Auroch follows the clues as drilling campaign progresses

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Auroch Minerals is making good ground in exploration at the Nepean nickel project in WA, with drilling well underway and assays on the horizon.

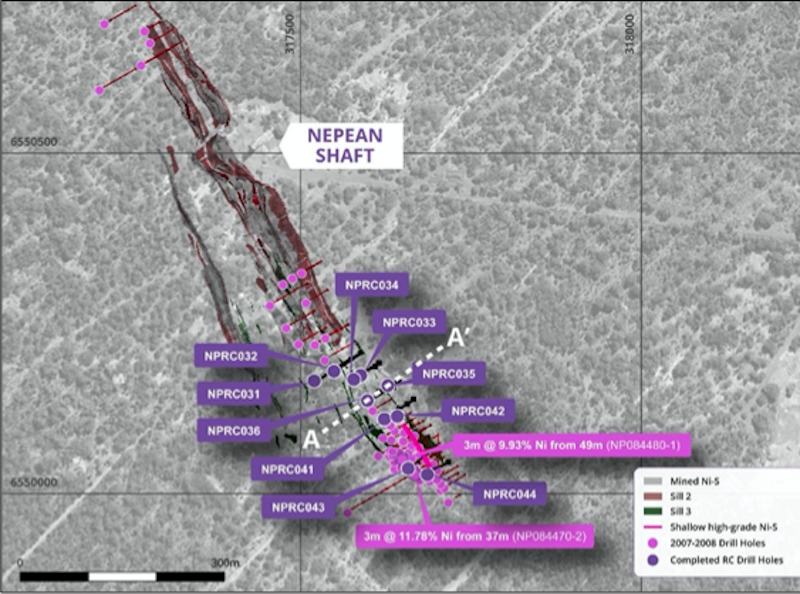

Auroch (ASX:AOU) announced it was on schedule in its maiden 3500m reverse circulation drilling campaign, with 12 holes completed for 1012m – around one-third of the planned campaign.

An initial 10 shallow holes drilled for 742m targeted high-grade nickel sulphide mineralisation near the historic Nepean mine, designed to map the extent of near-mine high-grade nickel.

These holes were drilled to test if shallow, high-grade nickel sulphide mineralisation identified around 200m south of the mine by Focus Minerals in 2007-08 extended back to the remnant nickel sulphide mineralisation in the mine itself.

RC chip samples from the holes have been logged and submitted to the ALS Global laboratory for analysis – results are expected in the next week or two.

Meanwhile, Auroch is now testing aeromagnetic targets identified along the 10km of prospective strike to the north and south of the historic mine.

These drill holes have been designed to characterise the ultramafic units along strike, and define the important stratigraphic contact between ultramafic hanging-wall and the basalt footwall.

Auroch managing director Aidan Platel said the company was thrilled with the progress at Nepean.

“We are pleased with the progress of our maiden RC drill program at the Nepean nickel project and are eager to see the assay results of the initial shallow holes that have the potential to join the known shallow high-grade nickel mineralisation 200m to the south of the Nepean mine back to the remnant mineralisation in the mine itself,” he said.

“We are also very excited to now be drilling the aeromagnetic targets along the 10km of prospective strike at Nepean, all of which have very high potential to host significant nickel sulphide mineralisation, yet they have never been previously explored with modern techniques.

“We are expecting the first assay results within the next fortnight and we look forward to the market update when they are received.”

Auroch said all exploration holes drilled would be cased for follow-up downhole electromagnetic surveys to test for any nearby conductive units which may represent massive nickel sulphide mineralisation.

The remaining program is expected to wrap up in the next 2-3 weeks.

More drilling to come

In addition to the current program, Auroch has designed a 3000m air core drill program to define the ultramafic stratigraphy and footwall contacts over the 10km of strike at Nepean.

This drilling will be used to define the project’s stratigraphic sequence, provide basement geochemistry, and test for any potential channel embayments, and will begin mid-February.

The company plans to use the results from this program to produce a detailed litho-geochemical model over the full length of strike of Nepean, which will then be used for targeting in the next phases of drilling.

A modern, high-powered moving-loop electromagnetic survey (MLEM) will also be carried out over two critical areas to the north and south of the historic mine, using significantly more current than historic surveys.

MLEM is proven as a technique for finding conducive geological units, such as the massive nickel sulphide orebodies Auroch is chasing at Nepean.

Auroch’s current drilling campaign has not been impacted by recent COVID-19 lockdown restrictions in parts of WA.

Nepean is located 25km south of Coolgardie, and operated under an 80:20 joint venture agreement with Goldfellas Pty Ltd.

This article was developed in collaboration with Auroch Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.