Ground Breakers: Costs rise for ASX gold miners as inflation bites

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Gold miners have endured an arduous 2021 in equity markets.

While cash has been easy to come by and deals are being done, most gold producers have been hit by poor sentiment as prices have struggled to break out.

Over the past year the All Ordinaries Gold Index has sagged around 20%.

Although most are still making good money, rising costs and the impact of inflation and labour challenges are also hitting miners in the hip pocket.

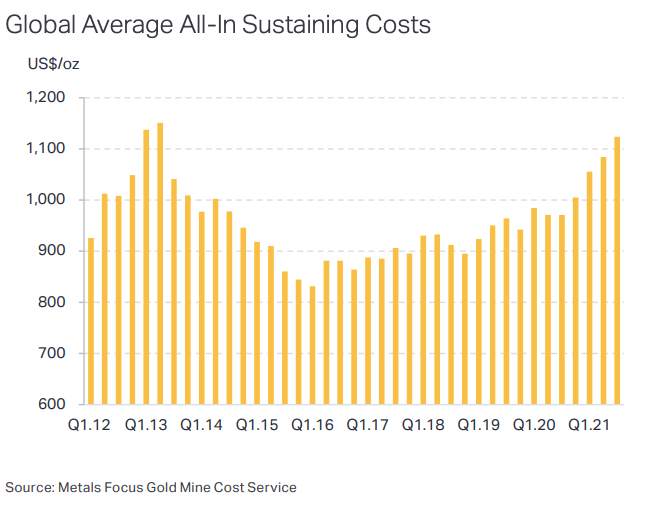

Metals Focus says the global average all in sustaining cost for gold miners hit its highest level since 2013 in the September quarter, rising 3.6% quarter on quarter to US$1123/oz.

Australian miners were the worst off when it came to cost pressures, with costs in Australia climbing by an average of 13.1%.

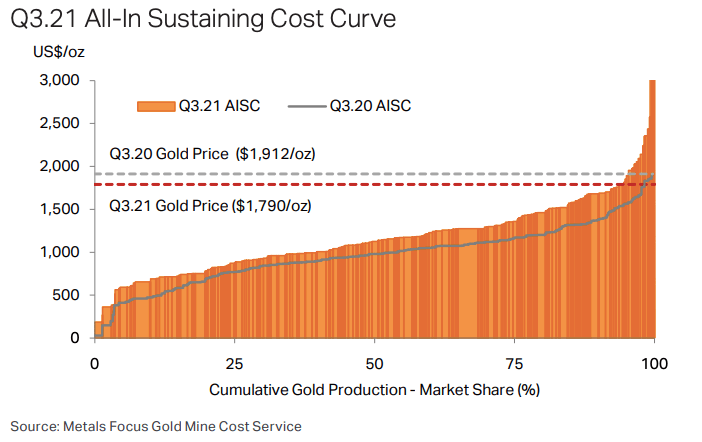

Global AISC margins fell by 9% QoQ to US$667/oz, with Australia’s sliding 18%, Canada’s dropping 5% and Russia’s falling 7%.

Margins remain high historically speaking, and 94% of gold operations tracked by Metals Focus remain profitable.

“As might be expected, increasing costs and a lower gold price have squeezed margins in the September quarter,” they said.

“However it is worth noting that their margins are still substantially higher than in previous years.”

“Despite the relatively healthy margins, the lower gold price and rising costs are putting pressure on higher cost operators,” Metals Focus said.

“While the proportion of output that is profitable remains high at 94%, it has fallen from 98% in Q2.21. A number of operations and projects are already under strategic review with regards to increasing costs.”

“If cost inflation persists and margins diminish even further it is likely that development project approvals will be delayed and also possible that the highest cost production of more marginal producers could potentially be closed.”

Although global average head grades rose 0.5% (5% in Australia), inflationary pressures including crude oil prices, rising salaries amid Covid restrictions, labour shortages and turnover, and the cost of equipment due to supply chain issues drove up operating costs for the fourth straight quarter.

Markets reacted badly this morning to news of the spread of the omicron coronavirus variant around the world, with materials sliding 1.19% this morning.

Chalice soars on new Julimar discovery

Market darling is a phrase that doesn’t quite cut it with Chalice Mining (ASX:CHN), which is up 60 times over since making the Gonneville nickel-copper-PGE discovery 70km north of Perth early last year.

Shares jumped more than 4% this morning after Chalice announced another discovery at Julimar, where last month it declared Gonneville the world’s biggest nickel sulphide discovery in 20 years and Australia’s first major platinum group elements resource.

The new mineralised intrusion is an ultramafic unit to the west of Gonneville, separated by around 70m of metasediments.

Located immediately south of the 6.5km Hartog anomaly, Chalice struck 3m at 2g/t palladium, 0.3g/t platinum, 0.6% nickel, 0.5% copper and 0.05% cobalt for a 1.7% nickel equivalent from 68m in one hole.

The second mineralised intercept struck 2m at 1.8g/t Pd, 0.2g/t Pt, 0.6% Ni, 0.5% Cu and 0.06% Co for a 1.9%NiEq from 139.2m.

The discovery did not show up on EM, “highlighting the potential for further blind discoveries” according to Chalice.

While Chalice has already drilled around 180,000m at Julimar, part of its value proposition is the idea that more will be found with the Gonneville resource accounting for just 7% of the 26km strike of the Julimar complex.

It has submitted a conservation management plan to get at the Hartog target, which will be a bit more thorny because unlike previous drilling which has been located on private farmland, Hartog lies beneath the Julimar State Forest.

Chalice says its CMP for drilling the Hartog-Baudin targets is sitting with the WA Government and it expects approvals shortly.

Chalice Mining share price today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.