BlackEarth Minerals is moving up the food chain fast in the graphite world

Pic: Tyler Stableford / Stone via Getty Images

From day one, BlackEarth Minerals boss Tom Revy says, the graphite junior’s aim was to be more than just a miner.

Those dreams may come true very soon with the MoU with India’s Metachem expected to be finalised into a binding agreement shortly.

It will see BlackEarth (ASX:BEM), the owner of the Maniry Graphite project in Madagascar, head downstream into the production of expandable graphite.

Final engineering and costing are expected to be completed within 8-10 weeks following the JV agreement being signed on the proposed 2500tpa joint venture; construction is planned to commence before the end of the year at a cost understood to be between US$3-3.5 million.

“On January 19, 2018, we listed and the vision from day one has always been to become a material player in the global graphite supply chain, not just be a miner, but to basically provide our shareholders with the uplift in margin by processing downstream our concentrate product or products,” Revy told Stockhead.

“Metachem have been in the business of producing expandable graphite now for about 25 years. So they clearly have the skill base and the operating know-how and that’s what they bring to the joint venture.

“BlackEarth brings access to raw material initially on the market and once we’ve developed the Maniry Project, from our own mine site.

“They’re currently a 1000 tonne per annum producer and they do sell some graphite internationally. Their reputation for their product is first class, which reinforces our view on them as a joint venture partner.”

Graphite goes beyond batteries

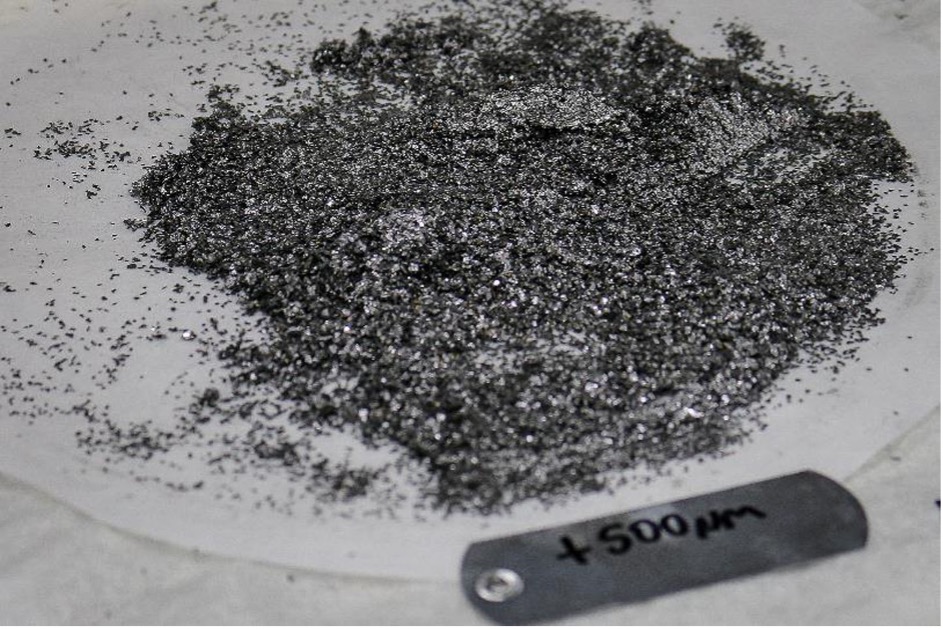

Coarse flake graphite is a high value product because it has the potential tobe processed into expandable graphite.

It is a sought-after material used as a fire retardant and for heat dissipation that has exploded into public consciousness following the tragic Grenfell tower fire in London.

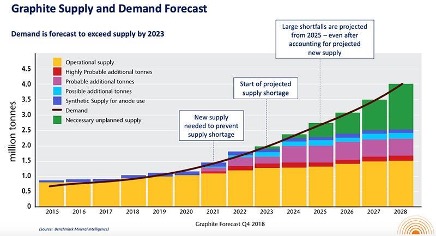

Rising safety standards for cladding in buildings will see the market for expandable graphite grow substantially. Benchmark Minerals Intelligence believes the market will be 200,000t in 2040, up from just 50,000t in 2015.

Around half of that demand will come from its use in flame retardants. It means the BlackEarth-Metachem joint venture could be coming on board at just the right time.

“Firstly, we’re not only going to see an appreciable increase in terms of demand for expandable graphite and demand for coarse flake graphite in general, which is used in other areas,” Revy said.

“But we’re also seeing a global decline in coarse flake production over the last two to three years, and from what we understand that trend is likely to continue.

“So you’re creating a perfect storm, whereby supply is falling, demand is increasing, and we’re coming on board to produce an expandable product very shortly.”

Like many emerging markets, Revy says the biggest issue is not demand for expandable graphite, but the inability of current producers to service a growing market.

“By adding around 2% expandable graphite, it basically acts as a fire retardant and stops the flame from traveling up the cladding or along the cladding in any direction,” he said.

