ASX Copper Tier List: Australian copper stocks to play the rising tide

Copper is in everything, and demand is only getting stronger and more urgent. But where can you find it on the ASX? Pic: Getty Images

We always hear it’s hard to find copper opportunities on the ASX. So with tariffs and record prices placing the red metal under the microscope, we’ve dug through the list to find close to 30 operating at projects in Australia alone.

It’s a common refrain among fundies and investors.

Copper is a great market, but where do I go to look for opportunities?

Attention tends to fall on the international markets in New York and Canada where the largest copper pure plays globally are based.

Think Freeport-McMoran, Ivanhoe Mines, First Quantum Minerals.

But the ASX is housing a growing coterie of copper stocks across all ends of the value chain, from large caps to exploration juniors, all of whom have the opportunity to benefit as copper demand scales higher.

The long-term outlook for the red metal is positive: Demand is expected to hit 50Mt by 2050 according to S&P Global and production is nowhere near close to that, suggesting prices need to rise to satiate the world’s need for a product that BHP says will be 70% more sought after thanks to electrification and urbanisation.

Increasingly, those needs are being met by China, which has built out an enormous amount of refining capacity to capture the lion’s share of the refined copper market.

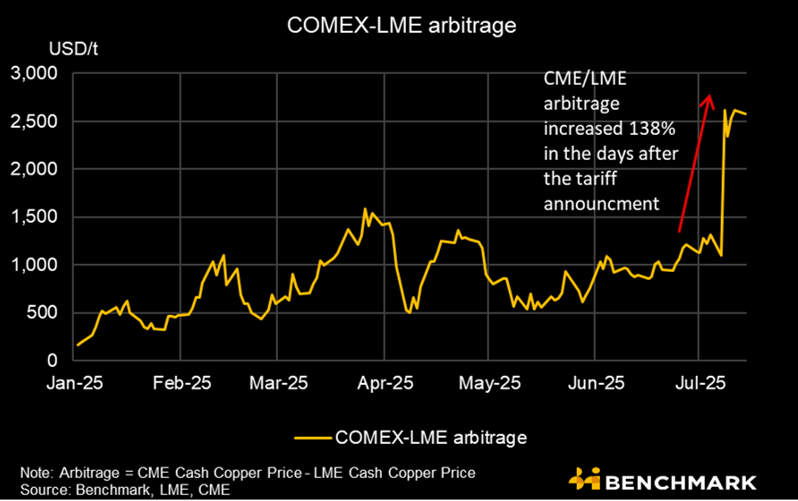

But that’s drawn alarm bells from the US Government and the tariff happy Trump Administration. Fears the Don would levy heavy tariffs on copper sent prices in the US market soaring earlier this year, hitting an all time high of US$5.69/lb after the declaration of a 50% tariff on copper imports last month as traders position to beat copper import duties.

They’re now sitting at a touch over US$5.50/lb, a massive arbitrage to the US$4.34/lb mark of benchmark LME copper.

Will the tariffs encourage America to reshore copper production and halt its reliance on imports (not from China, but actually from Chile, Canada and Peru)?

“… to make a real dent to the supply deficit the US would need to build new smelting capacity,” analysts at Benchmark Mineral Intelligence said.

“Smelters are multi-year projects and wouldn’t even be completed come the end of Trumps presidency, what if the next administration overturns these copper tariffs? Its this fear that will likely impact any investment decision.

“The short answer is therefore it is unlikely that the tariff will immediately boost supply, and it seems likely the initial effect will just be higher prices for US metal users, and by extension higher prices for US consumers.”

What the tariff has done is signal the centrality of copper to the next stage of the world’s economic and industrial development, and the premiums on offer for companies who can get into production as shortages emerge.

And in a note this week, Argonaut research analysts George Ross and Pia Donovan said that while the reported tariff had led to sell-offs in listed copper names outside the US, it only made M&A more likely.

