Base metal prices drop back on profit-taking and softer demand

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

- Copper and nickel prices draw back after year-to-date highs

- ‘It is only natural there is going to be some profit-taking after the euphoria of last week’

- ASX stocks Alta Zinc, Encounter Resources, Galileo Resources find new copper discoveries

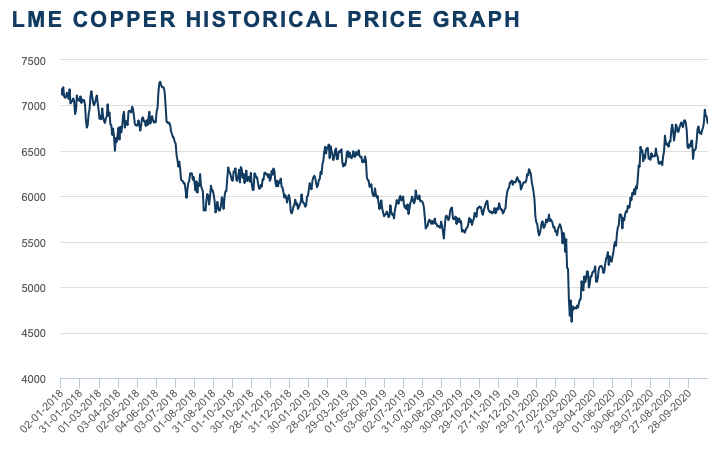

Copper and nickel prices have reached a pivot point after the two base metals made year-to-date highs last week of $US6,953 per tonne ($9,761/t) and $US16,064 per tonne ($22,552/t), respectively.

The red metal closed lower Tuesday at $US6,787 per tonne and nickel was down to $US15,602 per tonne, according to London Metal Exchange price data.

“It is only natural that there is going to be some profit-taking after the euphoria of last week,” metals analyst Robin Bhar told Reuters.

Bhar stressed the market was not in a sell-off state, as there is still a lot of optimism for copper, nickel and tin, he said.

“This pullback is a good opportunity for people to get some slightly better buying levels,” he added.

Nickel is a key ingredient in stainless steel, and lower Chinese steel futures prices this week are pushing down on LME nickel prices, said analysts.

Copper and nickel prices have recovered well from March slump

Both base metals have enjoyed a strong run up from their March lows of $US4,617 per tonne for copper and $US11,075 per tonne for nickel.

China’s faster-than-expected economic recovery from the COVID-19 pandemic and US monetary stimulus measures have stoked demand for copper and nickel, according to reports.

As has rising demand from the renewable energy and battery-powered EV sectors including Tesla which use the metals.

EV demand for nickel adds up to roughly 5 per cent of the metal’s market, according to analysts at Macquarie Bank.

The outlook for the copper market is looking bright with a forecast deficit this year of 50,000 tonnes, according to the International Copper Study Group’s latest update.

Global mine production of copper is set to decline by 1.5 per cent this year, before rebounding by 4.5 per cent in 2021, said the ICSG in its 2021 forecast for the metal.

The International Nickel Study Group is forecasting a 117,000-tonne market surplus for 2020, after the market tightened with Indonesia’s ban on exports of nickel ore to encourage a home-grown nickel processing industry.

New copper and nickel discovery in Italy for Alta Zinc

Alta Zinc (ASX:AZI) has made a discovery of closely-spaced mineralised sub-veins or splays for high-grade cobalt-copper and nickel-silver at its Punta Corna project in northern Italy.

The new sub-veins lie between several main veins within its project and potentially extend the project’s mineralisation which has a current strike length of 2,500m and depth of 340m.

“Our work at Punta Corna confirms that the project hosts a number of parallel vertical veins containing high-grade samples of cobalt, nickel, copper and silver mineralisation and these veins show good structural continuity over long strike lengths…” said managing director, Geraint Harris.

Innovative methods yield new copper targets for Encounter

Encounter Resources (ASX:ENR) has identified a suite of new, highly ranked copper drill targets at its Yeneena copper-cobalt project in WA’s Paterson province.

“The application of a number of innovative exploration techniques has generated a suite of new copper drill targets located under cover at Yeneena,” managing director, Will Robinson said.

The drill targets were identified with its earn-in partner gold company IGO (ASX:IGO) through a combination of fine fraction soil, magnetotelluric and electromagnetic surveys.

The company is targeting a multi-point copper soil anomaly of up to 774 parts per million copper at its Tarcunyah prospect located on the Vines fault system at Yeneena.

The drilling activity has been funded by IGO and by the WA government’s exploration incentive scheme up to $150,000, and IGO can earn an interest of up to 70 per cent in Yeneena for $15m of exploration expenditure.

Galileo finds nickel-copper sulphide in WA project

Assay results for Galileo Mining’s (ASX:GAL) recent drilling at its Lantern South prospect in WA’s Fraser Range nickel belt confirm the presence of a mineralised system capable of producing high-grade nickel-copper sulphide.

Drilling hits at Lantern South include 22.6m at 0.19 per cent nickel and 0.14 per cent copper from 132.6m, and the first occurrence of nickel and copper-rich massive sulphides over a 7cm section of drill core.

“For the first time we have identified a small section of primary massive sulphide with high levels of nickel, copper and cobalt,” said managing director, Brad Underwood.

“This means we have identified a mineralised system that can produce high-grade nickel and copper,” he added.

Share prices for Alta Zinc (ASX:AZI), Encounter Resources (ASX:ENR), Galileo Mining (ASX:GAL)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.