Big River Gold gets set to pump up production

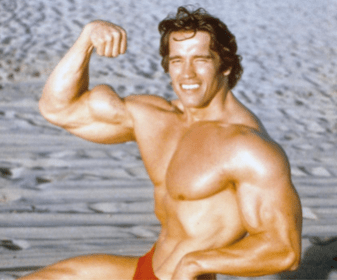

Arnold Schwarzenegger flexes his nuggetty biceps during his bodybuilder days. Pic: Michael Ochs Archives/Getty Images

Big River Gold has taken a leap forward in advancing its Borborema project by engaging GR Engineering Services (GRES) to undertake pre-feasibility studies (PFS) for a possible expansion to 3.6 million tonnes per annum.

The company expects the updated PFS for the 2.43 Moz resource to be completed this quarter as it ramps up the progress at its flagship Brazilian project.

News about the PFS closely follows Big River Gold’s (ASX:BRV) release of an Engineering Cost Estimate (ECE) study for what was the initial 2 Mtpa target, which also focused on optimising the resource and capital.

It also comes after highly encouraging internal studies reviewed expansion options arising from a water study de-risking the supply of process water for production of up to 4Mtpa.

Meanwhile Big River Gold is confident that extensional drilling — which kicked off late December — will extend mineralisation down dip at least 100m and across 1.2km of strike.

Executive Chairman Andrew Richards said of the latest updates: “We are very pleased with the long-term future of the project including the potential for higher throughput rates which could better reflect the original plan for the Borborema Project. This would not have been possible without the implications for water management identified in recent studies.”

The Perth-based company has also reported that land access acquisition to establish the power line from the town of Currais Novos to the site is well advanced.

The positive news flow from the 29sqkm project comes at a time when M&A action has been running hot in the gold sector in both Australia and Brazil, which is emerging from the Covid pandemic with a more upbeat economic outlook.

View to the northeast over the Borborema project site (Concept drawing, GRES).

Upstream investment boost

While capital costs in the updated ECE have risen in line with what has been happening across the global mining industry, they take in additional investments in all-important works for water management. These include upscaling the wastewater pipeline to improve flow, as well as improvements to essential water catchments and dams on site.

Other new investments allow for possible future expansion of the plant, earthworks and layout, such as plant not previously in the design but now incorporated due to the obvious efficiency benefits identified in engineering design studies.

The $65m market cap stock is up more than 26% year-to-date and it had a massive $16.6m in the bank at the end of December.

This article was developed in collaboration with Big River Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.