Bubalus is counting on Victorian gold, antimony riches to propel it forward

The new Victorian gold and antimony licences have the potential to deliver significant value for Bubalus Resources. Pic: Getty Images

- Bubalus’ Victorian gold and antimony licences have plenty of appeal with their in demand commodities

- Projects have favourable locations close to existing third-party mines and discoveries

- Company still keen to progress Nolans East and Yinnietharra to drill testing

Special Report: Gold and antimony have been two of the biggest rock stars of the resources world in 2024, so it is entirely unsurprising that a junior explorer would be quick to snap up an exciting opportunity covering both commodities.

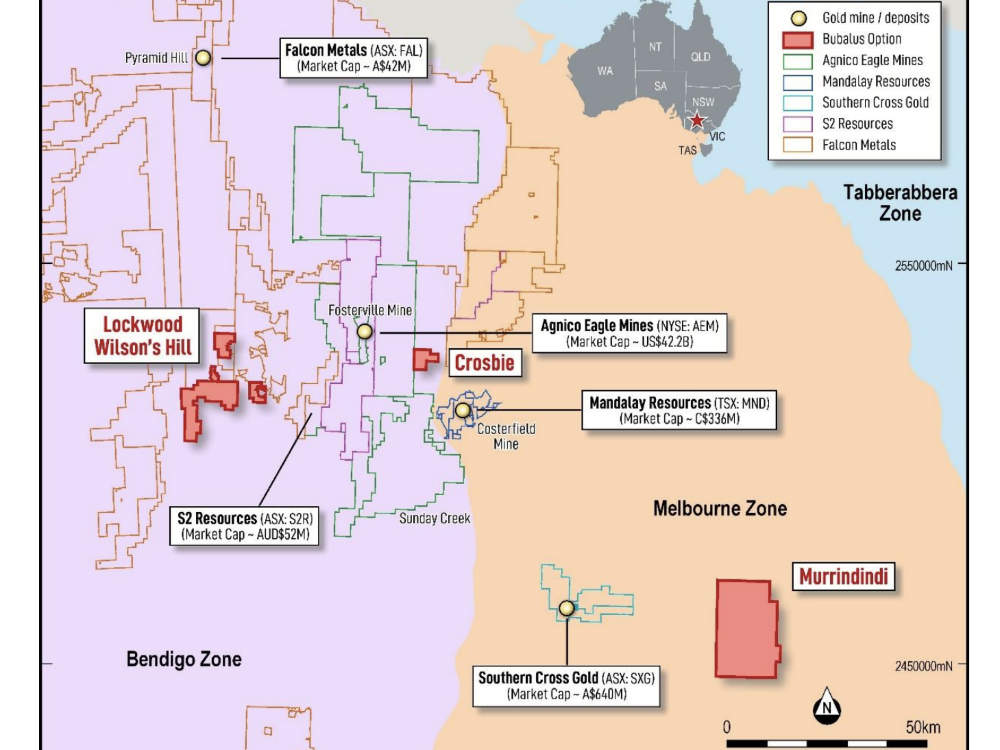

Bubalus Resources (ASX:BUS) showed stellar timing to acquire a portfolio of well positioned Victorian licences covering around 1000km² and prospective for gold and antimony.

Speaking to Stockhead, non-executive director Brendan Borg said that beyond the obvious appeal of gold – thanks to the current Australian price of >$4100/oz and its positive outlook – there were several other reasons why the company moved to lock in the option.

“The second factor was the location of the licences and their prospectivity. The Crosbie licence – being located between Fosterville and Costerfield, which are high-grade, operating Victorian gold mines – show that you can actually get mines up and running in this particular part of Victoria,” he said.

At the end of last year, Fosterville had resources of 21.6Mt at an average grade of 4.28g/t gold for 3Moz of contained gold and 8.6Mt at 6.10g/t gold in proven and probable reserves, while Costerfield has a resource of 1.25Mt at 9.8g/t gold and 2.7% antimony with 600,000t at 10.5g/t gold and 1.9% antimony in proven and probable reserves.

Permitting advantages

Another key point of consideration – given the company’s experiences with its legacy projects – is land access.

“Crosbie has already gone through the permitting process to allow initial drilling programs to be undertaken from existing tracks within the Crown Reserve while the vendor has arranged a land access agreement on key parcels of private land,” Borg added.

“The other key factor of Crosbie is the vendor has done significant surface sampling that has yielded high grade gold and antimony results. It has also done two different IP surveys in 2022 and ‘23 that generated IP targets that sit underneath those interesting geochemical anomalies.