Deals already on the table include MAC Copper’s sale to Harmony Gold and the bidding war for New World Resources (ASX:NWC), which fielded competing 6.5c and 6.6c bids from warring parties Central Asia Metals and Kinterra Capital on Thursday.

“Concerns over global growth and tariff uncertainties have impacted copper equities, with most stocks underperforming over the past month compared to the copper price. We suspect a new wave of deals could be just over the horizon and highlight potential ASX targets,” he said.

Outside of those companies already being acquired, Ross and Donovan say South Australian focused Havilah Resources (ASX:HAV), Queensland based True North Copper (ASX:TNC), Carnaby Resources (ASX:CNB) and Hammer Metals (ASX:HMX) and Zambian explorer Prospect Resources (ASX:PSC) were their picks to see potential M&A activity.

ASX copper opportunities

BUT THERE’S NO COPPER ON THE ASX, we hear you say. WRONG.

Here’s part one of our tier-list of the companies producing and exploring for copper with the potential to make it big.

Today, we’re focusing on the Australian miners, developers and explorers, with a focus on companies who already mine copper or have it as their key commodity.

Large cap producers

Starting with the biggest dog and it’s BHP, which owns the Copper SA business in South Australia.

An amalgam of the Olympic Dam mine BHP acquired in its 2005 takeover of Western Mining Corporation, it now owns three of the four largest copper producing operations in Australia with the Prominent Hill and Carrapateena mines purchased via its $9.6bn takeover of OZ Minerals.

BHP reports its fourth quarter results today, having guided production of 300-325,000t out of SA in FY25. It wants to eventually ramp that up to 500,000tpa and potentially 650,000tpa by the mid-2030s, with expansions at Olympic Dam and the development of the Oak Dam discovery.

An international player largely known for being the world’s biggest gold miner, it nonetheless warrants a place in this list given its Cadia and Boddington mines between them will produce around 90,000t in 2025.

Cadia is going through a couple lean years, but is expected to ramp up again from 2027. The mine near Orange in New South Wales has historically produced upwards of 100,000tpa of the red metal to go alongside ~700,000ozpa of gold.

Its guidance for 2025 has been set at 280,000oz and 67,000oz, with Boddington in WA to produce 560,000oz of gold and 23,000t of copper.

Another primarily gold producer, $15bn EVN has nonetheless set itself apart from its gold peers by using M&A to dramatically upscale the proportion of earnings the company derives from copper.

Its purchase of Glencore’s Ernest Henry copper and gold mine near Mt Isa and China Moly’s Northparkes mine in New South Wales saw the miner deliver 751,000oz of gold and 76,000t of copper in FY25.

Similar numbers are expected in FY26, with copper now the source of around a quarter of the miner’s revenue.

MAC burst onto the scene in 2023 with the US$1.1bn acquisition of Glencore’s CSA copper mine in Cobar.

After a rough couple of years dealing with the financial consequences of that big M&A deal, it’ll now trade on the operation in a US$1.03bn takeover by Harmony Gold, a South African gold producer which previously acquired the Eva project in Queensland.

MAC produced 8644t at a grade of 4.1% copper, the mine’s calling card, in the March quarter, with total cash costs of US$2.47/lb. Before the sale, MAC had been guiding to a 50,000tpa run rate from 2026.

Trading around the $18 offer price, some analysts continue to think a competing bid could fly in, with PTs closer to $22.

Small cap producers

A hard luck story, 29Metals was spat out of Owen Hegarty’s EMR Capital in a $2 per share, $527m IPO in 2021.

We should have called the top of the market. The closure of its Capricorn copper mine due to flooding in 2023 and 2024 left 29M with only the Golden Grove mine in WA in operation, its $450m market cap propped up by cap raisings and an insurance payment for the stricken Queensland operation.

29M shares have run 32% higher YTD, taking some of the fallen angel allure out of the company from an investment perspective.

It produced 5600t of copper and 12,300t of zinc in the June quarter at Golden Grove and deferred capital to 2026 to reduce its costs while it looks to open the new Gossan Valley orebody. First ore is due there in H2 2026.

