ASX juniors lead the charge to help build up Argentina’s mining sector

Picture: Getty Images

- Argentina is poised to become the third-largest producer of lithium by 2030

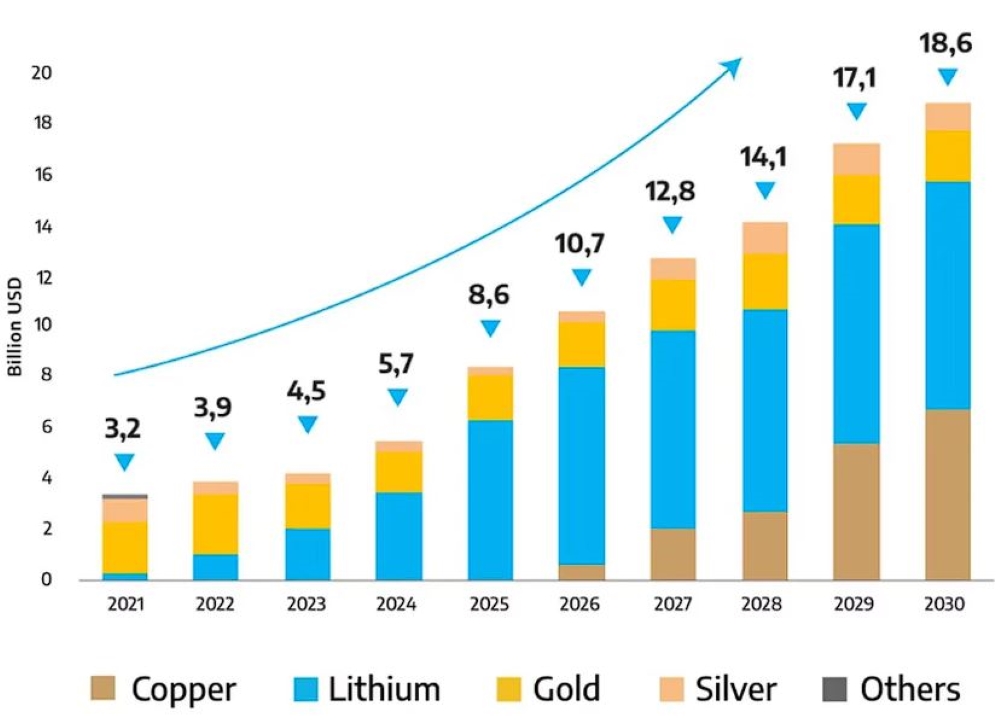

- Exports to rise from $3.2bn in 2022 to a projected $4.5bn this year

- Candidates in Argentina’s election have put their support behind mining

- There’s a bunch of ASX juniors looking to help grow Argentina’s mining sector

As Argentines voted on Sunday in a still tightly contested federal election, the country itself is facing serious economic issues – with annual inflation at over 120%, a fiscal deficit and a huge debt with the International Monetary Fund.

The nation is desperate to improve its economy and president of Argentina’s Chamber of Mining Entrepreneurs (CAEM) Roberto Cacciola says all leading candidates see the nation’s mining potential as a vital growth vehicle.

None of the presidential candidates have suggested centralising and nationalising any part of the mining sector as Chile has done with its lithium industry.

Argentina has a more pro-market model than its neighbours and is home to >30 mining projects in different stages – largely driven by foreign investment and regular permit approvals as the government looks to keep bringing in more USD through mining exports.

Argentina export growth

Cacciola says the final number of exports for this year will be close to US$4.5bn, a marked jump from US$3.8bn in 2022, according to official data.

Gold and silver still make up the lion’s share, with an expected US$3.2bn of total exports for the calendar year.

Leading producers of gold in Argentina are Newmont, Barrick Gold, Shandong Gold Group, AngloGold Ashanti, Yamana Gold and Hochschild Mining.

Lithium production has helped the rise in dollar-value mining exports, especially Gangfeng and Lithium America’s 40,000tpa LCE Caucharí-Olaroz lithium brine JV, which has just started ramping up production.

“Argentina will be able to increase its production six times, to more than 200,000tpa of LCE [in the next few years] and we estimate investment in 2024 could be above US$1bn,” Cacciola says.

