Battery Metals: Cashed up Neometals takes vanadium strategy to the next level

Pic: Getty

Neometals (ASX:NMT) is an explorer and project developer with lots of cash.

Neometals recently sold its 13.8 per cent stake in the already producing Mount Marion lithium mine near Kalgoorlie in Western Australia for $103m.

- Scroll down for more ASX battery metals news >>>

This means that after paying a dividend last quarter, the company still has about $116m in the bank, which is handy as it progresses key projects, including a battery recycling plant in Canada, and the Barrambie vanadium-titanium project in WA.

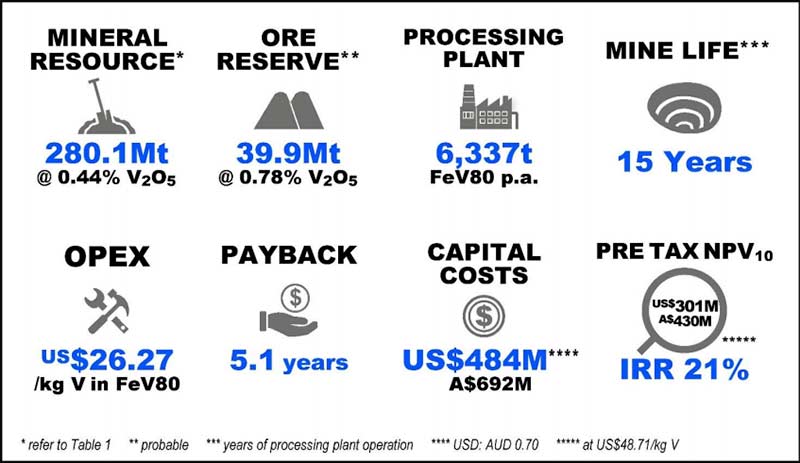

Today, a revised Barrambie feasibility study estimated construction costs of $692m (including a 14.3 per cent contingency) and $2.5 billion in earnings over an initial 15-year life.

Here’s the highlights:

The numbers aren’t mind-blowing, but it’s important to note that this only includes vanadium production.

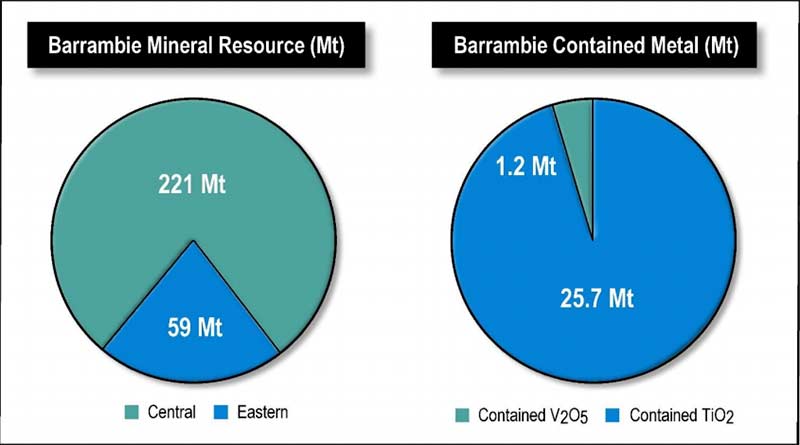

Neometals will now examine how it can effectively extract the titanium, which actually makes up about 95 per cent of the contained metal at Barrambie:

That means there’s plenty of upside here.

The company will kick off a staged pilot-scale evaluation to determine the optimal flowsheet to process both titanium and vanadium, which will underpin the final evaluation — a FEED study.

This study is due to be completed by the December quarter in 2020; then, all going well, the company will start building a commercial plant.

At this stage the product from the project is “unencumbered” by any offtake arrangements, says Neometals.

“A number of discussions have been held with parties both inside and outside China and it is clear due to the current structural deficit in the market that there is strong interest in potential offtake from the project,” the company says.

“Once the planned National Instrument 43-101 report is completed for the project (expected to be completed this quarter) this document will be used to further advance offtake discussions.”

In other ASX battery metals news today:

Lithium Australia (ASX:LIT) is, as the name suggests, focussed on developing its suite of lithium assets.

But the company acknowledges the competition from alternative technologies in the battery field; in particular, vanadium flow batteries, so it has defined a new ‘non-core’ vanadium strategy. Today, it unveiled a mineral resource estimate of 185 Mt at 0.33 per cent V2O5 for the Youanmi project in WA, which it has the option to purchase from private company Diversity Resources.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.