Awak Mas is Nusantara’s ‘highly profitable’ entry into gold production

Pic: Getty

Special Report: Cashed up project developer Nusantara Resources is attracting strong investor interest as it targets late-2022 production from Awak Mas – Indonesia’s next gold mine.

The Awak Mas project in South Sulawesi, Indonesia, has been a focus of modern-day exploration since 1991.

A succession of international exploration and gold mining companies including Battle Mountain, Lone Star, Placer Dome and Vista Gold completed a cumulative +125,000m of drilling and several development studies — but the mine was never built.

The turning point came with the arrival of Nusantara (ASX:NUS) in 2017.

“A Newcrest veteran geologist from Cadia Valley who had recently worked on Newcrest’s Gosowong mine in Indonesia — with huge experience in these types of deposits — sat down with the consulting resource geologist in Perth to look again at all the drilling data over more than the past 25 years,” Nusantara Managing Director Neil Whitaker says.

“They developed a new geological interpretation. It was a fundamental re-evaluation and reinterpretation of the geology at Awak Mas through a new pair of eyes and relevant experience.”

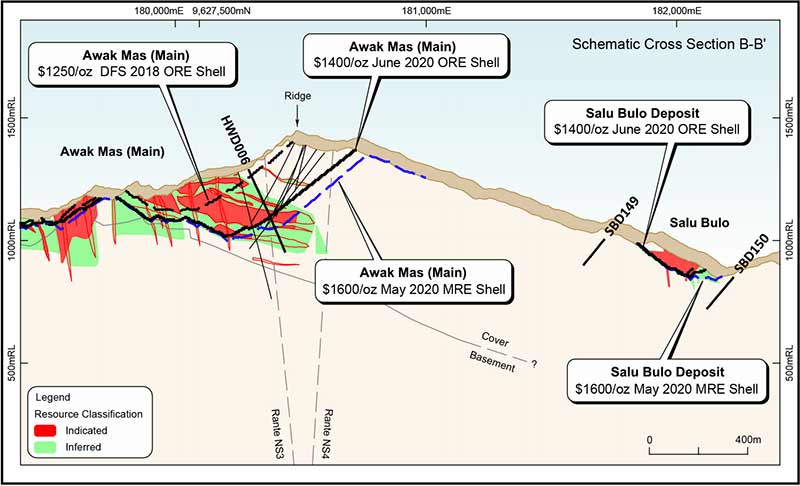

Nusantara discovered that previous drilling had missed parts of the orebody in the main pit where the gold is found in near vertical, high-grade zones.

“Most of the orebody is found in extensive strata-bound fairly low grade, flat lying horizons,” Whitaker says.

“Those would’ve been drilled over the years and found quite easily.

But this wider drill spacing missed many of the steep narrow fissures that actually carry the higher grade, later stage gold injection material.

“It is those high-grade gold zones that we have been able to identify.”

Now, a program of closer spaced drilling aims to intersect these higher-grade vertical zones that are prevalent within the project.

This program has strong potential to add to reserves and to extend and improve the existing pits.

“A highly profitable gold mine”

In October 2018 – just one year from listing — the company released a definitive feasibility study, a detailed look at whether a project is economic or not.

The numbers were solid. The $US146 million development boasted a low all-in-sustaining cost of $US750/oz, a net present value (NPV) of $US152m and an internal rate of return (IRR) of 20 per cent, based on a gold price of US$1,250 per ounce.

Those numbers have now substantially improved. The gold price is hovering close to $1,800/oz, for starters.

Higher confidence reserves have now increased by 34 per cent from the 2018 estimate to 1.53moz, driven by successful exploration results, improved mine planning, and this higher gold price:

Mine life has been extended to 16 years and production increased in the first four years of the project to 127,000oz per year, adding further value to an already robust project.

Nusantara is also studying the possibility of expanding the capacity of the processing plant from 2.5mtpa to 3.9mtpa.

“We are redoing the 2018 economics at the moment,” Whitaker says.

“By the end of this month we will be providing the market with an updated set of economics – an Addendum to the 2018 DFS.

