Base Resources hits production targets, has ‘clear growth path’ for mineral sands business

Base Resources hits production targets for mineral sands business (Image: Getty).

Special Report: It’s not very often you come across a junior resources company like Base Resources — one that is already in production, making money, and returning cash to shareholders.

Amid the global pandemic that has upended markets, there is no better place to be than selling into a market that has remained stable.

That is exactly what happened with mineral sands, despite all of the uncertainty COVID-19 threw up.

“Our markets have almost defied gravity in a sense,” Tim Carstens, managing director of mineral sands producer Base Resources (ASX:BSE), told Stockhead.

“We haven’t seen any significant drop-off in demand. It’s been still quite strong,” he says.

“We’re constantly anticipating it, but the longer this goes, the more comfortable we get that we’re not going to see a really significant fall in pigment production and consequent demand for feedstocks.”

Mineral sands are old beach sands that contain zircon, ilmenite, rutile and other minerals.

They’re used in just about anything you can think of that we need in everyday life.

Titanium dioxide from rutile and ilmenite is processed into titanium-based products for ultra-white pigments that are used in paints, fabrics, plastics, paper, sunscreen, food and cosmetics.

Zircon, meanwhile, has a high melting point, making it ideal for use in engines, electronics, spacecraft and the ceramics industry.

Prices holding steady

“We’ve seen the ilmenite price largely track sideways since about April and rutile has come under a bit of pressure,” Carstens said.

“The high-grade feedstocks aren’t quite as in demand at this stage, but we’re not seeing a really significant drop-off in price for rutile.

“And zircon has continued to be reasonably robust as well, with prices possibly coming off a bit into the fourth quarter, but that’s really going to be determined by what the other big suppliers, Tronox and Iluka, do in terms of trying to meet production guidance and sales guidance.

“So, it’s been in pretty good shape up to this stage.”

The average rutile and ilmenite prices in FY20 were 18 per cent and 30 per cent higher, respectively, than in FY19.

This more than offset a 9 per cent year-over-year decline in zircon prices.

That stability, and the fact Base has a mineral sands project in Kenya which has not been as badly affected by the COVID outbreak, has resulted in the company hitting the upper end of its production guidance for FY20.

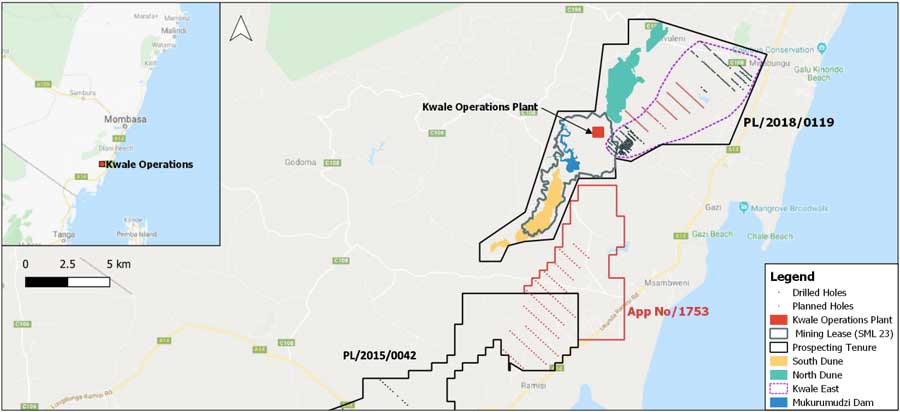

With the production of 78,920 tonnes of rutile, 355,093 tonnes of ilmenite and 31,657 tonnes of zircon, the Kwale operation exceeded management expectations in the first full year of mining the South Dune deposit.

“We are a pretty substantial exporter in Kenya,” Carstens noted. “In fact, I think we’re the largest single exporter and about 70 per cent of the mining industry, so the government has been quite keen to work with us to make sure that we’re able to continue to operate.”

The strong financial year boosted Base’s net cash position to $US87.6m ($120.5m) by the end of June 2020.

Clear growth path

Base also has a second mineral sands asset in its stable – the Toliara project in Madagascar.

Toliara is expected to have a 33-year mine life, producing 780,000 tonnes of ilmenite, 53,000 tonnes of zircon and 7,000 tonnes of rutile each year.

The company’s advantage is that it already has a successful business model in its operating Kwale mine that it can replicate at Toliara.

COVID-19 has delayed the move to development slightly, which has actually been a good thing for investors.

“We’ve always had the objective as part of the development of Base of delivering returns to shareholders, but wanting to make that transition to delivering returns in two ways — capital growth, which is typically the pathway of development companies and small companies, and sensible cash distributions as well,” Carstens explained.

“With Toliara being delayed somewhat by the impact of COVID and our inability to move people around the world, as well as the suspension of activities by the government in Madagascar, the final investment decision has been moved out.

“Earliest it’s likely to be is September next year, and that has broken the nexus, if you like, between cash accumulation and cash deployment.

“So we made the decision that now is the right time to make that transition to becoming a dividend payer.”

Base revealed in August it would pay a 3.5c-per-share, or around $41m, back to shareholders by October 7.

The company is, however, still very determined to get cracking on bringing the Toliara project into production as soon as it’s able.

The company has two clear growth objectives: extend the mine life of Kwale and bring Toliara into production.

When Base first acquired Toliara at the end of January 2018, it was of the view that it was sitting on one of the “best undeveloped mineral sands asset in the world”.

“Everything we’ve done since has just reinforced that view and we see it’s getting considerably bigger,” Carstens said.

“We see lots of expansion potential and its competitive positioning is absolutely at the top of the tree in terms of revenue to cash cost ratio. That’s just such a compelling growth path.

“We just need to work our way through the various non-technical issues, the risk issues, fiscal terms and pinning all of that down over the next 12 months to get it up and moving.

“So we have a really clear growth path.”

Investors starting to realise the value

There are just three mineral sands producers on the ASX and that includes the +$4bn Iluka Resources (ASX:ILU). There are also a number of other project developers.

Investors appear to be starting to realise Base’s value, with its share price climbing around 144 per cent since the COVID-19 market bottom in May.

Base, which has a market cap of around $350m at a share price of 30.5c, is also ahead nearly 40 per cent since the start of 2020.

“What makes us different, and not just amongst Australian listed mineral sands companies but amongst mineral sands companies globally, is that we’ve got a really strongly cash generative asset in Kwale that we think we can extend, and we also have a pretty attractive — in fact, very attractive — growth path in the Toliara project,” Carstens said.

“If you look across our competitors, they’re very much tied to the operation that they’re currently working with.

“They haven’t sort of taken that step across to development assets.”

This article was developed in collaboration with Base Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.