Auroch has eyes on the nickel prize – 10km of strike at Nepean

Auroch has started drilling at the previously producing Nepean nickel project in Western Australia. Pic: Getty Images

Special Report: Auroch has started drilling at the recently acquired and highly prospective Nepean nickel project that was the second producer of the metal in Australia.

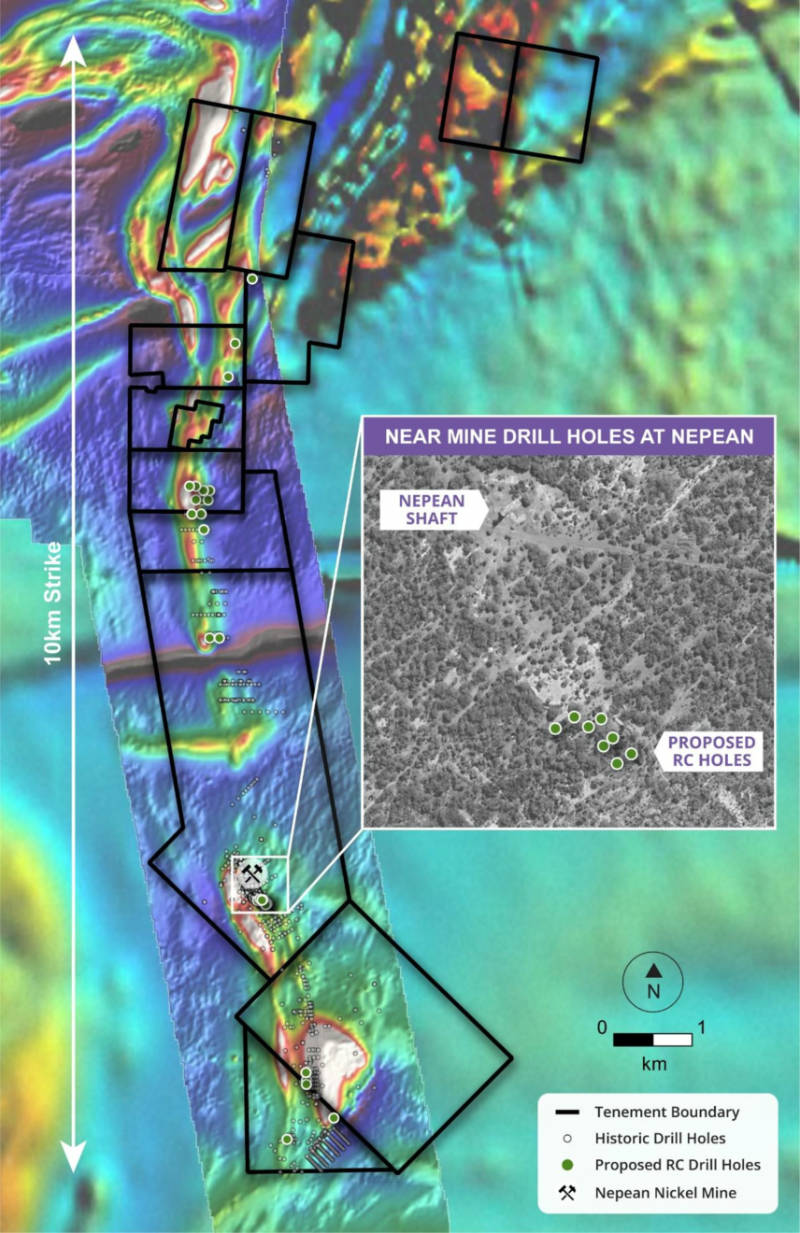

Drilling will test a series of aeromagnetic targets over more than 10km of strike to the north and south of the historical high-grade Nepean mine that produced 32,303 tonnes of nickel metal at an average recovered grade of 2.99 per cent between 1970-87.

These targets align with the Nepean mine stratigraphy and are thought by Auroch Minerals (ASX:AOU) to represent a serpentinised core or high MgO unit of the komatiitic unit that have the potential to host significant massive nickel sulphide mineralisation.

The drill holes at these targets are intended to intersect the ultramafic-basalt contact and to define channel geometry, fertility and the presence of any nickel sulphides.

An initial eight holes in the 3,500m drill program will also test shallow near-mine mineralisation about 200m south of historical operations.

These will seek to define the extents of mineralisation identified by historical intercepts such as 3m at 11.78 per cent nickel from a depth of 37m, 3m at 9.93 per cent nickel from 49m and 4m at 6.63 per cent nickel from 46m.

Modern high-powered down-hole electromagnetic surveying will also be carried out on the completed drill holes to identify any nearby conductive massive sulphide bodies.

“We are pleased to have drilling underway at our recently-acquired high-grade Nepean Nickel Project, and are very excited by the huge potential to build on the existing nickel sulphide mineralisation as well as uncover further significant high-grade nickel sulphides,” managing director Aidan Platel said.

“The nickel price has continued to rise to over US$18,000/t and many forecasts for the price of nickel have recently been upgraded as we continue to see a greater disconnect between supply and demand for nickel, and in particular for Tier 1 nickel, forecasted for the next few years.

“As such, Auroch has aggressive work programs planned for 2021 as we consolidate our existing high-grade nickel sulphide resources and move towards scoping studies, whilst at the same time continue to aggressively explore for new nickel discoveries, and we look forward to creating real value for our shareholders this year.”

Proven nickel potential

The formerly producing Nepean mine is just 25km south of Coolgardie and ceased production because of low nickel prices, leaving plenty of metal in the ground.

While former owner Focus Minerals (ASX:FML) estimated a remaining resource of about 13,250t contained nickel at 2.20 per cent, Auroch believes there’s more where that came from.

Nepean is also similar to the Flying Fox mine that had produced about 8,000t of nickel and was believed to be constrained at depth before Western Areas picked it up in 2003 and encountered a granitic dyke at depth that covered significantly more high-grade nickel sulphide mineralisation

This article was developed in collaboration with Auroch Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.