Australia can now join the silica sands race thanks to a global supply crisis

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Up until now Australia hasn’t been a contender in the silica sands industry, but the tightening supply crunch has made an opening for potential players.

While silica sand is the most abundant mineral on the planet, it is still a finite resource. It’s also – apparently – the most used commodity after air and water.

Most supply is used to make concrete for construction, but it is also used to make glass for buildings, solar panels and electronics like mobile phones and TVs, as well as to make car parts.

And with the growing push for renewable technologies such as solar panels, silica sands demand is on the rise.

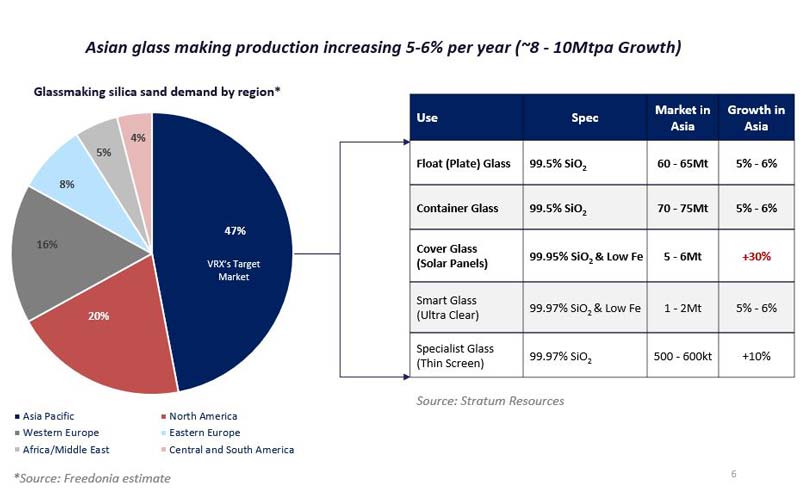

Around 47 per cent of the world’s glass is made in Asia and is increasing at a rate of 5 to 6 per cent, or around 8 to 10 million tonnes, each year.

And domestic solar panel uptake in Asia is yet to hit its peak.

The market in Asia is growing at a rate of about 30 per cent each year and is currently sitting around 3.5 billion solar panels. But within the next decade that is expected to reach 50 billion solar panels.

Meanwhile, the casting industry is particularly big in Korea and the foundry industry in India is one of the fastest growing.

Carmakers Audi and VW now get all their parts cast in India and BMW is looking to do the same.

Strategic mineral

The supply shortage is becoming such an issue that China has added it to its list of “strategic minerals”.

And that’s because you can’t just take good old beach sand and sell it to a glassmaker, according to the boss of one ASX-listed small cap silica sands explorer.

“There is becoming an issue with sand supply and the sand you see down the beach is not suitable for concrete or glassmaking, it’s predominantly calcium carbonate,” VRX Silica (ASX:VRX) managing director Bruce Maluish told delegates at the Association of Mining and Exploration Companies (AMEC) Convention in Perth.

“It is a finite resource. It’s not like you can drill deeper with gold or copper and find a bit more.

“Also, they are variable grades. Predominantly, sands have got contaminants in them like aluminium, titanium and iron, which make it unsuitable for many uses, particularly in glassmaking.”

According to Australian Silica Quartz, a wholly owned subsidiary of Bauxite Resources (ASX:BAU), traditionally the Australian silica market has been dominated by Japanese trading houses operating as private Australian companies and supplying the South East Asian markets.

But the growing supply deficit is forcing the price higher, which has made it possible for ASX-listed players to join the game.

Maluish said the price of raw materials to make glass had been steadily rising at 5 to 10 per cent each year.

“Australia can now compete on the global stage in this particular industry … because the price now can handle the shipping cost from Australia,” he explained.

“So until now there hasn’t been a silica sands sector in Australia, but there will be and it’s mainly because the price has steadily increased.”

Limited investment opportunities

Right now there are just a handful of ASX small caps that have projects in silica sands.

VRX Silica has three projects in Western Australia.

The company is aiming to complete a bankable feasibility study for its Arrowsmith and Muchea projects in the third quarter of this year.

It will also soon send samples of its product to potential customers in Japan, China, India, Vietnam, Thailand, Taiwan and Korea.

Metallica Minerals (ASX:MLM) has a project called Cape Flattery in Queensland that is located near Japanese heavyweight Mitsubishi’s producing silica sands operation — the world’s largest silica sands mine.

Bauxite Resources has exposure to silica sands through its subsidiary Australian Silica Quartz.

Australian Silica Quartz has three high-grade silica sand projects in Western Australia.

Perpetual Resources (ASX:PEC) picked up an option in February this year to acquire the high-grade Beharra silica sand project in Western Australia from high profile mining personality Tolga Kumova, Peter Gianni and Robert Jewson.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.