Aura goes ‘Skål!’ as it spells out sweet numbers for Swedish polymetallic project

Drinks all around as Aura’s Scoping Study outlines attractive economics for its Häggån project in Sweden. Pic: via Getty Images

- Scoping Study outlines attractive economics for Häggån development

- Returns improve substantially if uranium extraction is given the go ahead

- Aura now moving to apply for key exploitation concession

Aura has released a Scoping Study that spells out the “extraordinary” potential of its Häggån project in Sweden to produce critical minerals such as vanadium, potash, nickel, molybdenum, zinc and uranium at scale.

While the company is focused on delivering its Tiris uranium project in Mauritania, the study also outlines the potential of Häggån to deliver very robust economics – a testament to the work it has invested in the project since 2008.

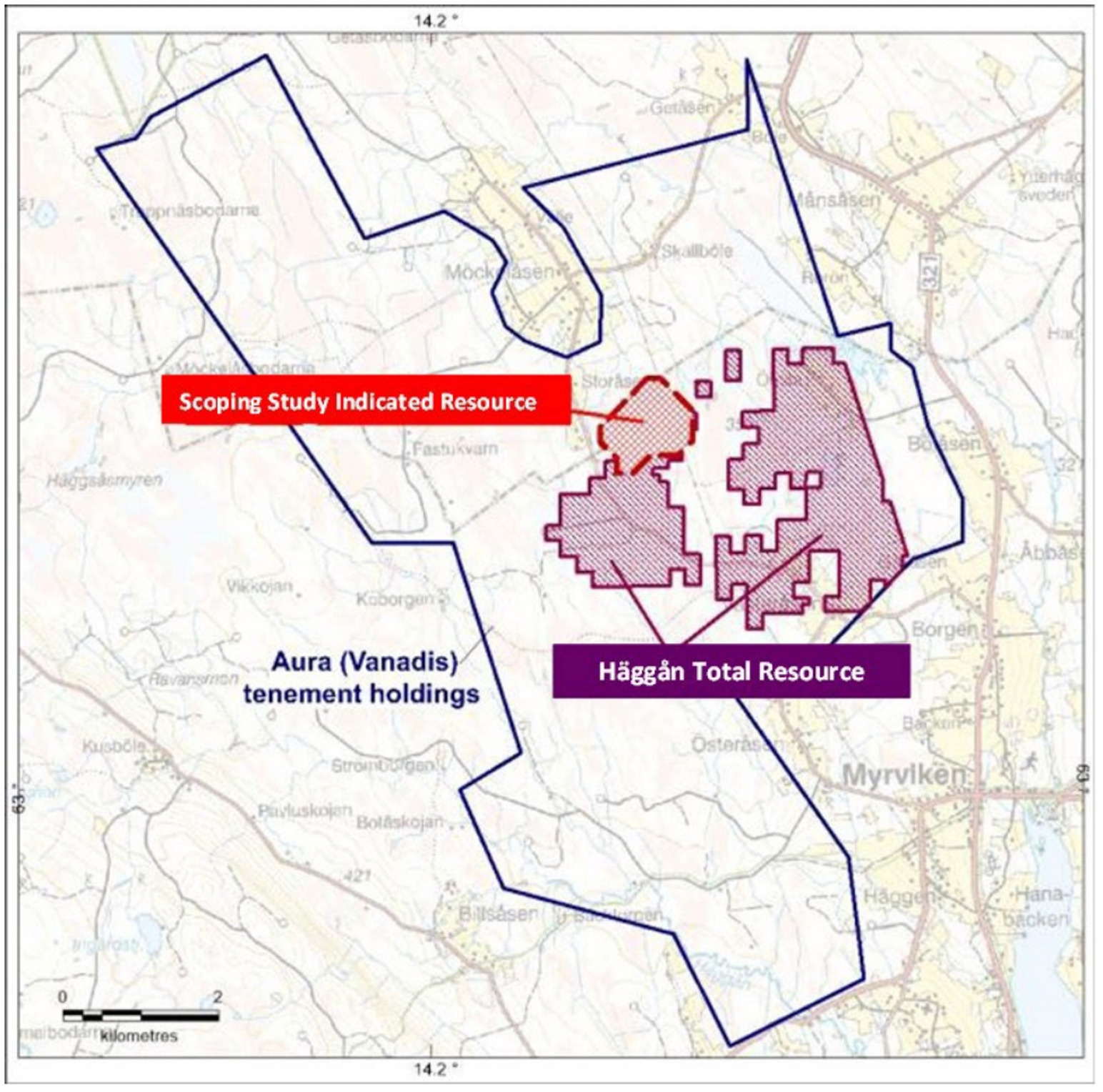

Häggån is based on a substantial discovery in the Jämtland province in central Sweden, with a polymetallic resource of 1.96 billion tonnes grading 0.3% vanadium pentoxide (V2O5), 212 parts per million (ppm) molybdenum, 337ppm nickel, 463ppm zinc and 3.8% K2O (potash).

Vanadium is central to the project’s value given its growing use in vanadium redox flow batteries (VRFBs) that are expected to play a significant role in the transition to renewable energy, as well as its traditional use in steelmaking.

Häggån also has economically extractable quantities of sulphate of potash (SOP), nickel, zinc and molybdenum that provide valuable by-product credits.

Polymetallic goodness

Sweden is a leading European mining and mineral nation that has acknowledged that nuclear power is necessary to achieving its goal of doubling electricity production in 20 years and is moving to lift its ban on uranium extraction.

Should Sweden lift its ban on uranium extraction, it will substantially improve the likelihood of Aura Energy (ASX:AEE) pushing ahead with developing Häggån as – like many deposits in the country – uranium is present as part of the polymetallic resource.

While there are plans in place to treat the uranium into an inert safe waste product for long-term disposal, having the ability to extract the energy metal for sale into the domestic and/or European markets will substantially enhance the economics of the project.

Under the base case, which excludes uranium, the project is expected to deliver post-tax net present value (NPV) of between US$380m and US$1,231m as well as internal rate of return of 26% to 47% depending on the price of vanadium – calculated here at between US$7/lb to US$13/lb.

This is based on the production of 10,400tpa of V2O5 and 217,000tpa of SOP.

Capex is estimated at US$592m to generate operating cash flow of between US$140m to US$270m per annum whilst payback is expected within 1.5 to 2 years.