“So it’s a major, major requirement in terms of building cladding. The industry is not just looking at incorporating it within new designs, but it’s also looking at retrofitting.

“The lack of availability of coarse flake for the production of expandable graphite is what is dictating how fast that can occur. So, there’s no shortage of demand at the moment.”

Expandable graphite is also used in upholstery, rubber and carbon fibre sheeting as well as graphite foil, which works as a heat dissipating material in electronics. Natural graphite is particularly common in vehicles and electric vehicles as a lubricant and in brake pads, while fine graphite is best known for its role as an anode in lithium ion batteries.

“So people shouldn’t be looking at electric vehicles in a one dimensional sense when they talk about graphite as purely being associated with the anode,” Revy said.

“There’s so many other uses, that graphite gets incorporated into not just current internal combustion engine vehicles but moving forward into electric vehicles.”

Margins the aim for BlackEarth

The big advantage for shareholders, Revy says, will be the uplift in margin from moving up the value chain.

While exact operating costs will come out in the advanced engineering studies, raw coarse flake graphite sells from between US$1000-1800/t. Revy said expandable graphite at the moment trades for between US$2800-3200.

“So for a low capital investment, working with the right people in Metachem, it’s certainly deemed to be a low risk,” he said.

BlackEarth and Metacham already have an offtake agreement for 2500tpa with Austria’s Grafitbergbau Kaisersberg – a company that has mined and produced graphite products for over 50 years, and a tier 1 buyer of expandable graphite

“We’ve significantly lowered the risk by having a legally binding offtake arrangement in place already,” Revy said.

“So for us, it’s a no-brainer to go down that path, get ourselves established in the market in at around 2500 tonnes a year and then do subsequent expansions from there and of course realise some nice margins for shareholders.”

The Maniry mine in Madagascar, where a feasibility study is due in the second quarter of 2022, is expected to be in production mid-2023.

But that will not hold back work on the Indian expandable graphite plant. Until then BlackEarth will utilise its contacts including a relationship with German graphite supply chain experts LuxCarbon to secure feedstock for the joint venture.

“Our Executive Director, David Round, has been involved in international sales in the graphite industry for many years,” Revy said. “Between himself and our contacts at LuxCarbon in Europe we’ll be sourcing that coarse flake material to start that expandable plant.

“And our intentions are to have Maniry in production 12 months after.”

At that point margins should get even better, with the cost of market sourced flake graphite replaced with the much lower cost of production at Maniry.

Maniry a long life operation

Maniry is located in southern Madagascar, a mining jurisdiction that is less obscure than some might realise.

In fact it has played host to graphite mining for over 100 years and is China’s number one source of the battery metal, the second largest supplier into India and a top 5 supplier into the United States.

Madagascar sits fourth among the world’s major graphite producers on the mining investment risk index, behind only Canada, Norway and Mexico and ahead of Brazil, China, India and Russia.

“It’s in the top 10 graphite producing countries, but it’s also a significant player in the mineral sands industry,” Revy said.

“Rio Tinto have the billion dollar QMM operation located only about 150km from where we’re planning to build the Maniry project.

“And there’s also the US$8 billion Ambatovy nickel project close to the central east coast.

“So there are some big players, there are some big projects, but there’s obviously a lot of smaller mining operations, and certainly the prospectivity for Madagascar’s exceptionally high.”

Revy said Madagascar has a strong reputation for the quality of its graphite, and the Maniry project should be no different.

It is backed by a resource across the Razafy and Haja of 20.2Mt at 6.51% total graphitic carbon for 1.316Mt of contained graphite. About 8Mt at 7.2% graphite are in the higher indicated category with the rest inferred.

BlackEarth’s January 2019 scoping study on the Maniry operation gave it a mine life of 10+ years based on Indicated Resources alone, although it will likely go much longer and the company holds a 40-year mining lease over the Razafy resource.

At a capital cost of US$41m for the first 500,000tpa stage, the project carries a US$103m NPV before tax with an internal rate of return of 42%, generating ~30,000tpa of graphite at an opex of US$593/t FOB.

This would generate life of mine EBITDA of US$209.7m with capital payback after 2.7 years. A second stage expansion to 1Mtpa from the fourth year of operations would cost US$29m and up production to 60,000tpa of graphite.

However, those figures (which will be updated in the higher confidence DFS) are extremely sensitive to grade. Should Maniry deliver feed grades averaging 7.2%, that NPV rises to US$152m with an IRR of 55%.

At 8.2% TGC those numbers climb to US$201m and 68%, for 9.2% US$250m and 81% and by adding 4% to the feed grade to take it to 10.2%, the NPV becomes $299m with a very compelling IRR of 94%.

BlackEarth may have one or two opportunities to find higher grade ore sources on its own ground as well, with Maniry consisting of some 20km2 of tenements with 35 large outcropping target areas and 90% of the tenure being largely underexplored.