S&P Global’s research databook released September 25 echoes this, reporting that Argentina’s lithium production will gradually increase year on year and could surpass Chile in 2027.

This would catapult the South American nation to become the third-largest lithium producer in the world behind Australia and China.

Infrastructure needed

Yet Cacciola says that to realise this, there’s a need for further investment in infrastructure so that mining projects, both those that are underway and those to come, are consolidated and bottlenecks are resolved.

“Mining is a reality, especially with lithium in this region, and the possibilities of copper and other minerals are added,” Cacciola says.

“There must be a connection between the private and public sectors so that the infrastructure and logistics possibilities are developed and are not an impediment to the necessary production and exports that Argentina can generate.”

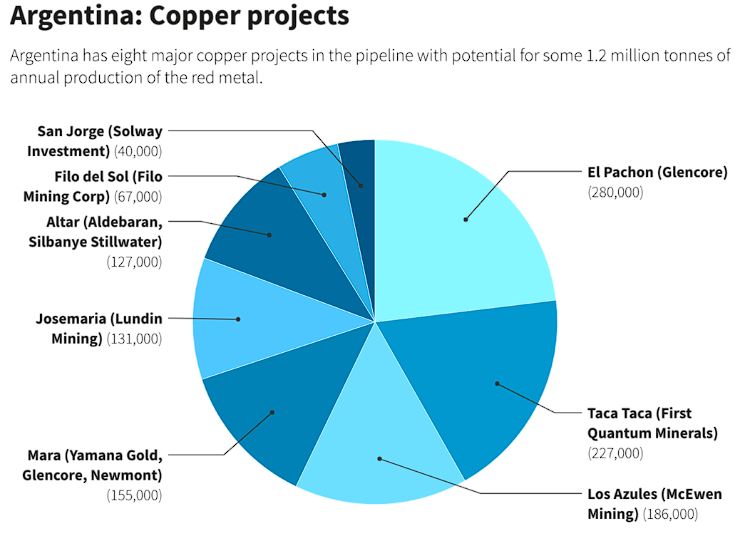

Argentina is also looking to reboot its shuttered copper mining industry, with planned projects that could produce almost 800,000t by the end of the decade, a mid-year report by BNAmericas says.

Aussie mining companies in Argentina

Belararox (ASX:BRX) is in the mix, hunting for epithermal gold and porphyry copper systems at its Toro-Malambo-Tambo project.

Some of the world’s biggest lithium names are active in the region, including Allkem (ASX:AKE) with its Olaroz brine operation, which recently achieved record production of 16,703tpa of LCE, marking a 30% year-on-year increase.

Galan Lithium (ASX:GLN) is developing its Hombre Muerto West (HMW) and Candelas lithium brine projects in three stages to lower initial capex and help fund development.

The two projects have a combined resource of 7.3Mt at 852mg/l Li – with HMW providing the bulk of this at 6.6Mt LCE at 880m/l Li – giving the company one of the highest grade, large scale resources in the brine-rich Catamarca region.

Construction is underway, with an aim to start production of Phase 1 in H1 2025 which will output 5,400tpa of LCE. Phase 2 is aimed at 20,000tpa and a final output Phase 3 will deliver 60,000tpa.

At Argosy Minerals’ (ASX:AGY) flagship Rincon lithium-brine project, a 2,000tpa lithium plant is being commissioned this year, with plans to expand to 10,000tpa.

Rincon currently has a resource of 245,120t contained lithium carbonate and exploration upside could see that double in the near future.

Power Minerals (ASX:PNN) is developing the Salta project which has a 490,000t and growing LCE resource, Lake Resources (ASX:LKE) is developing its 8.1Mt LCE Kachi brine project, while Lithium Energy (ASX:LEL) has tenements in the Olaroz basin which it shares with neighbour Allkem, focusing on its 3.3Mt Solaroz project with a scoping study due for release before the end of the year.

Challenger Gold (ASX:CEL) has an advanced 2.8Moz Hualilan gold project, which is also near the ~400,000ozpa Veladero mine.

At Stockhead we tell it like it is. While Belararox, Lithium Energy, and Power Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.