ASX Resources Top 5: Gold hits, important deals and a couple of 13-baggers

Pic: Getty

- Golden Mile hits thick high grade gold at ‘Benalla’ project, shares fly

- Gold mine developer West Wits gets crucial environmental approvals

- Major miner Anglo American could fund redevelopment of Anax’s ‘Whim Creek’ copper zinc mine

Here are the biggest small cap resources winners in morning trade, Monday March 29.

GOLDEN MILE RESOURCES (ASX:G88)

Golden Mile’s team believes there is a significant gold system at the ‘Benalla’ project in WA, which has been bolstered by some thick, high grade hits in early drilling.

Early stage drilling returned a highlight 33m at 1.60g/t gold from 48m, including 16m at 2.95g/t.

A re-assayed hole from 2020 drilling also returned 1m at 10.6g/t.

The stock hit +2 year highs in early trade Monday.

“The plus 10-gram gold intersection in hole BTAC082 at ‘Wanghi’ points to the potential for high-grade in the system and is further endorsement of our belief in Benalla to host a meaningful gold system immediately along strike from KIN Mining’s (ASX:KIN) 1.15Moz Cardinia gold project,” Golden Mile managing director James Merrillees says.

“With assay results received for only six out of a total of 81 holes drilled to date we are looking forward to a period of strong news flow over the coming months.”

NATIVE MINERAL RESOURCES (ASX:NMR)

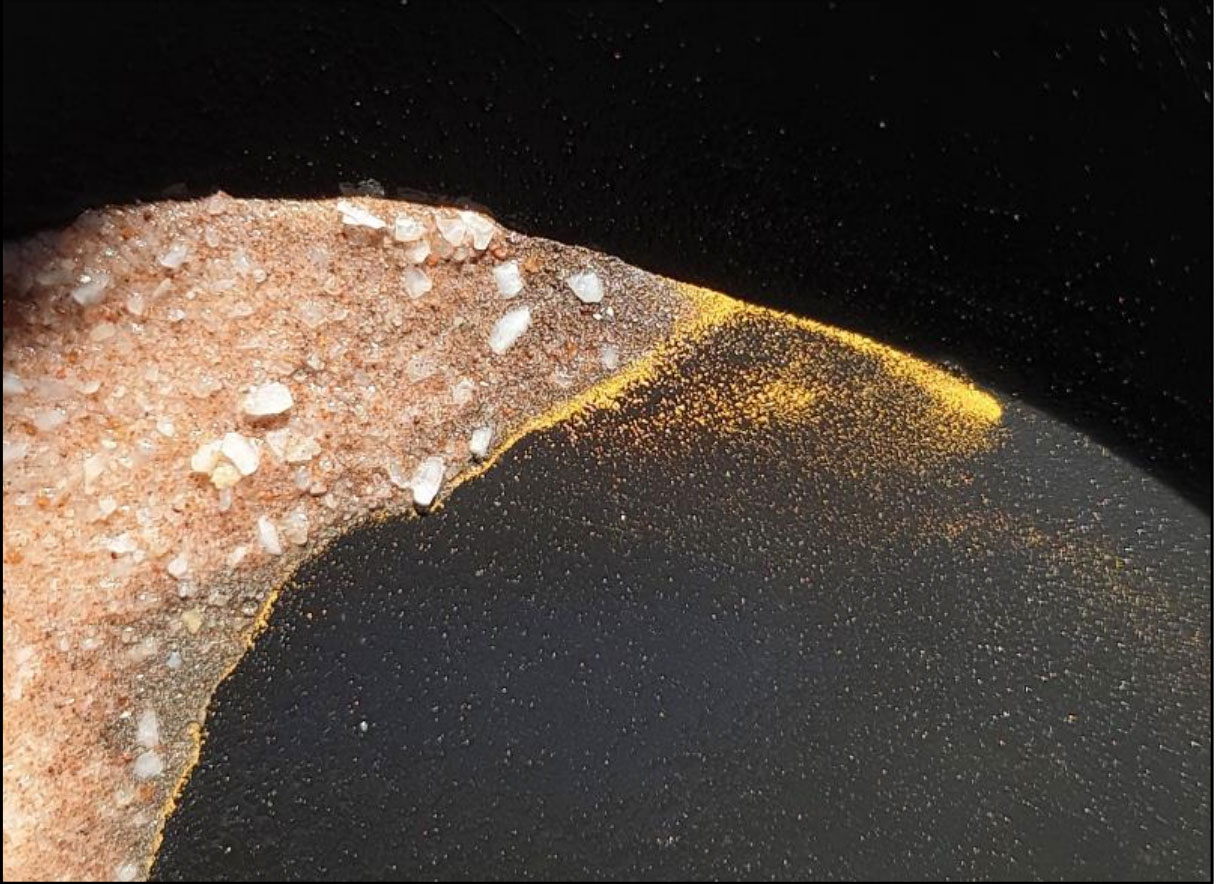

More early stage gold exploration success, this time from recent listing Native Mineral Resources.

First pass rock sampling at ‘Music Well’ in WA has returned over 100g/t in individual samples.

And visible gold was obtained from all 14 large samples collected — confirming that gold can be recovered using cost effective gravity separation techniques, the company says.

The South African government has finally signed off on crucial environmental approvals for West Wits’ 4.37moz, 60,000oz per year Witwatersrand Basin gold project.

The company wants to be mining later this year.

“The reinstatement of the environmental authorisation comes at an opportune time for WWI with the resource restatement and BFS on the ‘Qala Shallows’ project area scheduled for April and July 2021 respectively,” West Wits managing director Jac van Heerden says.

“The successful completion of the EA process significantly de-risks the project and is a major catalyst for execution of the next stage of the WBP’s development strategy, allowing the WWI team to ramp up activity as the company targets maiden underground gold production in 2021.”

West Wits is up 1230% over the past 12 months.

Yes, 1230%.

(Up on no news)

Xanadu’s main game is the ‘Kharmagtai’ gold-copper porphyry project in Mongolia.

Last week the explorer announced monster hits like 92m at 1.06% copper and 3.23g/t gold from 686m, which expanded the mineralised zone by ~70m.

Another hole – still in progress as of last week – has intercepted visual chalcopyrite (copper bearing) mineralisation another 400m away.

The Kharmagtai resource currently stands at a respectable 600Mt at 0.49% CuEq for 2.9Mt CuEq in contained metal, but it probably needs to get bigger to guarantee development.

Xanadu chairman Colin Moorhead wants to see at least 1 billion tonnes at a grade of at least 0.5% CuEq (5Mt CuEq of contained metal), while Argonaut analyst George Ross speculated in his recent initiation report on the company that 4-5Mt CuEq metal might be enough to attract a partner with deep pockets to help fund Kharmagtai’s development.

A non-binding agreement could see major miner Anglo American fund redevelopment of the ‘Whim Creek’ copper zinc mine in the NT.

The deal involves a $2m payment for a 1% Net Smelter Royalty (NSR) over ANX production (80%) of copper, zinc, lead concentrates and copper cathode for the life of mine.

Anglo American will also lend Anax ~$26m to fund redevelopment costs.

ANX is now up +1,200% over the past 12 months.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.