Razafy North West a high grade domain

On the grade front BlackEarth has been buoyed by drilling results last month from its Razafy North West prospect, about 600m from the existing Razafy resource.

A typical graphite operation mines at a grade of around 5-6% total graphitic carbon. Try these hits from Razafy NW on for size:

- 29.7m at 17.6% TGC from 5m

- 16.1m at 16.2% TGC (from 3m)

- 10.7m at 15.8% TGC (from 22m)

- 5.1m at 18.9% TGC (from 22m)

“We’ve had intersections within that wide zone of up to probably four or five metres at 28-29%,” Revy said.

“To put it in context other people in Madagascar are mining typically 4-5%. At the moment, the Molo Project 60-70km north of us is in construction and they’ll be processing around 6% TGC – total graphitic carbon.

“So we’re about 7% at Maniry, but those recently announced grades are unheard of in terms of Madagascar, so we’re onto something special there.”

The discovery of the Razafy North West mineralisation highlights the quality of the graphite domain where BlackEarth operates.

Its market cap remains just ~$28 million despite this, which according to analysts at WA brokers Argonaut, could present a buying opportunity.

Mining analyst John Macdonald recently gave BlackEarth a speculative buy rating and 27c price target, against its current price of 13c calling Maniry “potentially a top shelf natural graphite project, currently carrying a basement level price tag”.

“The race is on to build graphite to anode supply chains outside China, from a zero base,” he said. “We expect premiums will be paid for access to graphite deposits like Maniry. Not all graphite projects putting a hand up will qualify.

“What looks like a coming wall of natural graphite supply is highly fragmented according to quality and specification.

“A handful of comparable projects to Maniry each have enterprise values (EVs) greater than A$100M, compared to BlackEarth’s A$19M. NextSource (TSE:NEXT) is working a similar deposit 70km from Maniry, and has an EV of A$193M.”

BlackEarth wants to build community

Madagascar may be prospective ground for miners, but it is also one of the poorest nations on Earth, with the World Bank estimating around 75% of the population lives below the poverty line.

Maniry is located near the town of the same name and it is located in one of the poorest regions in Madagascar, Ampanihy, where most of the community work in farming and successive years of drought have pushed the population into famine.

“Right now, those villages are going through one of the worst famines ever experienced in the area,” Revy said.

“We’re supporting them with regular food parcels and also looking at water supply, where we’ve recently refurbished a pump water station for them.

“Historically, we have worked with Australian Doctors in Africa.

“We provide them with office space and logistics support also so they can operate properly in Madagascar as well.

“And we’ve also been associated with the nearby villages as far as helping them furnish classrooms as well as providing assistance in a new medical clinic nearby.”

“And I see that as a pretty integral component to working with the local Madagascan folk, because we don’t see ourselves as transient visitors. We’re there for the long term, we’re looking like we’re going to be operating in a huge graphite domain, so we’re going to be there a long time as neighbours.

“So we see ourselves as more or less long term partners rather than fly-in, fly-out type people.”

Revy said the mine could be transformative for the local community.

“It will provide jobs directly, both permanent and contract. It will provide the opportunity for peripheral industries to grow, whether that’s associated with food or whether it’s associated with textiles, or whether it’s associated with vehicle maintenance.

“You’ll get the flow on effect that you’ll see other industries start to flourish nearby and prosper and allow people to basically lead a better life.”

Donnelly River ticking the boxes

While Revy has scoured the globe for opportunities to build BlackEarth’s graphite business, its second project is a little closer to home.

BlackEarth is exploring relatively uncharted nickel, copper and PGE prospects to the 240km south of Perth near Manjimup and adjacent to Chalice Mining and Venture Minerals’ Thor and Odin prospects at their South West JV.

“The market’s aware that we recently flew some VTEM. And the VTEM results demonstrated a number of target areas for us to follow up on,” Revy said.

“The area itself, we’ve identified mafic-ultramafic rocks, those are the rocks traditionally associated with the nickel sulphides that people know of in the eastern goldfields kind of area from Mt Keiths down to Nova. So there’s a big tick to start with.”

Surface sampling at Donnelly River has also delivered elevated levels of nickel, copper and PGEs. Revy said while the focus was on Maniry and BlackEarth’s downstream graphite business, work would be ongoing in WA.

“Moving forward, we’re currently working out how we best extract maximum value out of our asset,” he said.

“But we won’t be slowing down then, we’ll be looking at the next phase of exploration, which will probably incorporate more surface sampling, particularly around the delineated targets from the VTEM exploration activities.

“And then ultimately, those sort of results will feed back into a drill program.

“If it takes 10 steps to make a major exploration find we’re probably at stage three. But to date, we’ve ticked stage one, stage two and stage three. So nothing’s guaranteed, but the pathway that we’ve followed so far has been very positive.”

This article was developed in collaboration with BlackEarth Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.