“So we’ve got combined geophysical and geochemical anomalies, we have got the access to get in there and do initial drill testing on those targets.

“For a company like BUS, that’s important because the runway to drilling is not a long one.”

The low cost of entry certainly doesn’t hurt.

Field mapping and sampling at Crosbie has identified various breccia, bladed quartz-calcite and multiple vein generations which suggest the presence of a well-developed magmatic hydrothermal fluid system at a shallow crustal level, while historical sampling at Crosbie South returned up to 19.1g/t gold and 1.1% antimony from the Prince Foote trend.

3D inversion modelling has identified four chargeable and resistive features associated with previously mapped aplite dykes and gold-antimony veins, as well as high-level hydrothermal-magmatic features observed in the field resistivity modelling, indicating that potentially a large intrusive body is present.

Borrowing some of that antimony shine

While Crosbie is undoubtedly the most attractive Victorian project, the Murrindindi project is immediately east of Southern Cross Gold’s (ASX:SXG) headline making Sunday Creek antimony-gold project.

Borg points out that SXG has been getting good market responses to its discovery while Murrindindi remains untested by drilling despite having similar geology and high-grade gold outcropping at surface.

“The plan will be to get in there and expand upon those existing high-grade surface results and then do some geophysics to help define drill targets there as well,” he added.

“It is within crown land, so drilling will be able to be undertaken from existing tracks within the licence and discussions have already been held with the native title group, which is the same as the group that holds Crosbie.”

Borg believes that SXG’s successes in the Melbourne Zone show what is possible if the company achieves drilling success.

“Their (SXG) market cap is about $688m, BUS is starting from a very low market cap even post the recent capital raising so that gives very good potential upside should we have success with our exploration programs,” he said.

