Australian Vanadium drills into BFS

AVL holds the regional high ground as it progresses the Australian Vanadium Project towards a BFS. Pic: Getty Images

Special Report: Drilling is underway at the Australian Vanadium Project’s Gabanintha resource, as its namesake owner works towards a bankable feasibility study (BFS) on the flagship project in WA.

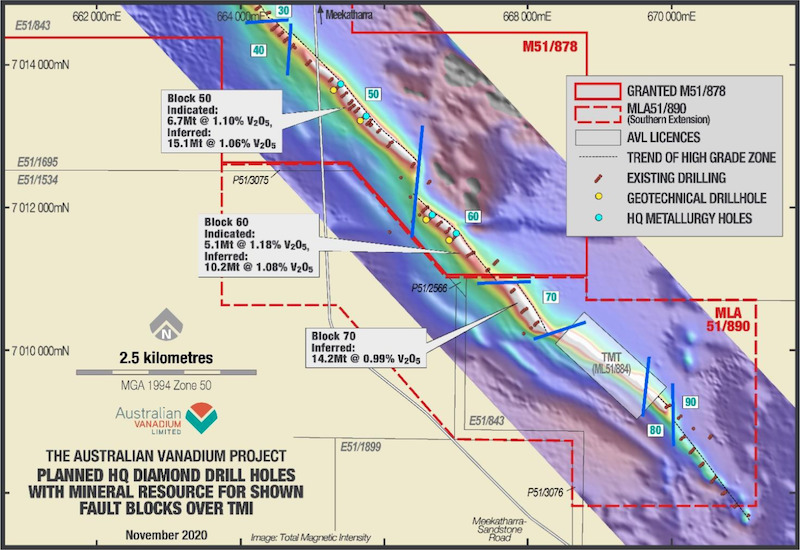

An eight-hole diamond drilling campaign has kicked off in southern resource blocks 50 and 60 at the Australian Vanadium Limited (ASX:AVL) project, with drilling to focus on metallurgical variability sampling and pit wall geotechnical information.

The drilling is designed to quantify any potential differences in the massive magnetite horizon between the northern and southern resource blocks at the Australian Vanadium Project. It follows diamond holes completed in 2009 and 2015 which indicated the weathering of material in block 60 was shallower than the northern blocks 20 and 30.

Diamond holes will also be drilled to determine important pit slope information, with the intention of including the southern indicated resources in a mining schedule on granted mining lease M51/878 to be included in the BFS.

The BFS is scheduled for completion in mid-2021.

In a statement to the ASX, Australian Vanadium said southern blocks 50 and 60 had become increasingly important to the outlook for the project overall.

“The planned inclusion of these blocks in the mine schedule offers flexibility in mining, to ensure that the blend of material to be delivered to the plant is the optimal ratio to maximise plant operation, without requiring large waste pre-stripping and the stockpiling of lower recovery mineralisation,” it said.

The current drill program is expected to be carried out over the next four weeks.

Battery system sold

The commencement of drilling comes just days after Australian Vanadium’s wholly-owned subsidiary VSUN Energy sold its first standalone power vanadium flow battery system to a residential customer.

The vanadium redox flow battery (VFRB) was sold to a customer in regional Western Australia, who acquired the standalone power system due to the high cost of connecting to the grid and a lack of reliable power in the region.

The VFRB was provided by Singapore-based manufacturer V-Flow Tech.

VFRBs are generally considered safer and longer lasting than lithium ion batteries for this particular setting, and their credentials for large-scale systems are well established.

Australian Vanadium also announced a green hydrogen strategy for its flagship vanadium project in November.

The strategy involves the use of green hydrogen – that which is sourced from renewable energy rather than natural gas or coal – for environmental and financial benefits at the project.

A percentage of green hydrogen could be introduced into the natural gas feed for the processing plant to reduce carbon emissions – an option to be explored in full in the upcoming BFS.

In October, AVL announced it had signed a memorandum of understanding with a UK engineering firm to extract vanadium from waste products.

High quality metallurgy

AVL’s testwork on ore from its namesake project has also come back strong, with results released earlier this month showing product purity was comparable to products made by established peers.

Metallurgical test work carried out to support the vanadium purification flowsheet for the project produced a 99.4% purity vanadium pentoxide product – demonstrating the ability to produce high quality vanadium at scale.

Both ammonium metavanadate and ammonium polyvanadate production routes were tested, to allow options in the BFS which could simplify refinery circuits and potentially lower capital and operating costs.

This article was developed in collaboration with Australian Vanadium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.