Better known for crocs than mining, here’s why NT is becoming an exploration hot spot

Pic: Schroptschop / E+ via Getty Images

Mention the Northern Territory and the first thing that springs to mind are those big, hungry crocs you’ve been warned to steer clear of.

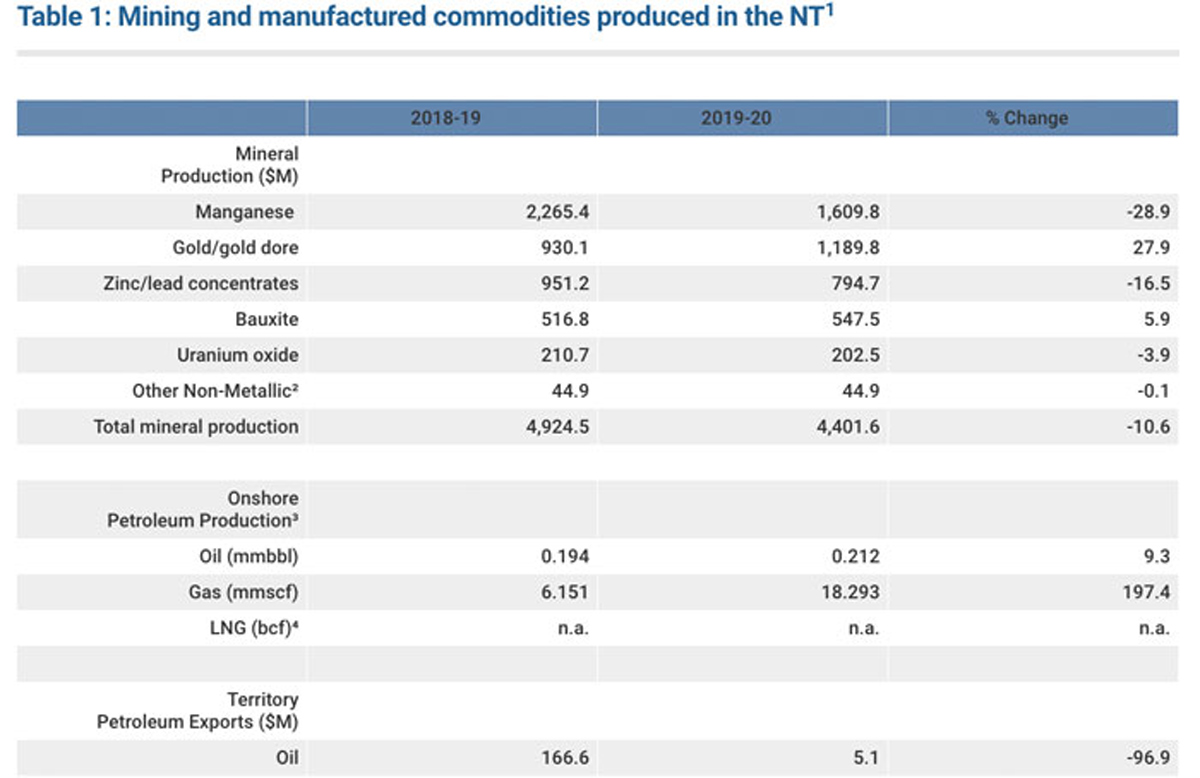

Unlike its state counterparts Western Australia, Queensland and New South Wales, the NT is not in the spotlight as much for its mineral potential despite being actually quite fertile for commodities like manganese, gold, zinc, bauxite and uranium.

According to NT government stats, the mining and manufacturing industries accounted for 31.6 per cent of the territory’s economic output in FY20.

The two industries rose 31.9 per cent to $8.5bn in the last financial year, with mining witnessing strong growth of 39.7 per cent to a record $7.5bn.

Producers sold $4.4bn worth of commodities in FY20, which was dominated by $1.6bn in manganese and $1.2bn in gold.