“It doesn’t take much to realise at current gold prices, compared to $1,250/oz we used in the last feasibility study, that this will be a highly profitable gold mine.

“The Company appointed a debt and hedging adviser and is closely monitoring the gold market considering the value of hedging to under write project development.”

Finance and cornerstone partnerships

Getting a project like Awak Mas up and running is all about attracting money and the right partners.

In December 2018, Jakarta-listed $US1 billion energy and service conglomerate Indika Energy invested in Nusantara. This was huge milestone.

“Indika now hold 23 per cent of the shares in Nusantara and have rights to buy into 40 per cent of the Awak Mas project,” Whitaker says.

“They have already put $15 million into our bank account, which is funding us through this year.

“Their construction company subsidiary Petrosea have another $15m at our disposal as part of a deferred loan facility.

Over the course of 2020, the joint venture partners will look to complete project debt financing and to move into a construction and commissioning phase in 2021.

“The company and specialist advisor Noah’s Rule out of Australia is s preparing for the debt financing process with a number of interested international banks,” Whitaker says.

“We have a funding pathway to a decision to mine in early 2021.

“We have secured equity finance of $40m and we are looking for $120m in debt finance.”

Could Awak Mas be a 5moz project?

Whitaker’s main focus right now is hitting this year’s big pre-development milestones so that Awak Mas enters construction in 2021.

“My role is to understand and manage the risks, and make sure we deliver on our promises,” he says.

“I think that is absolutely fundamental — delivering on our promises.”

But this initial 16-year mine development is just the beginning. Nusantara also have a large mining license that is hugely prospective.

“We’ve been saying for two years that we think this will eventually be a 5-million-ounce development,” Whitaker says.

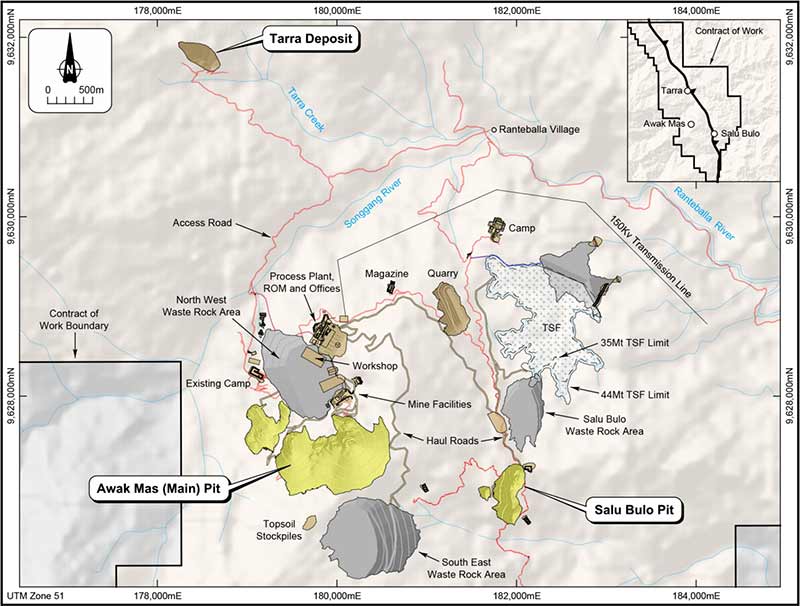

“The mine lease – or contract of work (CoW) – is huge. For starters, have additional known deposits here like Tarra that aren’t included in the mine plan.

“We are going to be doing some geophysics here and a number of other areas this year.”

Another impetus for long term growth comes from partner Indika Energy, who is absolutely committed to gold.

“They haven’t bought into Awak Mas just for the current project,” Whitaker says.

“The interest of Indika Energy is in diversification and they see see this as an entry into the very attractive gold space.

“They are looking to piggyback off this and with Nusantara Resources build a south east Asian mining company.

“Our vision as Nusantara is not just to deliver this gold mine. This gold mine is just the beginning of something much bigger.”

This story was developed in collaboration with Nusantara, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.