Guidance for calendar 2025 is 22-25,000t copper, 60-70,000t zinc, 20-25,000oz gold and 750,000-1Moz silver.

Regulatory issues to secure a restart at Capricorn, the firm’s big growth option, are being worked through.

Canaccord’s Tim Hoff has a sell rating and 16c PT, saying a quarterly miss on zinc production leads to concerns about whether Golden Grove alone could support the whole business.

The simplest small cap copper producer on the ASX, Hillgrove owns the Kanmantoo mine in South Australia, which has been taken from an old open pit to an underground development under the guidance of former EVN and OZ executive Bob Fulker.

HGO’s just cracked into the Nugent orebody as it targets production of 12-14,000t of copper metal in CY2025.

At 1002t, May was the project’s best production performance to date.

The focus there is also on the exploration potential as well. Drilling recently hit a down dip extension of the Kavanagh orebody, with an exploration target at various prospects of 25-40Mt suggesting there’s plenty of mine life to be added.

At a share price of 3.6c and $85m market cap, HGO is one of the cheapest exposures to copper production on the ASX. At spot prices, Canaccord Genuity’s Tim Hoff says the company would generate $38m in free cash flow in 2026.

Produced 24,900t of copper, slightly below guidance, in FY25 along with 55,200oz of gold.

The owner of the Tritton and Mt Colin mines on the east coast, Aeris has a couple growth options at Stockman in Victoria and, potentially, the reopening of the Jaguar mine in WA.

It also owns the Cracow gold mine in QLD, which produced around 45,000oz in FY25.

The company is chasing a long term production rate at Tritton of over 30,000tpa after a refinancing in May, with the 2026 development of its higher grade Constellation underground a key step.

Jaguar still has five years of mine life remaining, if a PFS supports its reopening two years on from its closure due to seismicity.

More a gold miner, but base metals are becoming a larger part of the $330m company’s product mix.

AMI produced 45,400oz of gold, 2700t copper, 16,800t zinc and 15,700t lead in FY25 from its Peak and Federation mines in NSW’s Cobar Basin, as the higher cost Hera and Dargues wound down.

It has aspirational guidance that would be a major body recomposition effort, targeting production in FY28 of 30-40,000t gold, 6-8000t copper, 40-50,000t zinc and 23-33,000t lead.

AIC produced 12,863t of copper and 5955oz gold at the Eloise mine in Queensland, its second straight year of achieving (and in fact exceeding) production guidance.

Aaron Colleran-led AIC announced a $55m placement in June to bankroll the development of the Jericho mine, a satellite to Eloise that should lift production to ~20,000tpa from FY27 on.

$230m capped AIC is down 20% over the past year.

Bill Beament brings a big reputation to this one, the former Northern Star boss carrying DVP to a $1.5bn valuation just weeks into its life as a base metals producer.

Its mining services business is part of the reason, but the company is also on track to open two production fronts for copper and zinc in NSW at Woodlawn and in WA’s Pilbara at Sulphur Springs.

The first concentrate has been produced at Woodlawn, which is expected to deliver 22,000tpa of copper equivalent production from an underground resource of 11.3Mt at 4.1% CuEq.

