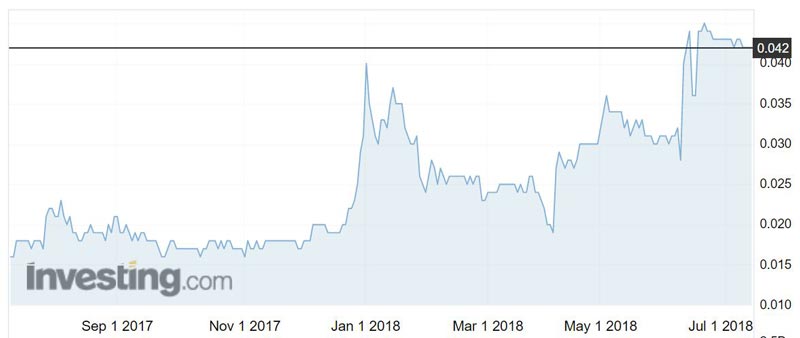

Atlas needs Gina now more than ever as losses mount

Australia's richest woman Gina Rinehart. Pic: Getty

Struggling iron ore producer Atlas Iron is feeling the pinch of market conditions and it’s forcing the company to dip into its pocket and cut back production.

Although Atlas’ (ASX:AGO) full cash cost didn’t increase from the $62 per tonne it was in the March quarter, the company only received an average price of $59 per tonne, including hedging gains, in the June quarter.

The benchmark price for 62 per cent iron ore averaged $US65 ($88.26) per tonne in the June quarter, down from $US74 per tonne in the prior quarter.

Atlas’ iron ore doesn’t fetch as high a price because it is lower grade than the benchmark 62 per cent.

Gina Rinehart’s privately owned Hancock Prospecting tabled its $390 million all-cash offer because it wants Atlas’s ore to improve the quality of its own ore and extend the life of its operations.

Atlas’ iron ore shipments increased slightly in the June quarter to 2.1 million tonnes, up from 2 million tonnes in the March quarter, and the company did meet its full year guidance with shipments totalling 9.2 million tonnes – albeit at the lower end of the targeted 9 to 10 million tonnes.

Cash on hand, meanwhile, dropped from $64 million to $57 million in the June quarter.

Atlas attributed the declining cash balance to negative operating margins, a $3.12 million break fee it had to pay for backing out of its planned tie-up with Mineral Resources (ASX:MIN) and timing of shipments late in the month.

The company has flagged that it will need to book a $75 to $100 million non-cash write-down for the 2018 financial year, but it is still to work out the exact figure.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Atlas is also suspending iron ore crushing at Mt Dove and reducing the mining rate at Mt Webber to 7 million tonnes per annum from late July.

“Atlas is constantly monitoring market conditions and will seek to ramp up iron ore production with a short lead-time if economics permit,” the company said.

The company continues to urge shareholders to take Ms Rinehart’s deal of a better offer doesn’t come along.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.