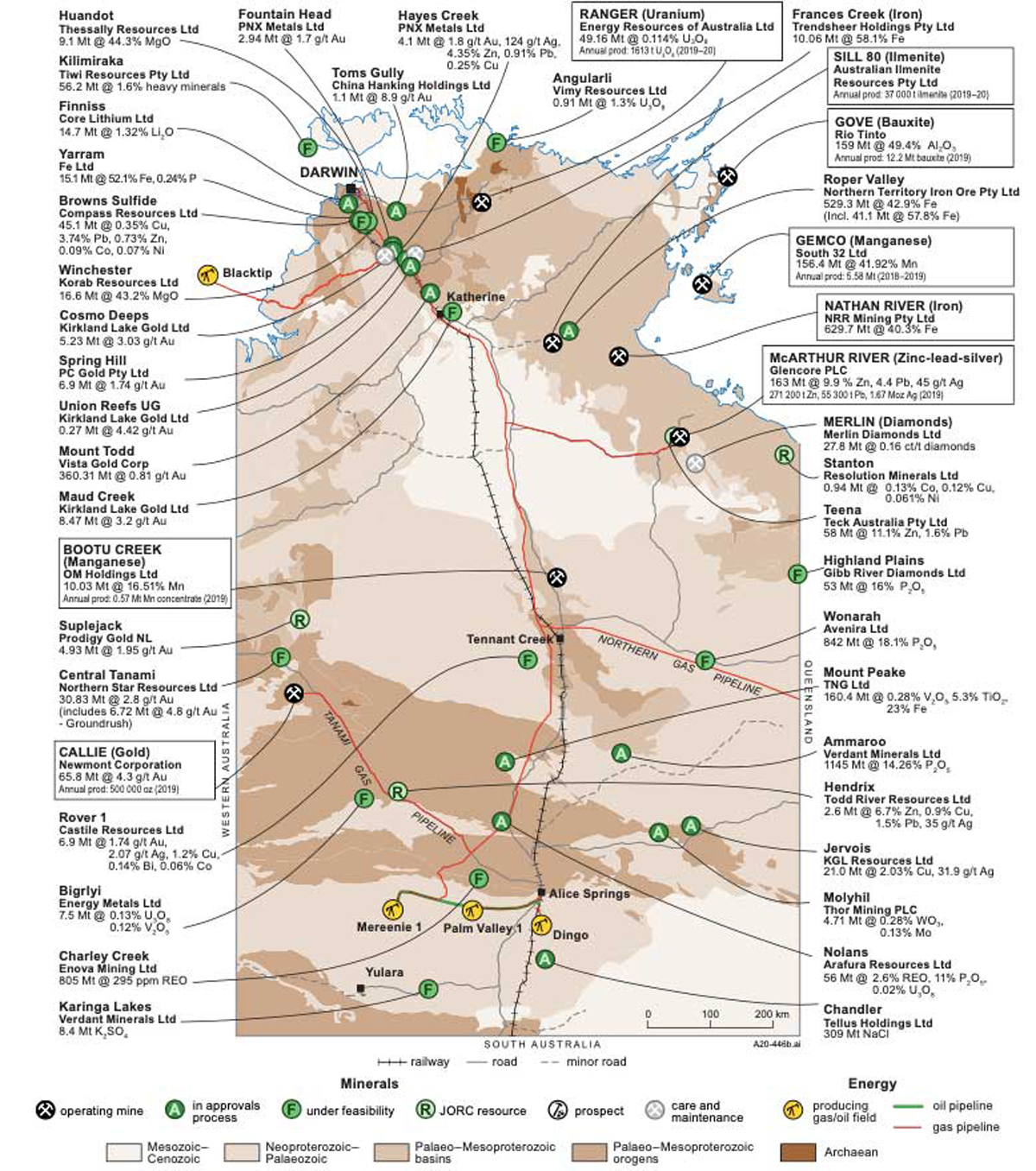

The NT has produced over 20 million ounces of gold primarily from Pine Creek, Tennant Creek and the Tanami.

Data released in August from the $225m federal government-funded Exploring for the Future program estimated Tennant Creek alone could host mineral deposits worth up to $12.4bn.

And explorers are proving there are still plenty of untapped opportunities in the Pine Creek and Tanami regions.

PNX Metals (ASX:PNX) recently announced the acquisition of the first of what it says are several opportunities in the Pine Creek region.

The company’s plan is to acquire ‘bolt-on’ assets to build scale at its Fountain Head gold project.

Fountain Head – which currently has a resource of 2.94 million tonnes at 1.7 grams per tonne (g/t) for 156,000oz of gold — could become a regional processing hub for mineral deposits in the Pine Creek region that are considered “stranded” due to their modest grades and distance from existing infrastructure.

PNX’s first acquisition is the Glencoe gold deposit, which is located in the same structural trend as and less than 3km from Fountain Head.

The company recently completed a rights issue raising $3.2m, which is on top of its recent successful placement that raised $2.3m. The rights issue was well subscribed and included participation by a number of major shareholders — including DELPHI Unternehmensberatung Aktiengesellschaft, which took up its full entitlement.

“This funding together with the placement will enable the company to progress its 100 per cent owned Fountain Head gold and Hayes Creek zinc-gold-silver projects and will see the company through a significant period of project development and gold exploration activity over the next 12 months, including finalising the acquisition of the Glencoe gold deposit,” managing director James Fox told investors this week.

