ASX vanadium companies are in the hot seat as batteries rise

Vanadium could be heating up right about now. Pic: Getty Images

- Batteries are essential to making renewable energy work in the net zero transition

- Vanadium batteries offer a viable alternative to lithium batteries for grid storage purposes

- VRFBs offer longer lifespans, greater safety and are more tolerant of operating temperature

Batteries are the key to making renewable energy work as the world continues to transition towards net zero, there are simply no ifs or buts about it.

For all their strengths, wind and solar also have their flaws. They can’t generate power when the wind isn’t blowing or the sun isn’t shining – when’s its night or raining cats and dogs for instance.

Batteries are an essential solution to ensure electricity continues to be available when conditions aren’t ideal for renewables.

Highlighting this, the Australian Energy Market Operator has forecast in its Integrated System Plan that Australia will need 19 gigawatts of energy storage capacity in the grid by 2030, with this figure more than doubling to 43GW by 2040.

Lithium batteries of any stripe – be they using nickel manganese cobalt (NMC), lithium iron phosphate (LFP), or some chemistry – tend to be the first port of call.

But there are other types of battery storage that are better suited for energy storage at the grid-level.

For all their strengths – including high energy capacity and the ability to both charge and discharge energy quickly – the most commonly used lithium-ion batteries suffer from limited lifespans, a limited operating temperature range, safety concerns and high costs.

The first means that replacement batteries will be needed over time, while the second means that such batteries would not be suitable for use in certain parts of Australia.

And while the reputation of lithium-ion batteries as being prone to catch fire is drastically overblown, it can be a concern.

LFP batteries present a better option here with their longer operating lives, greater operating temperature range and safety.

Vanadium flow batteries – the choice for grids?

Superior as LFPs might be, another battery technology – one which has completely different roots from lithium-based technologies – is finally gaining traction in regards to its suitability for grid and indeed any stationary energy storage applications.

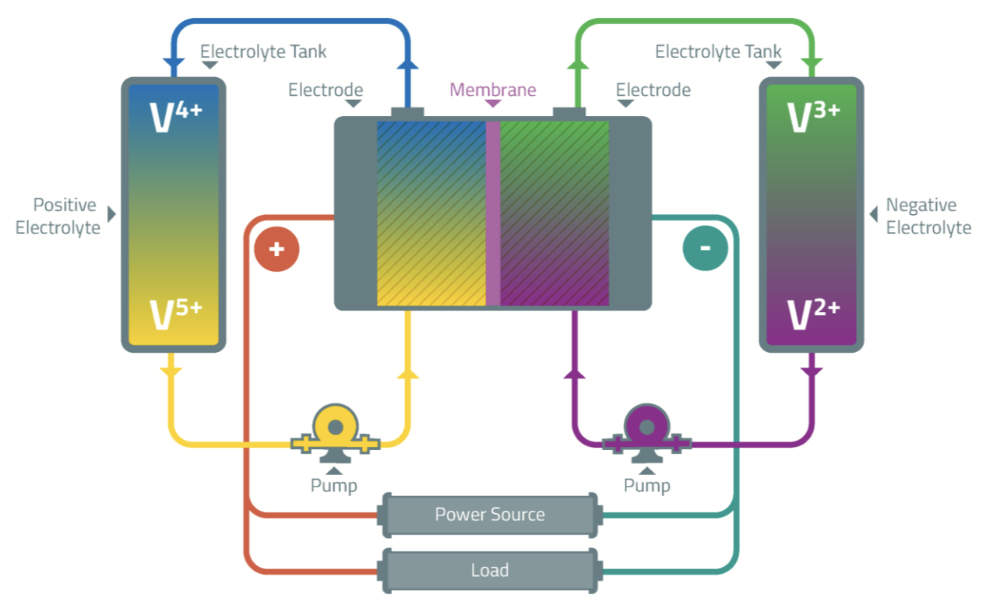

Vanadium redox flow batteries (VRFBs) have longer lifespans than their lithium-ion equivalents, lasting more than 20 years, or up to 25,000 cycles. They also boast greater safety metrics and an equally broad range of operating temperatures.

They can also be discharged completely – that is to be completely drained of energy – and store energy for long periods of time with no ill effects, which is not the case for lithium batteries.

It also benefits from not needing critical minerals such as nickel or cobalt that could be expensive or have constrained supply chains. The most common electrolytes the use just vanadium, sulphuric acid and water.

