Copper could replace silver in solar panels, price forecast to rise

Copper metal is seen as replacing silver in advanced solar panels. Pic: Getty Images

- ARENA funds solar startup SunDrive to produce rooftop panels that use copper instead of silver

- ‘Next generation solar cells require two to three times more silver per cell’

- Copper prices forecast to rise into 2021 on growing supply shortage

Copper prices are showing renewed strength on China’s economic rebound and a weaker US dollar as new streams of demand arise for the industrial metal, the latest being for solar panels.

The Australian Renewable Energy Agency (ARENA) announced this week $3m of funding to Australian start-up SunDrive for its rooftop solar panels that use copper instead of silver.

Solar power units currently represent 20 per cent of global annual silver consumption, ARENA said.

“This presents an ongoing supply risk as solar demand grows and is further exacerbated if the industry moves to higher efficiency next generation solar cell structures which require two to three times more silver per cell,” the agency said.

“As we continue to transition our energy system, the solar industry needs to continually evolve and adopt new cell structures that increase efficiencies, reduce costs and employ more abundant materials,” ARENA chief executive Darren Miller said.

The ASX’s 10 best-performing copper stocks

| Code | Company | Price | MktCap | %Mth | %SixMth | %Wk | %Yr |

|---|---|---|---|---|---|---|---|

| REE | Rarex Limited | 20.5 | $ 75,361,127.28 | 242 | 1106 | 78 | 242 |

| RCP | Redbank Copper Ltd | 6.3 | $ 25,695,847.30 | 232 | 232 | 3 | 232 |

| MAG | Magmatic Resrce Ltd | 19 | $ 32,891,906.62 | -19 | -24 | -10 | 228 |

| AQI | Alicanto Min Ltd | 17 | $ 47,729,814.38 | 10 | 286 | 0 | 209 |

| CTM | Centaurus Metals Ltd | 53 | $ 172,704,294.80 | 10 | 382 | 8 | 172 |

| COY | Coppermoly Limited | 1.5 | $ 31,908,209.84 | 114 | 275 | -12 | 150 |

| ENR | Encounter Resources | 28.5 | $ 80,035,115.88 | 111 | 197 | 50 | 90 |

| ALK | Alkane Resources Ltd | 146.5 | $ 872,244,592.00 | 30 | 98 | 4 | 83 |

| NWC | New World Resources | 3.8 | $ 42,800,033.42 | -10 | 443 | 0 | 73 |

| OAR | Oakdale Resource Ltd | 2.3 | $ 37,238,433.94 | -8 | 1178 | 10 | 70 |

ASX copper stocks see strong demand from investors

Argonaut Resources (ASX:ARE) successfully raised $2.7m from a share placement to institutional and sophisticated investors last month to develop its Murdie copper project.

“This placement and share purchase plan come as we see the copper price strengthen on the back of strong Chinese demand and weaker South American supply,” chief executive Lindsay Owler said.

The project is 45km to the east of BHP’s (ASX:BHP) Oak Dam discovery and OZ Mineral’s (ASX:OZL) new Carrapateena mine in South Australia’s copper-rich Gawler Craton.

Also located in South Australia’s Gawler Craton is Coda Minerals’ Elizabeth Creek copper project which has an exploration target of 1 million tonnes by 2021. Coda Minerals is set to list on the ASX boards in mid-October after its $8.5m IPO last week.

Another company with copper interests is Encounter Resources (ASX:ENR), which last month struck a farm-in deal with BHP for its Elliott discovery in the Northern Territory.

Redbank Copper (ASX:RCP) has made progress in developing its Redbank project in the Northern Territory and the focus of its Sandy Flat copper extraction program.

The company has set an exploration target range (ETR) of 14,100 to 20,900 tonnes of contained copper for the project, and will carry out drilling to establish a resource estimate.

“The ETR has reaffirmed our view that a significant amount of copper remains at the Sandy Flat mine site following the cessation of mining in 2005,” chairman Mike Hannington said.

Market deficit starting to emerge for copper metal: S&P Global

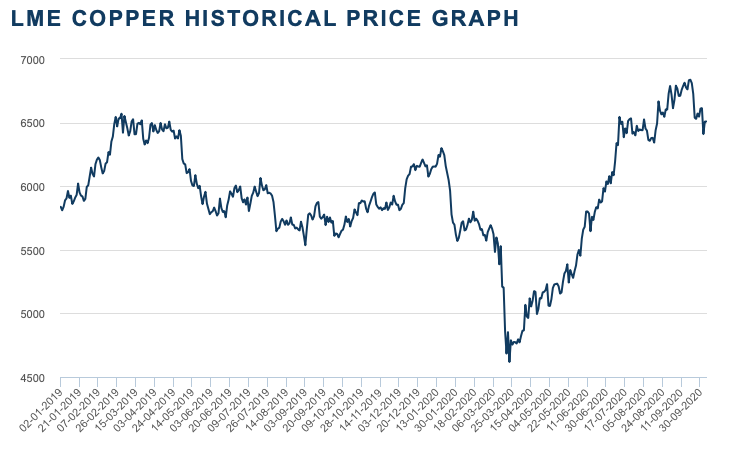

Copper was trading steady at $US6,525 per tonne ($9,149/tonne) on the London Metal Exchange, Wednesday.

The red metal has been on an upward trajectory since its March low of $US4,320/t.

Demand for copper is starting to pull ahead of available supply, say market analysts.

This may lead to a market deficit for copper of 87,000 tonnes in 2021, and 97,000 tonnes in 2022, S&P Global Ratings said.

“Looking into 2021, we expect a more pronounced recovery to result in a supply deficit that should support higher prices.”

As a result, the company has revised upwards its forecast prices for copper to $US6,500 per tonne for the rest of 2020.

Previously, it had forecast $US5,900/tonne for the second half of 2020.

For 2021, S&P Global Ratings is expecting copper prices to reach $US6,300/tonne, and $US6,400/tonne in 2022.

Chinese consumers are purchasing more EVs, with sales in China up 22 per cent year on year in July to 2.2 million, S&P Global said.

Argonaut (ASX:ARE), Encounter (ASX:ENR) and Redbank Copper (ASX:RCP) share prices

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.