BPM Minerals eyes acquisition of tasty-looking REE project in WA

BPM Minerals expects to kick off a maiden exploration program at the project next year. Pic: Getty Images.

- BPM Minerals to acquire Durack rare earths project in WA

- Rock chip sampling returned 89% TREO including high value neodymium and praseodymium

- REEs classified as critical minerals by the Australian government

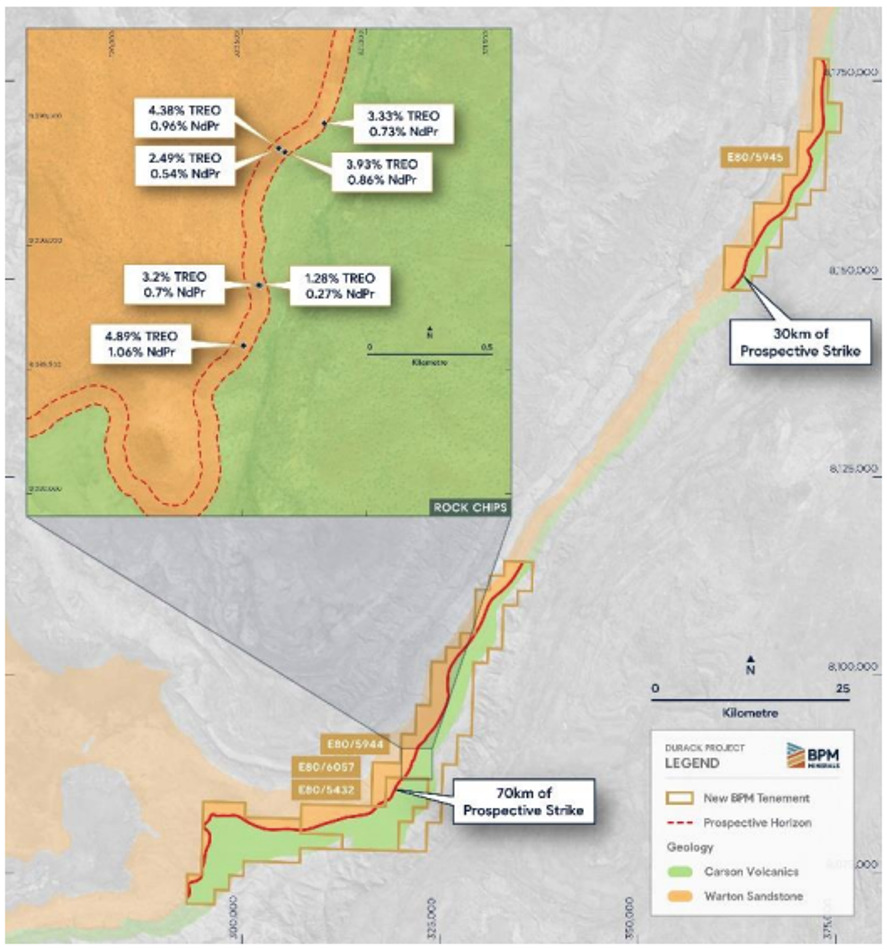

Special Report: BPM Minerals is acquiring the 494km2 Durack project in WA, which hosts high-grade rare earth elements along with accessory zircon and titanium.

Importantly, the host REE material is monazite, a well-known mineral source of neodymium and praseodymium, which are vital for permanent magnets in electric vehicles and wind turbines.

Plus, monazite is a favourable mineral for commercial processing, with multiple processing facilities under construction in Australia and globally.

The project encompasses over 100km of prospective strike, and rock chip sampling by the vendors has returned results of:

- 4.89% TREO (Total Rare Earth Oxide) including 1.06% Nd2O3 + Pr6O11

- 4.38% TREO including 0.96% Nd2O3 + Pr6O11; and,

- 3.93% TREO including 0.86% Nd2O3 + Pr6O11.

BPM Minerals (ASX:BPM) has now entered into two exclusive option agreements to acquire the tenements that comprise the project in a move it says align with its long-term strategy and commitment to exploration.

Spearheading the next big discovery

BPM CEO Oliver Judd says the acquisition is a strategic move aligned with the company’s vision to spearhead the next big discovery in the region.

“Initial rock chips have returned multiple high-grade Rare Earth Element assays demonstrating significant concentrations, including 4.89% TREO with 1.06% Nd2O3+Pr6O11,” he said.

“The identification of monazite is a big tick as we know this is a typical source of LREE’s globally and a favourable mineral for commercial processing.

“HMS style deposits can be huge, often in the billions of tonnes. With this in mind, coupled with the initial high grade rock chips, large prospective land holding and compelling scalable radiometric anomalies, the Durack Project has the potential to deliver a major REE bearing resource in a new emerging REE district.”

REEs a critical metal for Australia

REEs are classified as critical minerals by the Australian federal government, which has active initiatives to fund projects and position Australia as a globally competitive REE producing hub.

The company is keeping an eye on promising developments in the sector, which include the approval in 2022 by the federal government for a $1.25 billion loan for Iluka Resources’ (ASX:ILU) Eneabba rare earths refinery.

That project will process monazite concentrate from previously mined heavy mineral sands projects owned by Iluka, presenting a refining pathway in Australia for those materials.

“With REEs recognised as a critical mineral by the Australian Federal Government, there are opportunities to benefit from national initiatives aimed at establishing Australia as a leader in the global rare earth market,” Judd said.

It is anticipated that the tenements will be granted in 2024, with the company commencing extensive exploration activities leading to a maiden drilling program during the 2025 field season.

This article was developed in collaboration with BPM Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.