Australian Mines nearly doubles scandium resource in major critical minerals boost

An indicated resource has a higher level of confidence than inferred and allows the company to consider mine planning work. Pic: Getty Images

- AUZ has updated the Flemington scandium resource from 3.7Mt to 6.3Mt

- Currently China controls around 80% of global production

- Company is exploring potential production scenarios

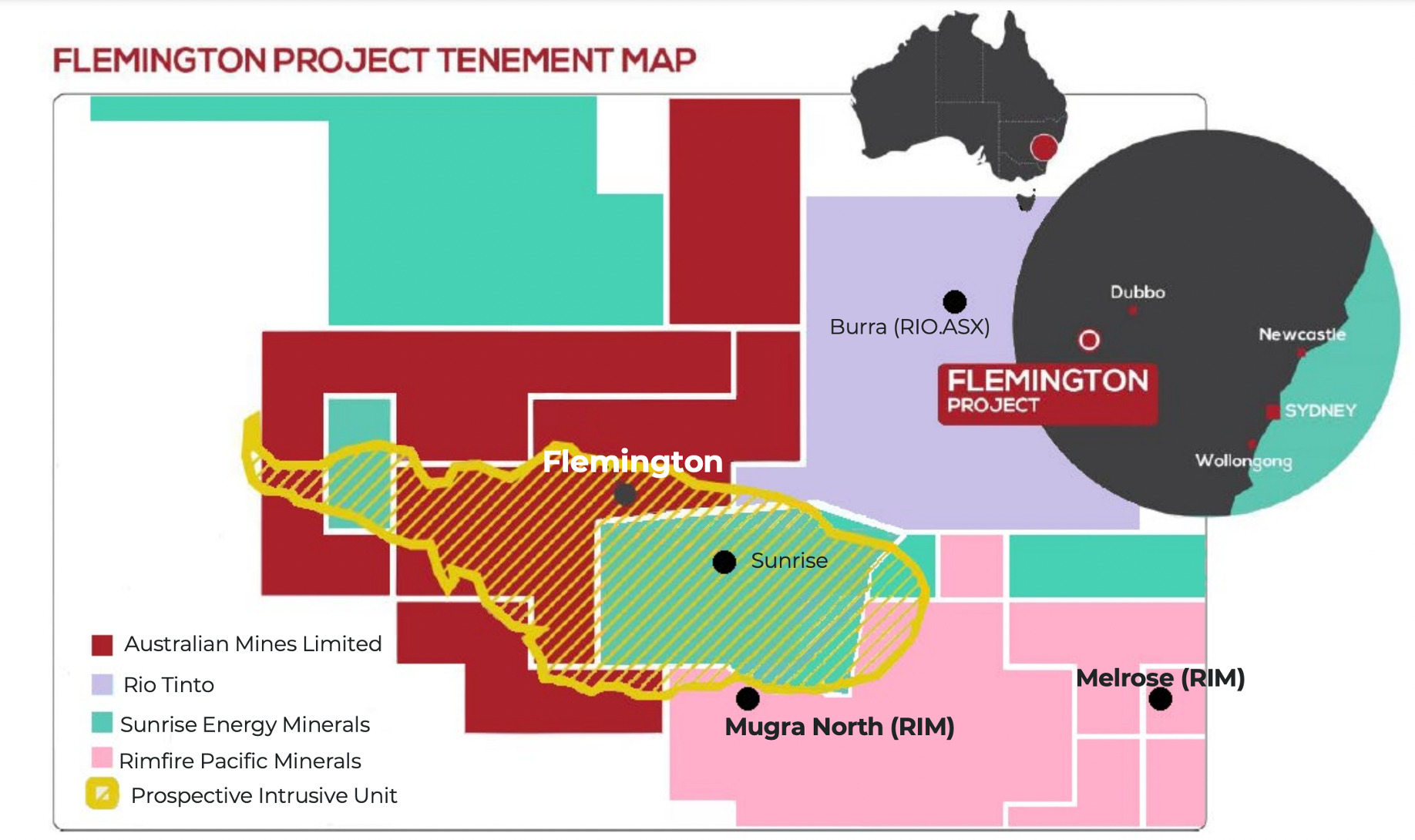

Special Report: Australian Mines has close to doubled its scandium resource at the Flemington project in New South Wales, placing the company at the centre of Aussie hopes to become a new source of the rare but critical metal.

The project’s Mineral Resource Estimate increased from 3.7Mt at 458 ppm to 6.3Mt at 446 ppm (300ppm cut-off), with an impressive 98% of that classified as measured and indicated.

That classification means drilling has been conducted with enough density to include the resources in a future mine plan.

Plus, 90% of the resource is located within 50m at surface, presenting a compelling development opportunity for the company at a time when rising demand and Chinese control over the critical mineral (around 80% of global supply) has shone the spotlight onto Aussie production.

The US Geological Survey estimates that scandium supply and demand has doubled, from 15-25 tonnes in 2021, to 30-40 tonnes in 2023, and according to Mordor Intelligence the market is expected to expand at a compound annual growth rate of 14.7% through to 2030.

Along with the contained scandium, the resource also has a nickel grade of 1350ppm and a cobalt grade of 601ppm, highlighting the project’s by-product potential.

Australian Mines (ASX:AUZ) says the modelling indicates there’s “significant additional mineralisation at lower cut-offs”.

At a 100ppm cut-off for scandium the total mineralised inventory stands at a whopping 28Mt at 217ppm scandium (inclusive of laterite and saprolite). Compare that to October 2017 when the total mineralised inventory reported was 4.5Mt with an average grade of 415ppm scandium.

Exploring potential production scenarios

The review and update of the Flemington scoping study was prompted by scandium’s growth outlook, but also significant interest in scandium related to the hydrogen economy – as the critical element plays an essential role in solid oxide fuel cells (SOFCs), a highly efficient clean energy technology used in power generation aiming to reduce carbon footprints.

Given the resource increase and its sensitivity to cut-off, the company intends to re-consider the mining and metallurgical factors to optimise potential production scenarios.

“The 2025 resource update not only confirms Flemington as a high-quality critical mineral resource but also as one of the best defined and highest-grade scandium resources within the area,” AUZ CEO Andrew Nesbitt said.

“This coupled with the near surface, lateritic nature of the resource should provide AUZ a competitive advantage.”

Beyond hydrogen, scandium is also used in electronics to improve the performance of semiconductors and advanced communications technologies like 5G.

Other applications include aluminium-scandium alloys, which are lightweight, strong, and highly resistant to corrosion – thus able to reduce the weight of vehicles, airplanes and spacecraft and rocket cones to improve fuel efficiency and reduce emission for increased sustainability.

AUZ shares rose over 60% in early trade on Wednesday.

This article was developed in collaboration with Australian Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.