Aura Energy is spinning off its highly prospective gold and base metals assets in Mauritania

Aura is poised to set its Tasiast South project to sail under new management. Pic: via Getty Images

While Aura Energy is better known for its Tiris Uranium Project that is closing in on production, it also owns the intriguing Tasiast South Gold and Base Metals Project that it plans to spin out in early 2022, under the name Archaean Greenstone Gold.

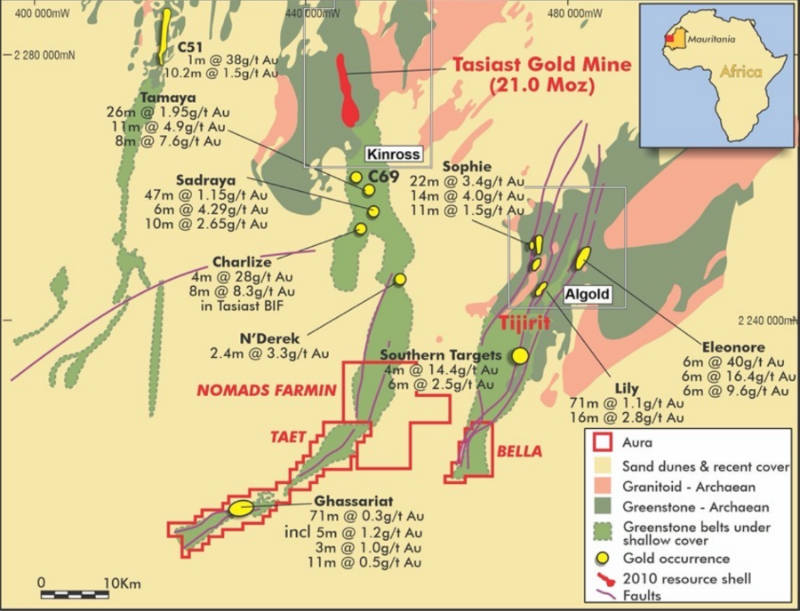

Tasiast South is a highly prospective project located just 36km south of Kinross’ huge producing Tasiast +20Moz gold mine in Mauritania on the same Archaean greenstone belt.

With 125 km2 of underexplored tenements, its Kalgoorlie without the crowds. Essentially Kinross owns the top half of the belt and Aura owns the bottom half of the belt which remains almost unexplored, a unique opportunity in the resource world these days.

However the project has not received the kind of attention it deserves due to the company’s focus on uranium production at its more high-profile Tiris Uranium development project.

Aura Energy’s (ASX:AEE) chosen solution to ensure the project receives the attention and exploration focus it deserves while creating further value for shareholders, is to spin-off its wholly-owned gold subsidiary Archean Greenstone Gold on the ASX via a planned IPO with an in-specie distribution to existing shareholders. This is planned for early 2022 and shareholders will need to hold Aura Energy shares to access to what could be a very interesting and special opportunity.

The company’s gold assets will be led by Aura Managing Director Peter Reeve, who will transition to Managing Director of Archaean, and direct his extensive experience in advancing exploration projects to building a potential monster gold company. Aura’s uranium project will be concurrently advanced to production by the new Aura board.

So just what makes Tasiast South so special?

Tasiast South, nearology and a whole lot of ground work

The Tasiast South project’s initial claim to fame comes from its proximity to the giant 20Moz Tasiast gold mine that started commercial operations in 2008, and landed in Canadian gold major Kinross Gold’s hands following its US$7.1bn acquisition of Red Back Mining in 2010.

Kinross is currently in the process of completing its Tasiast 24k project that is aimed at increasing production, reducing costs, extending mine life to 2033 and generating significant cash flow and attractive returns.

Despite its high prospectivity, previously there was little interest in the Archaean greenstone belt where Tasiast is located, allowing Aura to pick up three permits covering a total area of 345 sqkm containing 125sqkm of prospective greenstone for a mere $100,000 and a royalty on production.

The company’s first pass exploration confirmed the presence of a wide gold system with high-grade intersections and a geology similar to that at the Tasiast Mine. However, the drilling on the Aura gold prospects, being of a reconnaissance nature, was very broadly spaced and has never approached the target depths where the main Kinross mineralisation has been discovered. So drilling deeper to test the strong indications already achieved is a simple, early part of the exploration strategy.

In what has quickly become a multi-element exploration prospect, shallow drilling also uncovered extensive nickel occurrences, indications for potential nickel sulphides and other high grade battery metal intercepts. One astounding result from shallow aircore drilling was a 1.6km nickel zone with grades approaching 1% nickel, and significant multiple cobalt hits grading up to 0.581%. To add to the intrigue only 1 in 10 of the samples were assayed for cobalt, but still a significant array of cobalt results were achieved. Looking at the cobalt price you can understand management’s excitement.

