Battery Metals: Talga reckons it can sell its graphite product for 6 times more than it costs to produce

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

There’s a clear shift away from ‘dig and deliver’ towards vertical integration in the battery metals space.

Basically, it’s more lucrative. Lithium spodumene producers, for example, can get $US700/t for a 6 per cent concentrate or ~$US14,000/t by moving up the supply chain into hydroxide production.

- Scroll down for more ASX battery metals news >>>

Graphite play Talga (ASX:TLG) is attempting something similar.

The explorer’s vertically integrated Vittangi graphite project in Sweden will make serious money over its initial 22-year life by targeting Europe’s burgeoning lithium-ion sector, according to a project pre-feasibility study.

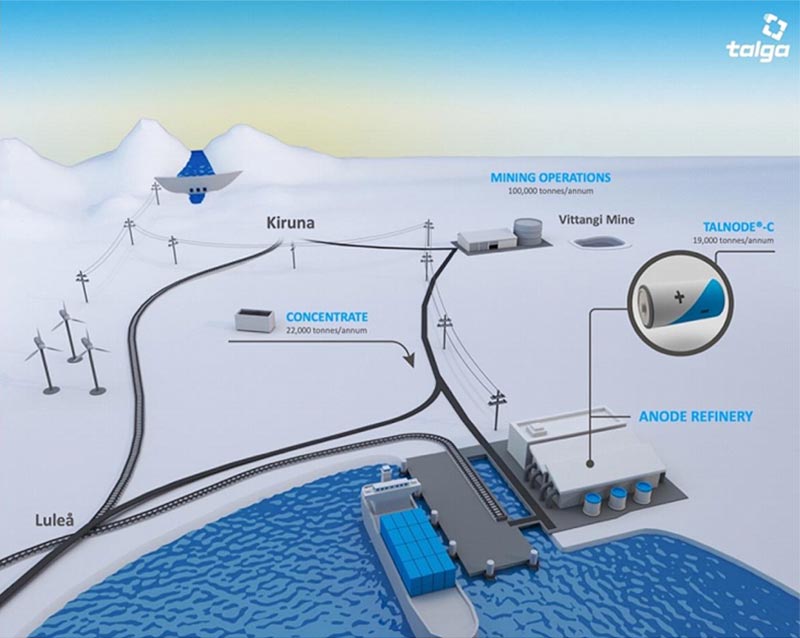

An open-pit mining operation, on-site concentrator and coastal anode refinery will produce about 19,000 tonnes per annum of Talnode-C, the company’s graphite battery anode product.

It’s going to look something like this:

First production is planned for early 2021.

A two-stage design means Talga can get into production for as little as $US27m. The estimated capex for Stage 2 would be $US147 million.

And the economics are incredible; Talga estimates revenue of $US4.14 billion over an initial 22 years of steady state commercial production.

More importantly, it’s going to cost them just $US1852 to produce each tonne of Talnode-C, which they will sell to battery makers for roughly $US11,250/t.

This pricing is a discount to the recommended pricing provided by independent, globally recognised battery metals experts Benchmark Mineral Intelligence.

That huge margin means Talga could pay back Stage 2 start-up costs in one and a half years.

Talga managing director Mark Thompson says the PFS supports Talga’s move to produce fully value-added graphite products for li-ion batteries.

“This is the most immediate path to significant revenue for Talga and aligns with our vertically integrated business that sets us apart from peers,” he says.

“Next steps include a Stage 1 Definitive Feasibility Study (DFS) to further optimise scale, in line with growing li-ion battery anode demand, and progress discussions with customers and potential strategic partners toward the targeted 2020 commencement of Stage 1.”

In other ASX battery metals news today:

Fellow graphite play Kibaran Resources (ASX:KNL) says its debt financing arrangements have “in-principal” approval from the Tanzanian government.

In April, Germany’s KfW IPEX-Bank agreed to arrange a senior debt funding facility for the company’s Epanko project. This approval means KfW IPEX-Bank can progress the loan submission process in Germany; a process which could take several months. Investors approved, sending the stock up by 8 per cent in morning trade.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.