Australian Mines spurs on scandium at Flemington

Heightened demand and Chinese control have started a race for new scandium production. Pic: Getty Images

Special Report: Australian Mines is spurring on the development of one of the world’s highest-grade scandium deposits at its Flemington project in New South Wales.

Currently standing at 2.7Mt at 403 grams per tonne of scandium, Flemington was last advanced via a scoping study in 2017 but rising demand and Chinese control over the critical mineral has led to a new allure of Australian production.

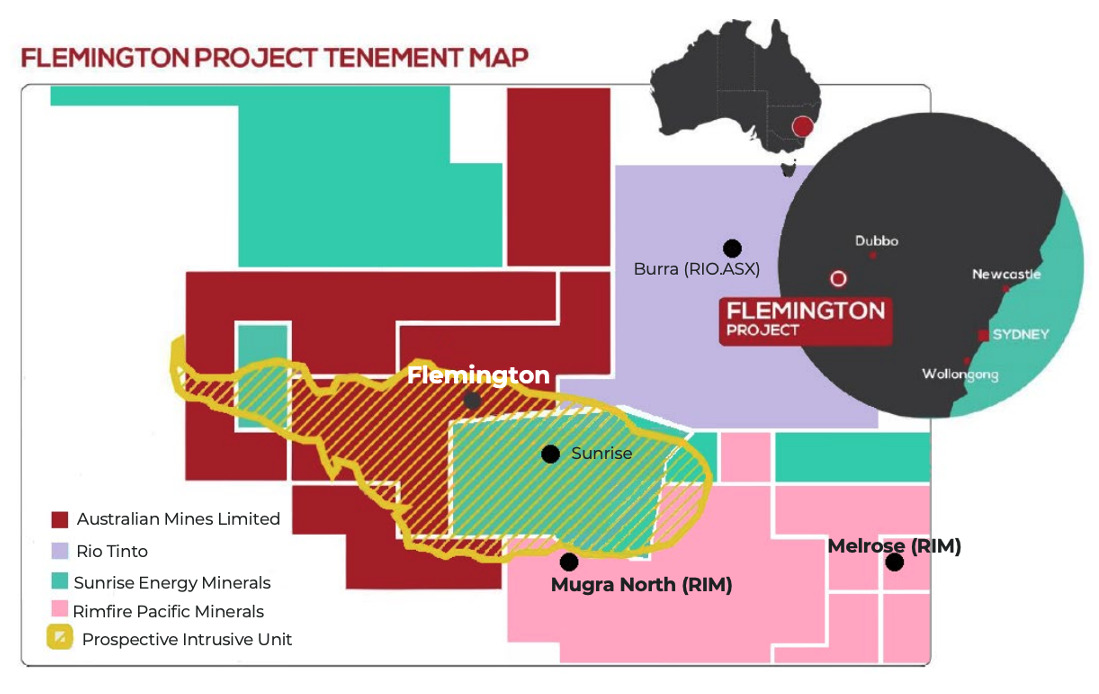

It can’t be understated how high the scandium grade at Flemington is in comparison to other promising deposits. Mining major Rio Tinto (ASX:RIO) is invested in the Burra project in New South Wales, which it describes as “one of the world’s highest-grade primary scandium oxide resources”.

Burra, formerly known as “Owendale”, was estimated in 2017 to hold a resource of 33.7Mt at 395 ppm scandium using a 300ppm cut-off.

Also in NSW, Rio Tinto’s (ASX:RIO) Melrose deposit holds an indicated and inferred resource of 3Mt at 240 ppm scandium with a cut-off grade of 100ppm. At the same cut-off grade, the company’s Murga North deposit holds an inferred 21Mt at 125 ppm scandium resource.

Flemington, meanwhile, holds 2.7Mt at 403ppm scandium at a 300ppm cut-off. Certainly not a grade not to sneeze at.

The study showed off a project with a net present value of $255m, a 37.3% internal rate of return, and an initial 18-year mine life. However, it also showed the project had the potential to be extended to an impressive 45-year mine life.

A presence of cheap Chinese supply was enough to dissuade development at the time, but with the minerals superpower now flexing its muscle over supply chains, the opportunity of first Australian production is in sight.

And with Australian Mines (ASX:AUZ), Rio, and Rimfire all now advancing in the same locale westward of Sydney, it appears New South Wales is the frontrunner.

Fattening Flemington

The Flemington review was sparked by a potential strategic synergy between the potential application of Flemington scandium with Australian Mines’ advancements in solid state hydrogen.

It has now found the potential to significantly increase the current mineral resource lying open in multiple directions with 500 historic drill holes yet to be accounted for.

Those alone are enough for AUZ to now look toward an upgrade before year’s end, and with the current resource covering only around a per cent of the prospective geology, further drilling could turn Flemington into a long ride.

Notable intercepts outside the resource include:

- 12m at 402ppm Sc from 9 metres deep

- 20m at 425ppm Sc from 8 metres deep

- 10m at 390ppm Sc from 12 metres deep

- 10m at 267ppm Sc from 1 metre deep

- 15m at 576ppm Sc from 12 metres deep

- 12m at 500ppm Sc from surface

- 10m at 315ppm Sc from surface

- 7m at 362ppm Sc from 2m deep

- 36m at 612ppm Sc from surface

- 15m at 504ppm Sc from 5m depth

- 18m at 419ppm Sc from surface; and

- 12m at 500ppm Sc from surface.

Doubled demand

Scandium is essential for production of the high efficiency clean energy solid oxide fuel cells used for carbon-reduced power generation, which alongside uses in alloys and electronics, has already led to the US Geological Survey estimating a doubling in demand from 2021 to 2023.

And Mordor Intelligence believes it will keep growing, expecting demand to have a compounded annual growth rate of 14.7% through to 2030.

Around 80% of production currently comes from within Chinese borders, a fact AUZ would like to see soon changed as it works on the historic holes and an Assessable Prospecting Operation submission to allow fresh drilling to begin as soon as possible.

This article was developed in collaboration with Australian Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.