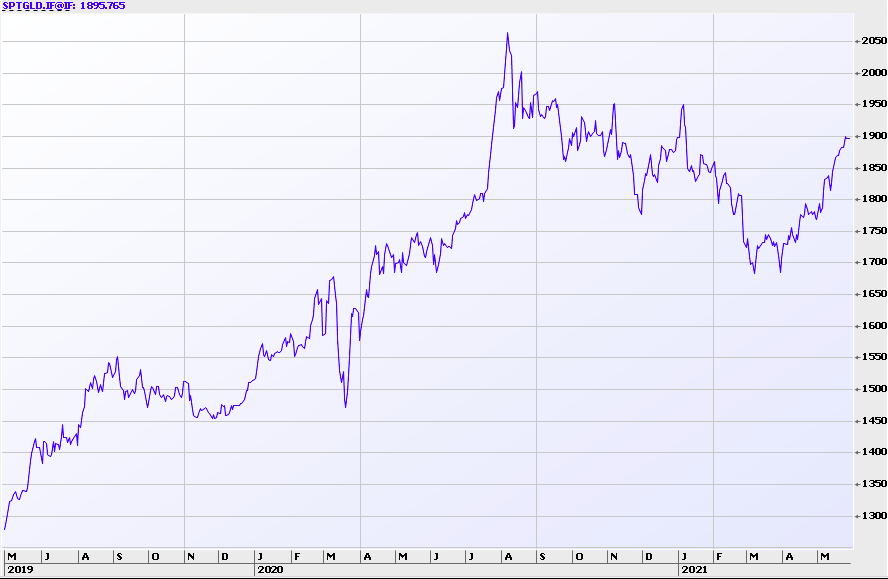

ASX gold stocks are on a tear as the gold price turns a corner, up ~12.7% over the past two months to a peak of $US1898/oz.

That’s a four-month high, erasing almost all of 2021’s losses.

The share prices of local gold stocks, which had drifted lower along with the gold price, are now beginning to stir.

We asked two experts for their stock picks — established gold producers, plus and a few speculative low market cap plays.

GAVIN WENDT

Founding director & senior resources analyst, MineLife

WEST AFRICAN RESOURCES (ASX:WAF)

Market Cap: ~$940 million

MineLife initiated coverage of West African back in 2015 when it was trading around $0.08 per share.

The company has since successfully managed to commercialise its ‘Sanbrado’ gold project in Burkina Faso, which is now in production.

“West African’s maiden guidance was recently set at 250,000 to 280,000 ounces of gold in 2021 at AISC US$720 to US$800 per ounce,” Wendt says.

“The company has the potential for further price upside as it looks to demonstrate steady-state gold production, combined with its attraction on a corporate level to a cashed-up suitor.

“West African represents a template for success for aspiring gold companies, particularly in a foreign jurisdiction.”

Market Cap: ~$15 million

The company is a new entrant on the gold exploration scene, having just listed in February.

The company’s main game is the 100%-owned gold properties within WA’s Widgiemooltha district, a mining district with a rich history where Auric maintains an existing gold inventory of more than 220,000 ounces.

“The company’s strategy here is to expand its resource base through innovative exploration, as in many instances the gold potential of the region has taken a back seat, with the overwhelming exploration focus historically being on nickel, with Western Mining Corporation the dominant regional player,” Wendt says.

“Auric’s market value is modest at just $15 million.”

Market Cap: ~$21 million

This explorer represents a risk/reward opportunity in a location that is a little off the beaten track, Wendt says.

“MetalsTech is appraising its flagship Sturec underground gold mine in Slovakia, which has historically produced more than 1.5 million ounces of gold and 6.7 million ounces of silver,” he says.

“The project currently hosts a JORC 2012 Resource of 21.2Mt @ 1.50 g/t Au and 11.6 g/t Ag, for 1.026Moz of contained gold and 7.94Moz of contained silver (on an open-cut scenario), with a further 388kt @ 3.45 g/t Au and 21.6 g/t Ag for 43koz of contained gold and 270koz of contained silver (on an underground basis).

“As a sweetener, MTC has also just announced a deal worth $18 million for the spin-out of its portfolio of lithium assets.

“The company’s market value is modest at just $21 million.”

SIMON POPPLE

Analyst, Brookville Capital Intelligence Report

Market Cap: ~$9 billion

~700,000oz per annum Evolution is an established (and growing) low cost gold miner.

They’ve got some of the lowest costs in the business, Popple says.

“Although I think the gold price will go higher, even if it does take a tumble, [Evolution] should still be making some good money,” he says.

“They also pay a nice dividend.”

Market Cap: ~$1.3 billion

A bit higher up the risk spectrum is fellow producer Gold Road. The massive $621m Gruyere gold project in WA poured first gold in late June 2019.

Gruyere – a 50-50 JV between Gold Road and major miner Gold Fields — will ramp up to ~350,000oz a year over its initial 12‐year life.

Gruyere celebrated its first 12 months of gold production on 30 June 2020, having produced 230,590 ounces.

But Gruyere covers a fraction (144 km2) of Gold Road’s extensive land package of 6,000sqkm.

“They’ve also got a lot of exploration potential – so if you like the comfort of a producer with perhaps some exploration upside, they are worth taking a look at,” Popple says.

METALICITY (ASX:MCT) and NEX METALS (ASX:NME)

Market Caps: ~$25 million and ~$8 million

Moving up the risk curve to out-and-out explorers.

“Metalicity and Nex Metals, they are both working on the Kookynie Gold Project,” Popple says.

Most recent results include grades of up to 52.8g/t in shallow reverse circulation drilling at the ‘McTavish’ prospect.

More assays are pending, and a maiden resource estimate is underway.

“It’s very early days, but this could be a high-grade gold project,” Popple says.

Market Cap: ~$55 million

There’s three “lottery balls in the drum” with this WA explorer, Popple says.

Lottery ball one: They find some more gold at the 873,000oz Mt York project in the Pilbara.

“If they can do this then I think they’ll have an asset that someone may want to buy for a decent price,” Popple says.

Lottery ball two: they make a decent discovery at ‘Kangan’ – also in the Pilbara — that provides the market some comfort that De Grey’s (ASX:DEG) Hemi discovery may extend onto their land.

Lottery ball three: they make a decent discovery at ‘Black Cat’ — part of the Roe Hills Project near Kalgoorlie – where drilling has just been completed.

“Enough to interest [neighbouring miner] Silver Lake Resources (ASX:SLR), or make some sort of JV with [neighbour] Breaker Resources (ASX:BRB) make sense,” Popple says.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.