ASX thermal coal plays in the spotlight after Japan’s 2050 carbon pledge

Pic: Tyler Stableford / Stone via Getty Images

- Japan joins coal customers Korea and China in signing up to net zero carbon pledge

- ‘Every major trading house in Japan has been divesting itself of thermal coal mining’

- Cashflow for ASX coal producers is still good, and some ASX juniors are at bargain prices

Japan’s shock pledge this week to become a carbon neutral economy by 2050 will accelerate the Asian country’s move away from using carbon-emitting thermal coal in power generation in favour of renewable energy and hydrogen.

Prime Minister Yoshihide Suga’s commitment brings Japan into line with other developed countries that have stated an intention to adhere to the Paris Agreement on Climate Change.

Energy expert Tim Buckley, director of energy finance studies at the Institute for Energy Economics and Financial Analysis (IEEFA), said Japan has been quietly shifting away from coal use for some time.

“Global capital is fleeing fossil fuels, starting with throwing thermal coal under the bus,” he said.

“The world is rapidly aligning to get behind the Paris Climate Agreement,” said Buckley.

For Buckley, a pivotal point in the fossil fuels and climate change debate occurred in January, when global investment fund Blackrock wrote a letter to its clients.

The letter said Blackrock was reducing its investment exposure to sectors it considered ‘high risk’ and named one of these as being thermal coal production because of its carbon intensity.

“Blackrock were doing it for financial reasons to manage the risk settings of its funds,” said Buckley.

The onset of the COVID-19 pandemic globally has sped up technology change in transport, such as moves toward EVs, and this is also having an impact on coal demand.

“There is an element of COVID-19 being a circuit-breaker and some commentators say it is adding to structural change [in economies],” he said.

Trend toward lower carbon fuel use underway for some time in Japan

Japan has been quietly working behind the scenes to reduce its consumption of coal and to chart a low carbon emissions future for the country.

The trend started two years ago, when Japanese commodities trading house Marubeni – one of the largest backers of coal-fired power plants – announced an exit policy for coal.

“Every major trading house in Japan has been divesting itself of thermal coal mining,” said Buckley.

Marubeni said in an October notice it would cut in half its 3GW of power generation capacity for coal by 2030, and would no longer back new coal-fired power plants.

Other commodity and coal trading houses in Japan have followed Marubeni’s lead in reducing their exposure to coal, including Itochu, Mitsubishi, and Sojitz, he said.

Mitsui & Co, another Japanese trading house, said it intends to withdraw investment in coal projects by 2030.

Japan’s Bank for International Cooperation said in April it will cease to make loans for new coal-based power plants after funding 30 such projects with $US14bn of loans, according to reports.

And, JERA, Japan’s largest buyer of Australian thermal coal, has announced it will close all of its non super-critical coal-fired power plants by 2030.

This shift away from electricity generation from thermal coal in Japan is in line with Ministry of Economy, Trade and Industry (METI) policy, which has charted a coal reduction strategy.

METI has categorised 114 of Japan’s 140 coal-fired power plants as inefficient, and aims to close 100 of these to reduce its dependence on coal to 20 per cent for power generation.