“Exploration will be rapidly advanced, with near-mine drilling to test newly identified target areas at Fountain Head commencing as early as February, subject to government approvals.”

Meanwhile, Mandrake Resources’ (ASX:MAN) recent focus may have been more on replicating Chalice Gold Mines’ (ASX:CHN) Julimar nickel-copper-PGE success at its Jimperding project in Western Australia, but it is also advancing the Berinka Pine Creek gold project.

The Berinka Pine Creek project covers 289skqm in the underexplored west Pine Creek Orogen, where historic work has identified gold mineralisation hosted in volcanics and sediments.

First-time speculative greenfields drilling conducted by Mandrake targeting soil and magnetic anomalism returned high-grade gold, silver and copper intercepts like 3m at 1.8g/t gold, 32g/t silver and 2.1 per cent copper, including 1m at 3.7g/t gold, 69g/t silver and 3.1 per cent copper, from 124m.

“This exciting unexplained gold-silver-copper grade has been overshadowed by the Jimperding project near Chalice and so is skipping under the radar,” Mandrake managing director James Allchurch told Stockhead.

“In an era where Australian gold explorers are re-hashing previous work by infill drilling historic RAB/AC grids, drilling under or along strike of pits or simply repeating historic work, the Berinka project represents an exciting greenfields gold play in the NT with plenty of smoke.

“The NT is unloved by investors at present, but I believe it represents very good value from an exploration point of view. All it will take is one discovery for the market to change its view.”

Mandrake is planning to undertake follow-up drilling in early 2021.

Heavyweights want a piece of the action

An explorer is obviously onto something good when it attracts a much bigger partner. In the Tanami region, Tanami Gold (ASX:TAM) has a joint venture with $9bn gold miner Northern Star Resources (ASX:NST).

Tanami Gold owns 60 per cent of the Central Tanami project, which is being sole funded by Northern Star through to the start of commercial production.

Work has been limited in recent months due to the COVID-19 pandemic, but the JV plans to undertake drilling at the Jims deposit to test the lateral and depth extensions of the mineralisation intersected below the main pit and start an aircore drilling program at Cave Hill.

NT government throws support behind juniors

While gold has dominated headlines in recent months, another commodity that has been in the spotlight is rare earths thanks to it landing in the “critical minerals” basket.

Australian governments have been particularly supportive of these projects, and the NT government is no exception having granted Arafura Resources’ (ASX:ARU) Nolans rare earths project Major Project Status.

Arafura is currently wrapping up offtake and financing agreements for its flagship project near Alice Springs that it describes as being ‘shovel ready’.

Nolans will produce the key rare earth elements of neodymium and praseodymium, which are used to manufacture magnets for a range of modern technologies. These include wind turbines, robotics, electric vehicles, MRI machines, and mobile phones and tablets.

A feasibility study with extensive flow sheet pilot testing is already in place for Nolans and potential customers have already qualified Arafura’s product range.

The project has secured all NT and federal government environmental approvals as well as the all-important Native Title agreement.

Nolans has a significant mining inventory capable of supporting 39 years of production.

Plenty of action in Tennant Creek

Tennant Creek, meanwhile, has positioned itself as a major resource hub with an abundance of exploration activity in the region.

Emmerson Resources (ASX: ERM) is developing a high-grade copper-gold-cobalt project in the region with two partners, Territory Resources and NT Bullion and Elmore Proprietary Limited.

The partners are funding the development of Emmerson’s Tennant Creek project, including a new 300,000-tonne-per-annum mill and tailings treatment plant and $10m for exploration by 2024.

Emmerson will receive a low-risk gold royalty or profit share from new mines at Tennant Creek, including 12 per cent of gross revenue from its Edna Beryl gold mine, and 25 per cent of the profit from copper and cobalt from its Mauretania and Jasper Hills tenements.

The Mauretania project has returned hits like 20m at 38.5g/t gold, while Edna Beryl has delivered 8m at 157g/t gold.

Castile Resources (ASX:CST) recently completed drilling at its Rover 1 copper-gold project, 80km south of Tennant Creek, as part of a prefeasibility study.

The results are due out in January, but previous drilling returned high-grade gold intercepts like 7m at 125.9g/t gold from 542m and 21m at 6.8 per cent copper from 469m.

Planning for a 2021 drilling campaign is underway and managing director Mark Hepburn says the company has a “number of exceptional targets” lined up to explore.

At Stockhead, we tell it like it is. While PNX Metals, Mandrake and Arafura are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.