Base Metals: Nickel play Mincor builds impressive $55m war chest to fund mine predevelopment

Mining

Mining

Kambalda-based Mincor has announced a $35m cap raise to fund its aggressive nickel restart strategy.

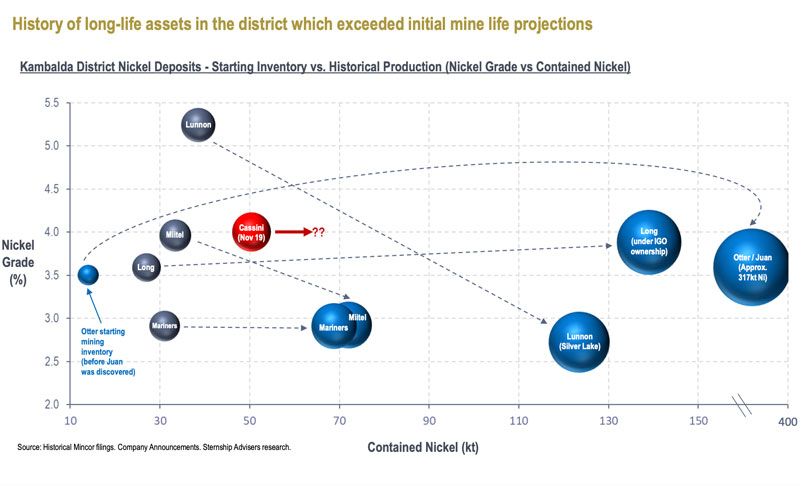

In August 2018, developer Mincor Resources (ASX:MCR) unveiled a maiden resource at Cassini, the first nickel deposit to be discovered in the Kambalda district for many years.

The resource has been updated three times since then. In November, it was increased to 1.254 million tonnes at 4 per cent nickel for 50,400 tonnes.

The latest round of drilling at Cassini produced several very wide, high-grade hits like 15.4m at 4.7 per cent and 12.3m at 5.1 per cent – the best from the project to date.

“The more we drill, the better it gets,” Mincor non-exec chairman Brett Lambert said earlier this month.

“Cassini is shaping up to be one of the most significant nickel deposits in the Kambalda district, which is particularly notable given this project is in its infancy.

“It took several decades to reveal the full potential of the major Kambalda nickel deposits.”

It’s just one part of Mincor’s assertive nickel restart strategy.

In March this year, it signed new ore treatment and offtake terms with BHP Nickel West, which provides a clear pathway back to production.

Two months later it purchased the celebrated Long nickel operation from Independence Group (ASX:IGO) for $9.5m, which saw the $3.5 billion miner jump on the Mincor register.

Mincor also has a pipeline of near-mine targets to run down. Mincor has budgeted ~$8m for nickel exploration in 2020, split between resource expansion projects and “emerging greenfields opportunities”.

Today, Mincor announced a $35m cap raise at a slight discount to the current share price to fund pre-production capital costs, among other things. It follows a similar $23m raise in May this year.

Proceeds will go towards Mincor’s early capital works at Cassini and Long-Durkin — like clearing, box-cut, decline, and underground development — ahead of the expected completion of the definitive feasibility study (DFS) in Q1 2020.

Existing shareholders Independence Group and Squadron committed $2m and $7.2m respectively. Once the placement is completed they will hold interests of 4.41 per cent and 6.17 per cent in Mincor.

This $35m windfall will increase Mincor’s cash position to ~$55m by the end of the year, managing director David Southam says.

“The capital raising effectively puts us ahead of the curve in terms of the normal evolution of a resource developer, as we progress from DFS through to production.

“With a significantly strengthened balance sheet, we will have the capacity to commit to important items of pre-production capital expenditure before we complete the DFS.

“We will also be in a much stronger position to negotiate a competitive project funding package and expect to be in a position to move seamlessly from DFS completion through to a formal decision to mine without delay, allowing us to capitalise as quickly as possible on the strong nickel market environment.”

Mincor – which is up about 86 per cent over the past 12 months – was down about 5 per cent to 61.5c in morning trade.

READ MORE: Carmakers, battery manufacturers are calling nickel companies direct as supply shortfall looms

Todd River Resources (ASX:TRT) discovers new areas of shallow base metal anomalism at the Mt Hardy copper-zinc project in the NT.

The anomalous (low-grade) target areas – found by resampling historic drilling which had been mostly assayed for gold only — are to the north of the Hendrix deposit and other recently drilled shallow targets.

Re-sampling of “historical RAB spoils” could be viewed as a first pass ‘free hit’ look at some of the geology undercover in the northern part of the project, says Todd River’s Will Dix.

“The Linda-Jane and Gilly Extension anomalies are the obvious areas that we will follow up in 2020, but we are also planning to extend the bedrock drilling program across additional parts of the project area along trend from where we have identified base metal mineralisation in the recently completed reconnaissance RC drilling program,” he says.

“The last couple of months have delivered outstanding exploration results and we are excited about the opportunities we will be able to chase in 2020 in an area that is fast becoming a stand-out base metal exploration play.”

READ MORE: Todd River shares rise on striking broad zones of base metals in the NT