Deeper drilling holds the key for Xanadu: Argonaut

Pic: Schroptschop / E+ via Getty Images

The identification of additional, higher grade resources at depth looms as the game-changer for Xanadu Mines’ flagship Kharmagtai copper-gold project in Mongolia, according to stockbroker Argonaut Securities.

Argonaut analyst George Ross initiated coverage on Xanadu (ASX: XAM) with a “speculative buy” recommendation and a target price of $0.09 last week, noting that the deeper heart of Kharmagtai may host large-scale deposits of >1% copper equivalent material suitable to be extracted using the bulk underground mining method known as block caving.

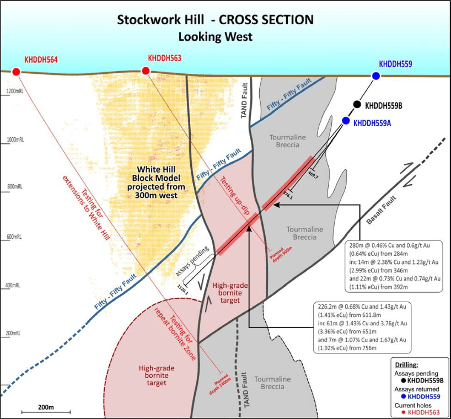

The theory about Kharmagtai’s deeper potential gained momentum in mid-February when Xanadu reported some of the best intercepts seen at the project from a diamond hole drilled beneath the existing Stockwork Hill resource.

Hole KHDDH59B delivered an upper interval of 280m at 0.64% CuEq from a depth of 284m and a deeper interval of 226m at 1.4% CuEq from 612m. The deeper interval included a higher grade zone of 61m at 3.4% CuEq.

The bornite-rich mineralisation observed in the drill core prompted Xanadu to draw comparisons with the Hugo South deposit, one of the highest grade zones at the giant Oyu Tolgoi operation, 120km south of Kharmagtai.

Argonaut’s Ross thought the results from KHDDH59B indicated “the potential for Kharmagtai to yield high grade deposit cores, nested beneath the shallow low-grade system”.

“Successful delineation of one or more deeply seated, high quality deposits with favourable geometry has the potential to reframe Kharmagtai as an open pit development complemented by efficient large-scale block cave underground mining,” he said.

Big but getting bigger

Kharmagtai is already one of the largest undeveloped copper-gold deposits owned by an ASX company – the resource currently stands at 600Mt at 0.49% CuEq for 2.9 million tonnes CuEq in contained metal – and one of the few large porphyry systems not controlled by a major.

But the consensus appears to be that it needs to get bigger still to guarantee its future development.

This is the mission Xanadu chairman Colin Moorhead, a veteran geologist and former senior executive with Newcrest Mining with plenty of experience with copper-gold porphyries, set for the company not long after he joined in November 2019.

To cement its status as a genuine Tier One project, Moorhead wants to see Kharmagtai with a resource of at least 1 billion tonnes at a grade of at least 0.5% CuEq.

Ideally included in that would be a high grade core of 100Mt or so at a grade of at least 0.8% CuEq, which would provide a point of differentiation from other porphyry projects globally.

Ross holds a similar view, saying that resource growth will be critical to attracting another party to help fund development or as a buyer of the project outright.

“Future value growth for Xanadu is largely dependent on eventual advancement of the Kharmagtai project to mine,” he said. “When progressed, Kharmagtai will be a large-scale development, with expensive upfront capital costs.

“To attract a suitable partner, the project needs to be bigger and ideally higher grade. We speculate an inventory of 4-5Mt CuEq metal might be enough to attract a suitable partner.

“This increase could either be achieved through further definition of shallow resources or identification of deep lying bulk tonnes with suitable characteristics for block cave mining.”

Grade the focus going forward

Hole KHDDH59B was drilled as part of a 23,000m phase one drilling program at Kharmagtai that has now been completed.

A phase two drilling program will be finalised following the review of all phase one results and will feature a more surgical focus on priority targets that are likely to improve the project’s overall grade.

Xanadu is expected to release an updated resource estimate for Kharmagtai shortly, incorporating results from the phase one drilling.

In calculating his price target for the company, Ross ascribed the bulk of his valuation to Kharmagtai ($0.07) with $0.01 ascribed to the Red Mountain joint venture with Japan’s JOGMEC and $0.01 ascribed to the company’s cash holdings ($7.7 million as at the end of December).

This story was developed in collaboration with Xanadu Mines, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.