ASX Resources Quarterlies: These Mark Creasy backed explorers are on a roll

Pic: Stockhead, Via getty Images

It’s quarterlies season!

The ASX market announcements page has become increasingly flooded with lodgements so, to save you the trouble, we’ve wrapped the highlights from some of the junior exploration stocks that caught our eye today.

PEREGRINE GOLD (ASX:PGD)

In February, a company controlled by billionaire prospector Mark Creasy scooped up a 9.6% stake in gold-lithium explorer PGD for $2.25m.

Cashed-up PGD now has ~$4.3m to accelerate exploration on its portfolio of gold and lithium projects, which has rapidly expanded since listing in March 2021.

In the June quarter, the company completed a heritage survey at the flagship Newman gold project (formerly the Pilbara gold project) in preparation for highly anticipated RC drilling.

At the Rocklea project results are pending from a reconnaissance stream sediment sampling program, while a report is expected in the coming weeks which will highlight Hemi and Ni/PGE style targets at the Mallina gold project.

Post the end of the quarter, on 11 July 2022, an exploration licence was granted over the Pilgangoora North lithium project.

A comprehensive reconnaissance sampling program focused on stream sediment and rock chips is planned for the current quarter.

SOUTH HARZ POTASH (ASX:SHP)

SHP’s main game is the significant ‘Ohmgebirge’ potash development project in Germany.

In a busy June quarter, the company completed a confirmatory drillhole program at Ohmgebirge.

“The assay results from these two holes have confirmed the quality of this world-class potash deposit and the integrity of the historic drilling results,” SHP exec Ian Farmer says.

The updated resource now stands at 338Mt at 12.9% K2O (previously 325Mt at 13.2% K2O).

A Scoping Study – the first proper look at the economics of building a project — is on track for completion in August 2022.

READ: Fertiliser price spikes point to hunger games kick-off, and these 5 ASX stocks are primed to benefit

KINGSTON RESOURCES (ASX:KSN)

KSN owns one of the biggest gold resources of any junior on the ASX – the 3.8m ounce (1.35-million-ounce reserve) Misima project in PNG.

A DFS was released June 6 outlining a large-scale, long-life, low-cost open pit operation with forecast gold production of ~2.4Moz gold plus 5.6Moz of silver over a 20-year life.

KSN estimated life-of-mine (LOM) revenue of $6.1 billion, and LOM pre-tax free cash flow of $2.7 billion.

“With all the necessary foundations now in place for a return to gold production at Misima, we look forward to advancing all the necessary approvals, strategic and funding options to bring the mine to production,” KSN managing director Andrew Corbett says.

CZR RESOURCES (ASX:CZR)

Resurgent Mark Creasy-controlled iron ore play CZR is at an exciting juncture. Yes, Creasy is everywhere.

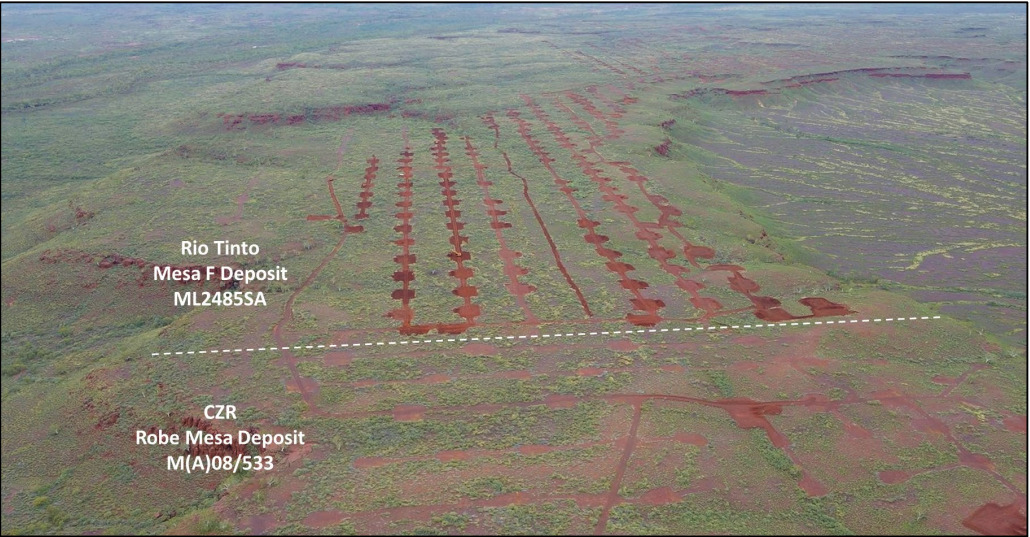

The explorer’s flagship ‘Robe Mesa’ project sits in the shadow of the Rio Tinto-led 30Mtpa Robe Valley mining joint venture, stoking speculation that it may be a takeover target for the mining behemoth.

Adding fuel to the fire is a current drilling program by the JV, which has gone right up to the project boundary.

Literally.

CZR’s focus during the last quarter was drilling to grow and increase confidence in the 37.5Mt at 56% Fe (62.6% Fe calcined, 55% Fe cut-off grade) Robe Mesa resource to allow for a bigger, longer life 3Mtpa operation.

On 23 June, CZR announced it had received heritage clearance to commence drilling the northern strike extension, “providing a significant boost to the company’s strategy to grow the mining inventory at Robe Mesa”.

A project DFS is ongoing.

READ: With Rio literally knocking the door down, here’s CZR’s Stefan Murphy on why they can go it alone

MITRE MINING (ASX:MMC)

MMC has reported on a busy June quarter today as it continues to progress its Batemans and Araluen Projects in the mineral-rich eastern Lachlan Fold Belt of NSW.

A total of 1,885 portable XRF (pXRF) readings were taken with negligible environmental impact. From these a large number of anomalous silver and rare earth element results were returned, including high-value magnet metals neodymium and praseodymium.

Meanwhile, rock chip sample assays returned with anomalous – and viable – gold up to 1 gram per tonne (g/t), plus some anomalous titanium, vanadium and iron, which is consistent with vanadium-bearing titanomagnetite.

Looking ahead, MMC has continued to submit further samples for assessment over the course of its ongoing exploration program, with more results pending.

A comprehensive works program has been formulated for the Araluen project, though this may be modified depending on the outcomes arising from the reconnaissance work.

The company is well-funded for its ongoing activities with $3.37m cash at bank.

At Stockhead we tell it like it is. While Mitre Mining and Peregrine Gold are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.