Australian coal producers are in a high-wire act to survive market downturn

Australian coal companies are in a high wire act balancing costs and revenue in a weak coal market: Getty Images, Cirque Du Soleil 'Kooza'

- Coal export earnings tumble in 2021 from COVID-19 fallout, recovery will be slow

- Weak demand from Asia keeps downward pressure on thermal coal prices: chief economist

- Smaller ASX coal producers see margins under pressure from weak coal markets

International coal markets are expected to take at least two years to recover from this year’s COVID-19 demand shock – with serious implications for coal miners in Australia.

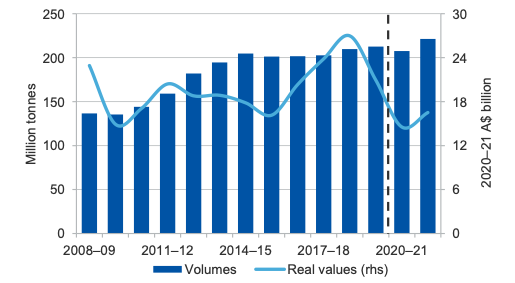

The Australian government’s chief economist’s September quarter report this week on the resources and energy industries shows tumbling export earnings for Australian coal.

Australia’s export earnings from coal are forecast at $38bn in the 2021 financial year, down 31 per cent from $55bn in FY 2020, and for the 2022 FY the forecast is $45bn.

The forecasts are based on government expectations of lower prices and varying export volumes for Australian coal shipments for the next two years.

“After dropping sharply in the June quarter 2020, the prices of metallurgical and thermal coal have steadied at relatively low levels,” said the chief economist’s report.

Chinese steelmakers driving demand for met coal

For metallurgical coal, the type used in steelmaking, Australia is expected to earn $23bn this financial year, down from $35bn for the 2020 financial year.

“The global COVID-19 pandemic has slowed the steel industry, driving the price decline,” the report said.

At around $US139 per tonne on a free-on-board Australia basis this week, premium-grade metallurgical coal prices are up from their August low of around $US100/t, on recovering Chinese demand.

“As the economic impacts of COVID-19 recede, metallurgical coal imports by China are expected to rise to 78 million tonnes in 2021 as steel production grows,” said the report.

China is the one bright spot for metallurgical coal demand with its import volumes forecast to grow to 89 million tonnes in 2022 FY, compared with 70 million tonnes in 2020 FY.

China’s imports of metallurgical coal have been constrained by its slow customs clearance process for cargoes, with 100 coal ships left queueing off Chinese ports in September.

Australian export earnings from metallurgical coal

Ex-China met coal market in slow down

Outside of China, demand for metallurgical coal is “extremely weak” and high-cost mines are likely to close as a result, said the report.

India imported 40 million tonnes of metallurgical coal in the 2020 FY, down from 58 million tonnes in the 2019 FY, and will get back to 48 million tonnes in 2021 FY.

Forecast prices for Australian metallurgical coal are $US124/t for the 2021 FY, and $US142/t for the 2022 FY compared with $US145/t in 2020.

Asian power generators cut demand for Aussie thermal coal

Thermal coal exports are forecast at $15bn for the current financial year, a drop on $20bn for the 2019 FY, but are due to recover to $17bn in the 2022 FY, said the report.

Strong competition from rival power generation fuel, gas, and rising use of renewable energy, plus the effect of COVID-19 containment measures affected coal use and prices.

“Weak demand from Asian coal-fired power utilities (as many of them switch to using gas) has kept downward pressure on the thermal coal price,” said the report.

“China is the only major importer to demonstrate resilient import demand, and domestic [coal] prices for Chinese produced thermal coal remain relatively high,” said the report.

Domestic coal production in China was lowered by Beijing’s efforts to control the spread of the Corona virus and Chinese power plants turned to imports to make up the difference.

Australian thermal coal prices for the Newcastle shipping hub are forecast to average $US55 per tonne in the 2021 financial year, and $US64/t in 2022, compared with $US61/t in 2020.

Australia’s export earnings for thermal coal shipments

Australian thermal coal mines struggling on current prices

Around half of the world’s thermal coal production is currently loss-making, according to Glencore, the world’s largest exporter of the product with operations in Australia.

The mining giant said its production costs at the point of delivery to customers in Newcastle port is $US46.40/t in 2020.

Traded prices for premium-grade Australian thermal coal averaged $US45-50/t in the September-ended quarter, as away from China, demand in the global market stays weak.

Therefore, the company is still making money from exports of premium thermal coal, just.

Glencore suspended production for two weeks at its Australian coal mines in September due to market weakness.

Glencore forecast in July that its coal production will be around 111 million to 117 million tonnes in 2020, based on targeted volume reductions in Australia and Colombia in the second half of the year.

This is down by around 18 million tonnes from Glencore’s previous 2020 production guidance of 129 million to 135 million tonnes.

The miner has reduced production at its Colombian coal operations, reducing its attributable output from its 33.3 per cent owned Cerrejon mine by 1.5 to 2 million tonnes, and cutting production at its Prodeco mine by 3.5 million tonnes, in the 2020 half year.

Glencore said in February 2019 it was capping its production of thermal and metallurgical coal at then prevailing levels of around 150 million tonnes per annum, as it repositions capital investment to commodities used in low carbon emission technologies.

Coal miners Anglo American, BHP and Peabody respond to market

Other industry giants have responded to current poor coal market conditions by cutting output.

Anglo American has halted production at its Grosvenor mine in Queensland until mid 2021.

BHP (ASX:BHP) has its Mt Arthur thermal coal mine in NSW under review with a view to a potential sale.

Peabody announced the temporary closure of its Wambo mine in NSW and some cutbacks at its jointly-run, with Yancoal, Middlemount mine in Queensland.

Glencore’s and other miners’ production cuts may help out smaller coal miners by allowing them to delay their own cuts.

But staving off production, cuts becomes more difficult the longer that poor market conditions last.

ASX coal miners on razor-thin margins

A number of ASX coal stocks are operating on thin margins because of low coal prices and they need to weather current difficult market conditions which could last for a while yet.

TerraComm Resources (ASX: TER) the operator of the 2 million tonne per annum Blair Athol mine in Queensland, reported a net loss after tax of $147.1m for the 2020 financial year.

Its revenue for the period was $316.9m, but its cost of goods sold was $296.2m.

Isaac Plains mine operator Stanmore Coal (ASX:SMR) recorded a net profit after tax of $34.8m for the 2020 FY, down from $91.5m for the year ago period.

Whitehaven Coal (ASX:WHC) with its flagship Maules Creek mine in NSW made a net profit after tax for the 2020 FY of $37.2m, down from $524.8m for FY 2019.

ASX share prices for Stanmore Coal, TerraCom Resources and Whitehaven Coal

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.