NPV – a measure of a project’s estimated profitability – jumps up to a whopping US$756m to US$1,606m if uranium is included in the mix.

But the real kicker might be that the planned 65Mt project – currently based 77% on Indicated Resources and 23% Inferred Resources – represents just 3% of Häggån’s known 2Bt resource, which clearly highlights its potential to scale up.

Chairman Philip Mitchell said the Scoping Study underpins the company’s 25-year Exploitation Permit Application while confirming the project’s scale and optionality.

“Häggån’s products are crucial to battery technology, agriculture and potentially with legislative change low carbon, secure and affordable electricity,” he added.

“The Swedish Government acknowledges that for Sweden’s clean power system to function, a large part must be readily dispatchable, and nuclear power is the only non-fossil option.”

Going nuclear

Mitchell pointed out the country’s Minister of the Environment Romina Pourmokhtari told the Times of London on 18 August 2023 that there was a parliamentary majority behind lifting Sweden’s ban on uranium extraction, which would open up some of the largest deposits in the European Union.

Sweden is looking to embrace nuclear energy is a big way with plans to build at least ten large reactors to meet an anticipated surge in demand for zero-carbon power.

Pourmokhtari noted that while wind and solar power would be important, the country also needed massive volumes of nuclear-generated electricity that can be reliably dialled up or down to keep the power supply steady through the peaks and troughs of renewable generation.

Forward plan

With the Scoping Study under its belt, Aura will now progress the Häggån project with the application for an exploitation concession.

This will require work such as the start of baseline flora, fauna and water studies as well as undertaking a more detailed Pre-Feasibility Study, which will require further resource and infill drilling, geotechnical and hydrogeological investigations, preliminary pit design scheduling options, and more detailed metallurgical test work.

Managing director Dave Woodall notes that first on the list of activity for the PFS is infill drilling aimed at increasing mine life and further enhancing project economics.

The Scoping Study also delivers a strong project sample that will support re-engagement with potential strategic partners.

Mitchell adds that the remaining 97% of the resource will be further studied as it offers exciting future prospects, such as the potential for rare earths that are known to occur in the Alum shales.

This article was developed in collaboration with Aura Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.