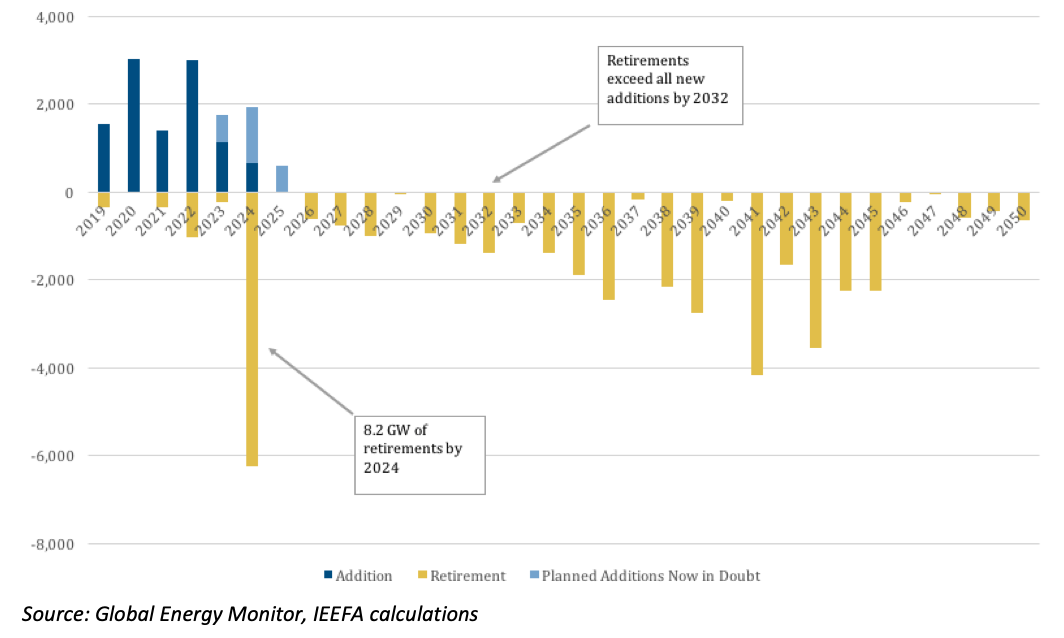

From 2025, zero new coal plants are planned in Japan, and the Asian country’s coal-fired power generation will peak in 2023 and then steadily decline out to 2050, according to IEEFA data.

Decade-low prices for thermal coal pushing miners to the brink

Carabella Resources’ Bluff mine in Queensland for PCI (pulverised injection coal) used in steel-making will be mothballed in November, said the company’s mining contractor MACA (ASX:MLD).

Current coal prices are below economic levels and uncertainty remains over Chinese government policy relating to Australian coal imports, MACA said in a notice on Thursday.

“The irony is that if Adani gets up and running with its coal mine, that will force more existing players into care and maintenance, as it will add more capacity in a declining market,” said Buckley.

Australia is the largest supplier of thermal coal to Japan, and to Korea which has made a similar 2050 carbon net zero pledge as Japan, as has China but with a slightly longer timescale.

About 70 per cent of the 136 million tonnes of thermal coal shipped to Japan this year will originate from Australia, much of it shipped from Newcastle port and mines in NSW.

The value of Australian thermal coal exports to northeast Asian countries including Japan, Korea and Taiwan was $19.7bn in 2019.

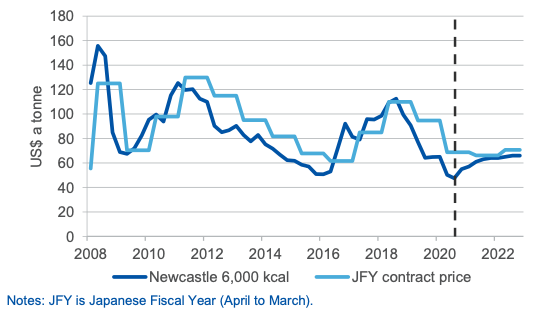

But Japanese contract and spot prices for high-grade Australian thermal coal exported from Newcastle port to Japan are forecast to trade at around $US60/mt ($85/mt) for the next few years, according to the Australian government.

Thermal coal producers caught in a pincer-movement

The outlook for thermal coal producers and explorers in Australia for the decade of the 2020s and beyond appears uncertain.

Thermal coal shippers in Australia appear caught in a pincer-movement with northeast Asian customers including Japan and Korea cutting demand, while they face lower prices for an extended period of time.

Some ASX coal companies have a sunnier outlook like Tigers Realm Coal (ASX:TIG) which sells Russian coal from its mines in eastern Russia to markets in Japan, Korea and China.

And, Australian Tin Mining (ASX:ANW) has picked up two Australian coking coal mines at bargain prices.

There are a number of Australian coal stocks on the ASX with a market value of under $100m.

These include Bathurst Resources (ASX:BRL) at $66.6m, Indonesian coking coal producer Cokal (ASX:CKA) on $54.5m, and Australian Pacific Coal (ASX:AQC) with its Dartbrook project in NSW on $8.5m.

Larger ASX coal companies are still generating significant cashflow at current depressed prices for thermal coal in Asian markets.

Whitehaven Coal (ASX:WHC), a major Newcastle coal shipper with mines in the NSW Gunnedah coalfield, has a market cap of $1bn.

The coal miner sold 16.5 million tonnes of coal and paid dividends of $312m in the 2020 financial year, said a company report.

New Hope Corporation (ASX:NHC) with a market value Friday of $890m, generated cash of $298m on sales of 11.5 million tonnes in the 2020 financial year.

Share Prices for Australian Pacific Coal (ASX:AQC), Bathurst Resources (ASX:BRL), Cokal (ASX:CKA), New Hope (ASX:NHC) and Whitehaven Coal (ASX:WHC)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.