ASX Resources Quarterlies: Freshly listed Koba kicks off drilling at US cobalt project

The company expects to receive assays from the Colson project in October. Pic: Westend61 / Westend61 via Getty Images.

It’s quarterlies season and the ASX market announcements page has become increasingly flooded with lodgements.

To save you the trouble of trudging through it all, we’ve wrapped up the highlights from some of the reports that caught our eye today.

The company listed in the June quarter with a $9m IPO and a focus on exploring its portfolio of cobalt projects in the USA – including the Blackpine cobalt-copper project and Colson cobalt-copper project.

Koba completed an Induced Polarisation (IP) geophysical survey at Blackpine ahead of its maiden drilling program scheduled to kick of in September.

At Colson, drilling commenced during the quarter and will continue through to August before the rig moves on the Blackpine – with initial assays expected in October.

The company reported a plethora of copper-gold drill results from its Costa Fuego project in Chile, so many in fact that we’ll just mention one intercept here of 552m grading 0.6% copper equivalent (0.4% copper, 0.2g/t gold, from 276m depth down-hole (Cortadera) including 248m grading 0.8% copper equivalent (0.6% copper, 0.2g/t gold) from 574m depth.

Plus, drilling is underway across the high-grade satellite deposits at San Antonio and Valentina, with both deposits to be included in the next mineral resource upgrade and subsequent Prefeasibility Study (PFS) open pit mine schedule, expected in Q1 2023.

At its Indonesian Projects, Far East Gold says metallurgical testwork from the Wonogiri Project’s Randu Kuning gold-copper deposit has shown high gold recoveries of 96%, with 75% of the contained gold gravity recoverable.

Essentially this suggests that rapid and low-cost recovery could be possible for this type of gold mineralisation, the company says.

FEG has also nabbed the technical approval for the Compliance of Emission Quality Standards for the project for any potential air emissions associated with the proposed mineral processing plant which includes a Carbon-in-Leach (CIL) processing mill operating at a rate of up to 1 million tonnes per year.

At the company’s Australian projects, a new zone of epithermal-type quartz veins was discovered at the Hill 212 property with an initial 2,000m drilling program planned in September.

And at the Mount Clark West property, FEG has finalised a plan to complete a 21-line kilometre MIMDAS geophysical survey in July 2022 and the results will be used to identify drill targets.

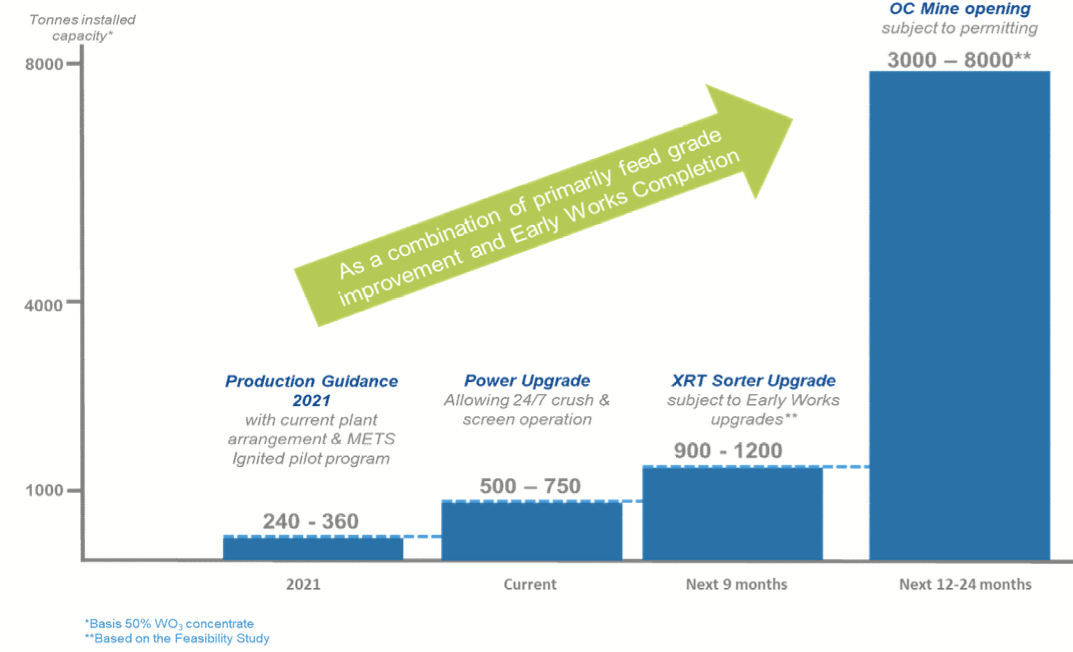

EQ achieved a solid milestone during the quarter, with the completion of the early works program at its Mt Carbine Tungsten mine in Queensland.

Production recommenced from the project in 2020 with dual product streams of tungsten concentrate and by-product high-quality specialised aggregate and road-making materials – and now two TOMRA XRT Sorters are fully operational for increased production efficiencies and doubling of sorting throughput.

Plus, the company nabbed a $6m grant from the Federal Government’s Critical Minerals Accelerator Initiative (CMAI) for its expansion program.

EQR also said that positive results from the underground mine Scoping Study gives it confidence to proceed with pre-feasibility work, with the underground mine having potential for a long life, technically and economically viable project (at current tungsten price).

Drilling at the 309 deposit at the Twins Hills project in QLD during the quarter has returned “excellent results confirming both scale and potential with major extensions of gold mineralisation”, the company says.

GBM is currently reviewing all the geology and the latest drilling of the 309 Deposit with the aim of revising the mineral resource estimate – currently 760,700 ounces of which the 309 Deposit has 501,000 ounces of gold – by the end of the September quarter.

The company also continued to generate a positive cashflow with gold production of 338oz at the White Dam copper-gold project in SA during the June quarter providing revenue of $862,000.

The company’s exploration strategy in the highly prospective but under-explored New England Fold Belt has been getting investors’ attention with the share price jumping 37% in mid-July.

Highlights from the June quarter include a number of thick, high-grade and shallow drill intercepts plus the discovery of additional mineralised lodes at Webbs Consol Silver Base Metals Project.

The company says it’s in a strong cash position to pursue numerous drill targets that remain to be tested at Webbs Consol, as well as develop its assets in the historic mining region of NSW.

At Stockhead we tell it like it is. While Far East Gold, Hot Chili, GBM Resources and Lode Resources are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.