PNX builds scale potential of Fountain Head with new ground

Mining

Mining

Special Report: PNX has unlocked the first of several opportunities to substantially grow the scale of its Fountain Head gold project in the Pine Creek region of the Northern Territory.

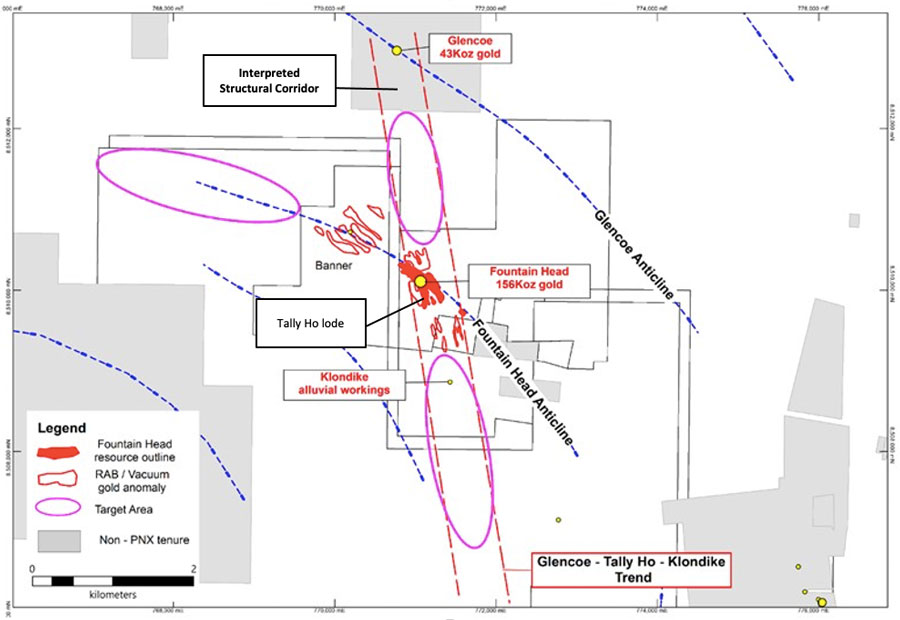

PNX Metals (ASX:PNX) is acquiring the Glencoe gold deposit, which is located in the same structural trend as and less than 3km from the company’s Fountain Head project in the NT.

The company has inked a non-binding term sheet with private company Ausgold Trading to buy the project for staged payments totalling $1.875m.

PNX’s plan is to acquire ‘bolt-on’ assets to build scale at Fountain Head, which is located within a historic mining area that comes complete with existing haul roads, water, rail, gas, grid power and telecommunications infrastructure.

Fountain Head – which currently has a resource of 2.94 million tonnes at 1.7 grams per tonne (g/t) for 156,000oz of gold — could become a regional processing hub for mineral deposits in the Pine Creek region that are considered “stranded” due to their modest grades and distance from existing infrastructure.

Glencoe is one of several gold prospects that could provide additional feed material to the proposed carbon-in-leach plant to extend the mine life and lower costs.

“The Glencoe gold deposit lies on the same structural trend and within 3km of Fountain Head and represents the first of many opportunities PNX has identified with the potential to significantly add to the company’s existing gold resource base, and to generate additional flexibility in its development strategy,” managing director James Fox said.

The Glencoe deposit has a historic, non-JORC compliant resource of 700,000 tonnes at 1.9g/t for 43,000oz of gold.

The resource has been defined within four main mineralised lodes over about 500m of strike. But there is plenty of exploration upside, with the historic resource remaining open at depth and along strike.

Limited historic drilling down to a maximum depth of just 30m returned high-grade hits including 6m at 3.4g/t gold from 45m, 12m at 1.82g/t from 25m and 2.7m at 28.38g/t from 25.5m.

PNX says these results could represent new extensional lode positions.

The company plans to start drilling after the NT wet season to convert Glencoe’s historic resource to a JORC-compliant resource.

This has prompted PNX to fast track the feasibility study and the development approvals process.

PNX aims to have the feasibility study completed in early 2021.

Adding to the upside, there is also material quantities of gold and silver contained in oxide mineralisation at Mt Bonnie that will be assessed in the feasibility study.

Mt Bonnie, which is part of the Hayes Creek project and situated 15km south by road to Fountain Head, has a resource of 1.55 million tonnes at 3.8 per cent zinc, 1.34g/t gold, 127g/t silver, 1.1 per cent lead and 0.2 per cent copper for 66,800oz of gold and 6.3 million oz of silver.

Including existing stockpiled material at Mt Bonnie, up to 28,000oz of gold and 1.5 million oz of silver are present in the oxide/transitional zone and may be recovered through the proposed carbon-in-leach plant.

The expanded feasibility study will investigate the technical and economic viability of a multi-asset development.

Fountain Head will be developed as stage one, with the Hayes Creek zinc-gold-silver sulphides to follow as stage two.

This article was developed in collaboration with PNX Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.