Legacy projects

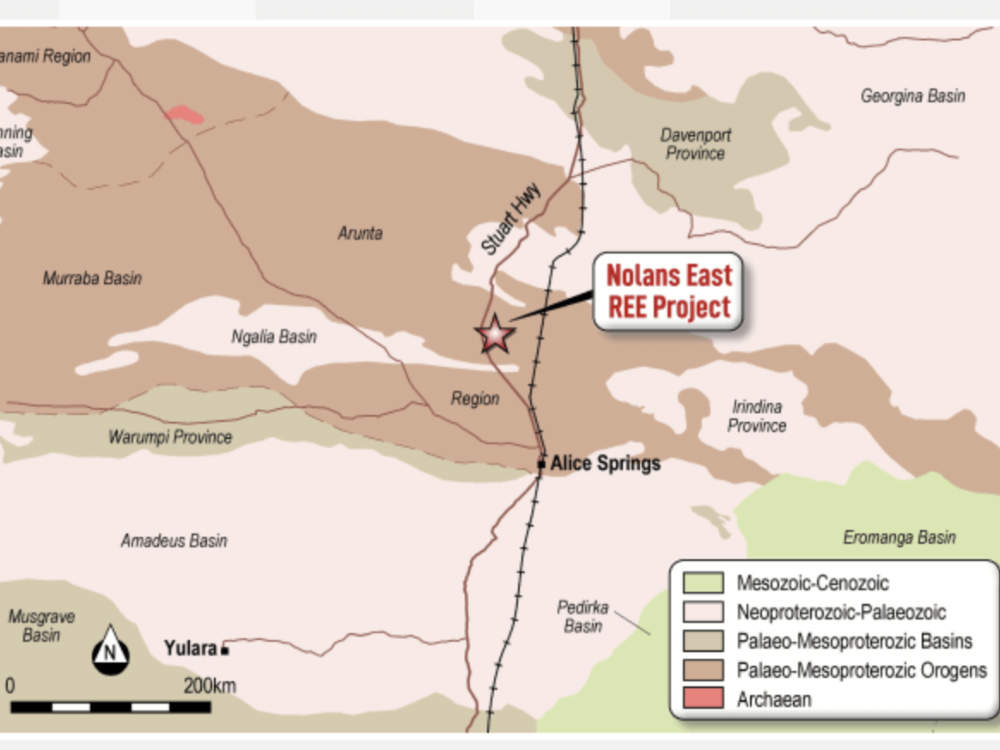

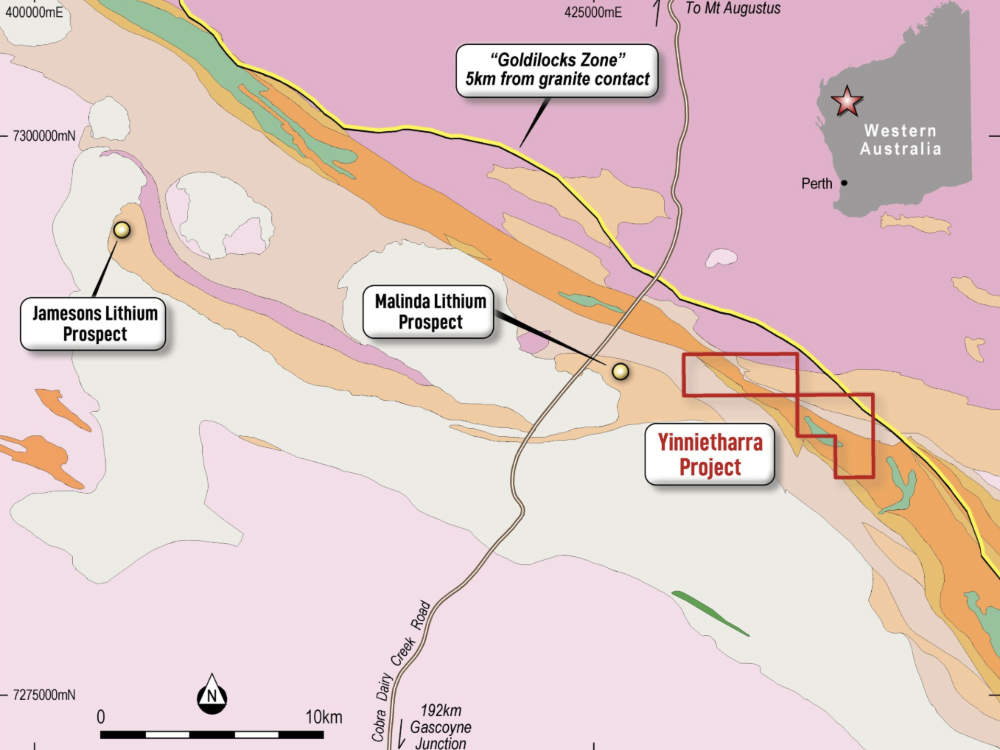

BUS is still keen to press ahead with what Borg describes as its legacy projects – the Nolans East rare earths and Amadeus manganese-cobalt-copper-nickel-zinc plays in the Northern Territory, as well as the Yinnietharra lithium project in WA.

Nolans East is – as its name suggests – located just 15km east of Arafura Rare Earths’ (ASX:ARU) Nolans development that has a resource of 56Mt grading 2.6% total rare earth oxides.

It covers 380km², has soil and rock chip sampling done across it, and areas of defined REE enrichment in soils.

However, no drilling has been done to date. Heritage and government clearances were received during 2024 and land access discussions are ongoing.

“Once we have that access agreement, we will be able to get out there and drill test those targets,” he said.

“That’s quite leveraged to further success that Arafura may have as well.”

Yinnietharra is also close to a more advanced third-party project – Delta Lithium’s (ASX:DLI) Malinda deposit, which contains 25.7Mt at 1% Li2O.

Importantly for BUS, the pegmatites at Malinda are interpreted to trend into the company’s ground and results from surface sampling has provided further encouragement.

Drilling, however, has to wait until a heritage survey is conducted. Following a recent agreement with the Wajarri Yamaji Aboriginal Corporation (WYAC) this has been provisionally scheduled for Q1 2025.

The road ahead

With the company set to hold $3.8m in the bank following the current capital raising, it is well-funded to test its projects.

BUS is currently undertaking preparations to carry out drilling at Crosbie in late Q1/early Q2, 2025.

“Concurrently, we will also be progressing the Murrindindi and Castleburn projects, though Murrindindi will advance much quicker to drilling than Castleburn as it will still require geochemistry sampling programs and geophysical surveys to define targets,” Borg added.

“On the legacy projects, Nolans East we will be looking to finalise those land access agreements and look to drill that probably in Q2 2025, while Yinnietharra will undergo a similar process with drilling towards the middle of the year.

“Once we have done those initial programs on Nolans East and Yinnietharra, we will look to make a decision on whether we keep them or move them on.”

Along with some early stage work on Amadeus, this means that BUS could potentially have up to four different drill programs on four projects happening during 2025, and that’s excluding the possibility of follow-up programs guided by promising results.

“We have also been approached by several parties with additional Victorian projects, so we will be evaluating any further opportunities in that gold space as well,” Borg concluded.

This article was developed in collaboration with Bubalus Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.