VRFBs are already starting to be rolled out commercially, a prime example being China’s Rongke Power in Dalian province, which connected its first phase 100MW/400MWh system in 2022.

Smaller scale projects have also come online recently with Enel Green Power turning on its 1.1MW/5.5MWh flow battery at its Son Orlandis solar PV plant in the Mallorcan municipality of Palma, Spain, earlier this year.

Stars are aligning

The stars certainly appear to be aligning for VRFBs to make a bigger impact on the battery scene.

Australia recently released the National Battery Strategy – itself part of the Future Made in Australia policy, which outlines how the government will support the domestic battery industry by expanding our manufacturing capabilities and improving skills.

Core to this strategy is the $523.2 million Battery Breakthrough that will provide production-linked incentives to Australian battery manufacturers with support from programs such as the $20.3m Building Future Battery Capabilities measure that seeks to build future battery industry skills and capabilities.

Adding to this is another key part of the Future Made in Australia policy – the $7bn Critical Minerals Production Tax Incentive, which provides eligible recipients with a refundable tax offset of 10% for the costs of processing the 31 critical minerals currently listed in Australia.

This credit, which includes vanadium, will be available for at least 10 years from 1 July 2027, and is aimed at keeping the domestic sector competitive with the US and others looking to prevent China from controlling the supply of materials.

Further highlighting that there’s funding available for vanadium players, front-runner Australian Vanadium (ASX:AVL) recently received the second milestone payment of $14.7m from the grant of up to $47m it received from the government under its Modern Manufacturing Initiative – Manufacturing Collaboration Stream.

Juniors in the vanadium space

So just who are some of the juniors looking to make headway in Australia’s vanadium space?

AVL of course deserves a mention.

The company recently completed a merger with Technology Metals Australia, combining two adjoining projects covering the same orebody into one – the Australian Vanadium project, which is now the subject of an optimised feasibility study.

Metallurgical test work has also confirmed that average vanadium concentrate grades of up to 1.6% V2O5 could be produced while pilot test work successfully produced a greater than 99.9% purity vanadium pentoxide.

Its electrolyte manufacturing facility in Perth has also successfully produced vanadium electrolyte that have been independently confirmed as complying with typical specifications required by VRFB manufacturers.

This facility, whose construction was supported by the majority of a $3.69m Australian government Modern Manufacturing Initiative grant, has the ability to produce 33MWh per year of high purity electrolyte for VRFBs.