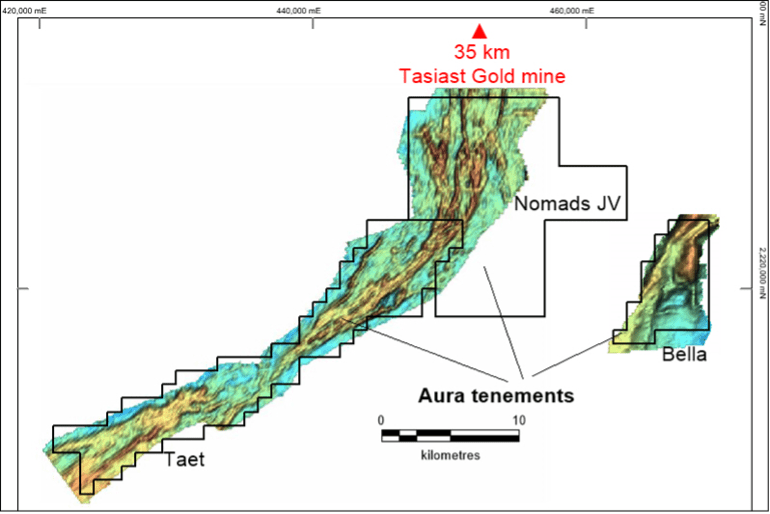

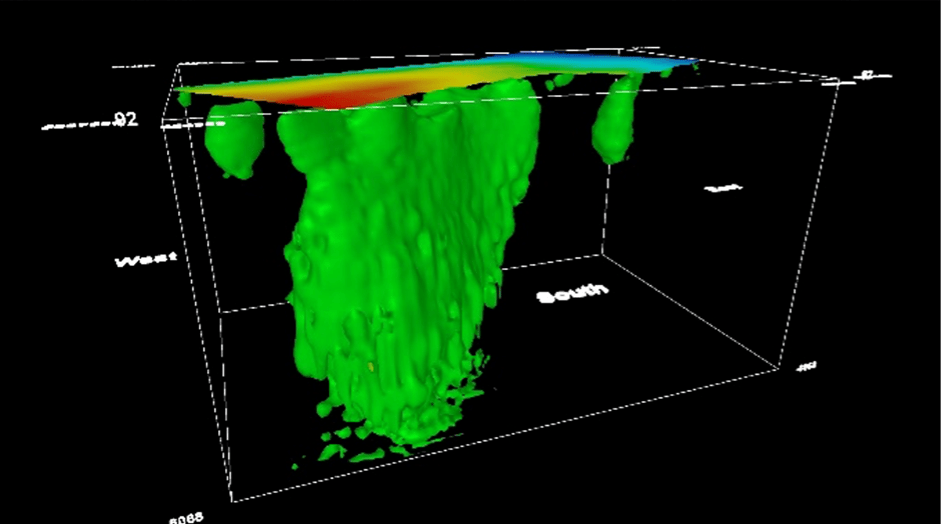

More recently, a gravity survey was conducted over all three of Aura’s tenements; Taet, Bella and Nomads tenements.

The survey was commissioned to better define the geology and identify structures likely to be of relevance to gold deposition, along with the possibility of direct detection of sulphide mineralisation on the nickel/cobalt targets.

This work has been particularly valuable for the Nomad’s JV tenement, where Aura is earning 70%, as it has had no meaningful exploration despite covering 50sqkm of the Archaean greenstone belt just 35km along strike from Tasiast.

Nomads has almost no outcrop and the survey has defined the greenstone belt, lithologies and structures.

This has permitted the planning of follow-up bedrock sampling and deeper drilling.

Over at the Bella tenement, the field data has indicated four localised gravity anomalies – all on ultramafics – that are of potential interest from the viewpoint of nickel sulphide mineralisation.

However, this belief will only be confirmed by a drilling program.

Upcoming work

While Aura maintains that the Tasiast South tenements represent some of the best, underexplored greenstone belt targets in the world, more work is needed to prove up its belief.

And the company has planned out an exploration program to achieve this goal.

This includes reverse circulation drilling to trace the known Ghassariat gold zone, and acquiring ground-induced polarisation data to locate additional zones.

The program will also drill test nickel and cobalt potential in the very large ultramafic body in the Bella tenement.

In addition to rapidly progressing the Tasiast South Project, it is the management’s intention to leverage its 15 years’ experience in West Africa to progress other projects in the region which has produced amongst the best gold discovery rate in the world over the past couple of decades, but remains significantly less competitive than other major gold provinces.

This article was developed in collaboration with Aura Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.