BCI quadruples its money in $35m iron ore sale; shares jump 11pc

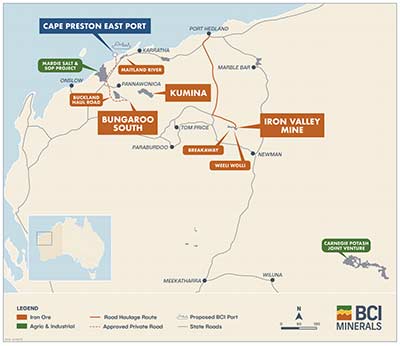

Mining junior BCI Minerals will bank $35 million from the sale of a Pilbara iron ore project — after paying just $9 million for the asset in late 2017.

BCI (ASX:BCI) shares were up 11 per cent to 15c in early trade Monday on the news. They have traded between 12.5c and 20c over the past year.

The sale of the “Kumina” iron ore project to diverse mid-tier Mineral Resources (ASX:MRL) should be finalised by the end of the year.

BCI first diversified into salt and potash following the steep drop in the iron ore price, and then decided to sell off its Pilbara iron ore projects after sinking to a $16.9 million loss in FY18.

Cash from the sale will fast track development of BCI’s Mardie salt & potash project during 2019, including finalising a Definitive Feasibility Study (DFS), establishing test evaporation ponds, and completing construction of project support infrastructure, the company said.

Mineral Resources previously tried to snap up another junior iron ore producer Atlas Iron (ASX:AGO) before it lost out to Hancock Prospecting’s higher all-cash bid.

Unlike Atlas, the company was not interested in acquiring BCI’s entire iron ore portfolio, Mineral Resources boss Chris Ellison said.

“However, an opportunity arose late in BCI’s divestment process for MRL to acquire Kumina project on its own, and I am very pleased with the agreement we have announced today,” he said.

Junior miner BCI Minerals previously confirmed that its other iron ore assets had also attracted the interest of mining magnates Gina Rinehart (Hancock Prospecting) and Andrew “Twiggy” Forrest (Fortescue Metals Group).

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.