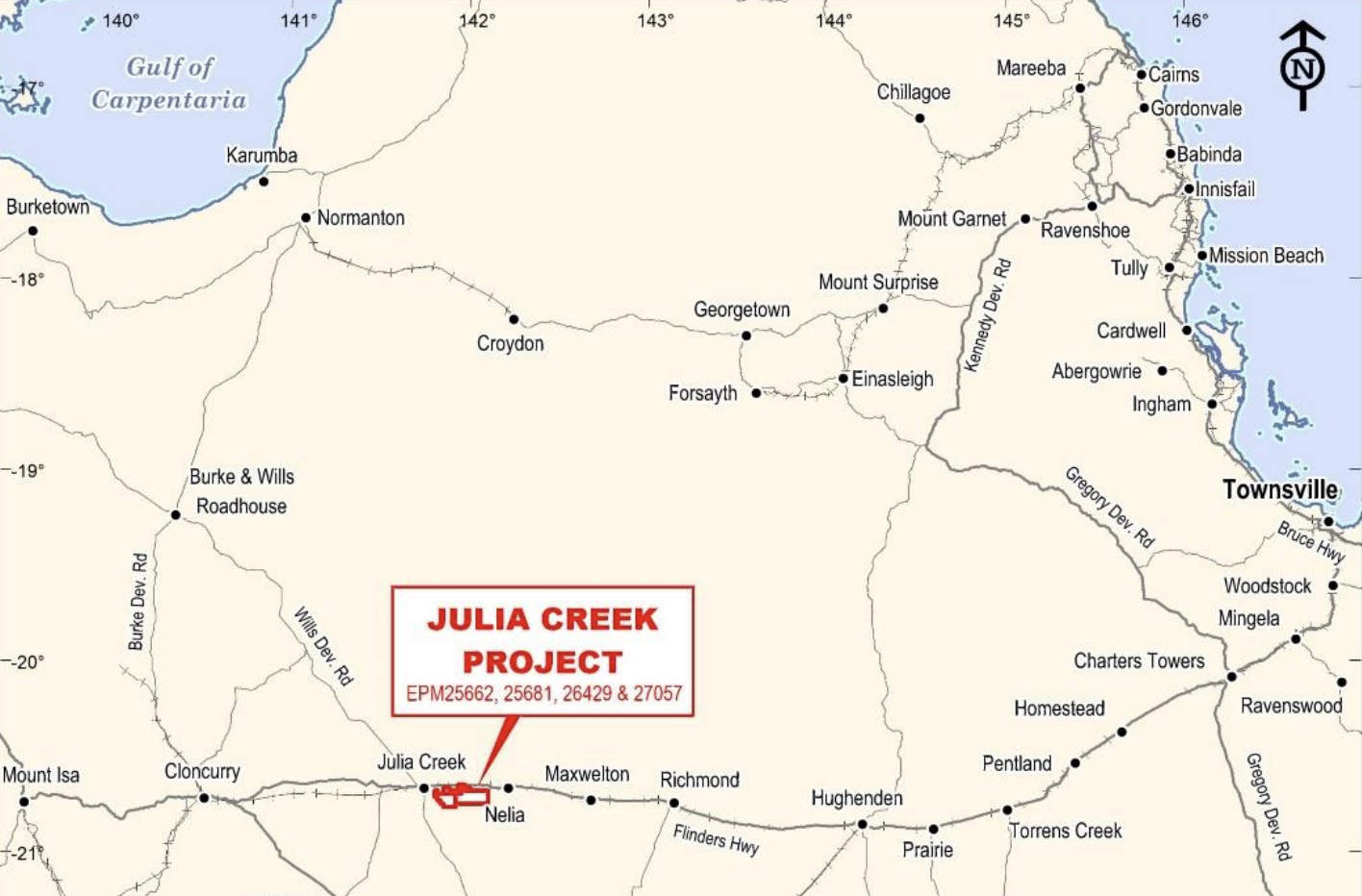

QEM (ASX:QEM) has also been progressing its Julia Creek vanadium and oil shale project in Queensland, which has a resource of 461Mt grading 0.28% V2O5 in the higher confidence indicated category. Indicated resources can be used in future reserves and mine planning.

Another 2406Mt at 0.31% V2O5 sits within the inferred category, which highlights the sheer scale of the project.

It includes best estimate (2C) contingent oil shale resource of 92 million barrels of oil equivalent that is a valuable co-product in its own right

During the March quarter, the University of Queensland’s (UQ) Sustainable Minerals Institute identified an improved vanadium beneficiation flowsheet that consists of two stages while a scoping study for the project is due for completion imminently.

The company has also progressed its recycling efforts with its Circular Economy project with the UQ successfully extracting V2O5 with a purity of 99.3% from spent catalyst.

In the same neighbourhood is Richmond Vanadium Technology (ASX:RVT) with its Richmond-Julia Creek project, which consists of five tenements covering 1403km2 and an ore reserve of 459.2Mt at 0.49% V2O5 at the Lilydale deposit.

This shallow ore reserve lends itself to the development of an open cut, free dig vanadium mining operation and is the subject of a pre-feasibility study outlining a project mining 101.5Mt of ore to produce 317,500t of V2O5 flake with a purity of 98%.

Capex is estimated at $242.2m with net present value and internal rate of return – both measures of a project’s profitability – estimated at $613m and 38% respectively.

A bankable feasibility study is due for completion in the June quarter of 2025.

Viking Mines (ASX:VKA) is progressing its Canegrass battery minerals project in WA’s Murchison region – an outcropping hard-rock vanadium magnetite project – with a pit constrained resource of 61Mt grading 0.81% V2O5 and 35.9% iron.

This is currently envisioned as a 1.5Mtpa project that can produce vanadium for 20-60 years.

Metallurgical test work has also succeeded in the production of V2O5 flake with work underway to roast the remaining magnetic concentrate to optimise and further purify and enhance the product.

Other companies with vanadium assets that are not necessarily the centre of their universes include Venus Metals (ASX:VMC) with its Youanmi project that hosts a vanadium resource of 135Mt at 0.34% V2O5 and Neometals (ASX:NMT) with the 280Mt at 0.44% V2O5 Barrambie project.

At Stockhead we tell it like it is. While QEM is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.