Explorers

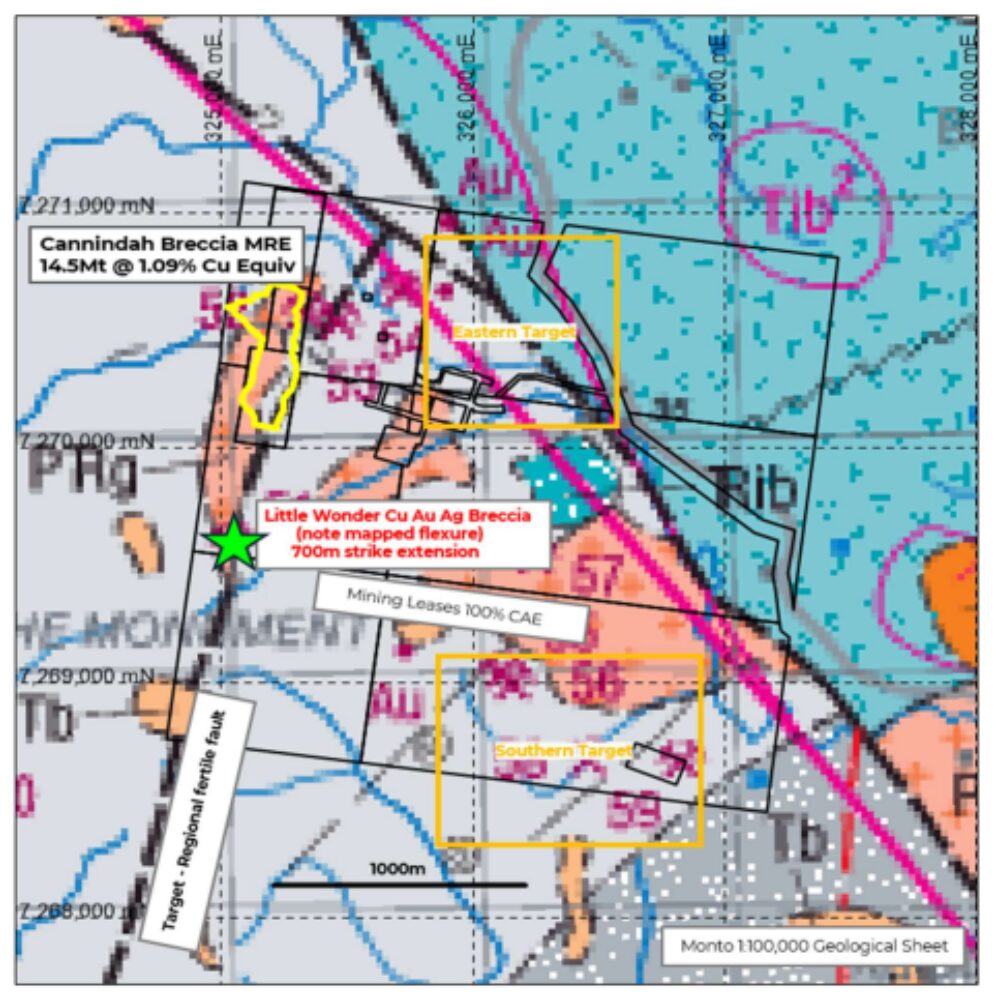

Cannindah shot to prominence last year when it announced an update to the resource of its Mt Cannindah copper and gold project, located 90km southwest of Gladstone in central Queensland.

The 14.5Mt at 1.09% copper equivalent resource represented a 183% increase in tonnage, 117% increase in copper metal, 229% increase in gold ounces and 148% increase in silver ounces to 104,800t copper, 197,000oz gold and 6.4Moz silver for 158,300t copper equivalent.

That’s substantial by Aussie exploration standards, famously pulling in Chilean State copper miner in to look over a project on our shores for the first time.

Drilling this year has uncovered thick intercepts like 71m at 0.95% CuEq and 274m at 0.49% CuEq, with intriguing high grade gold zones at depth, including a standout hit of 1m at 31.07g/t Au from 464m.

Recent exploration has picked up high grade shoots that aren’t fully defined in the current mineral resource estimate, strike extensions to the north, south and at depths and a 700m stretch of strike to test between the Cannindah Breccia and Little Wonder prospect, a similar target identified four footy fields to the south.

Despite small-scale mining from 1884-1920 and a leach operation from 1947-1965, exploration at Mt Cannindah has been spotty. But CAE views the ground as a potential pencil porphyry in the style of Northparkes and Cadia, a nature of discovery that would be very well received indeed.

CAE has some heavy hitters on board as well, with MD Tom Pickett flanked by chair Michael Hansel and non-executive director Tony Rovira, of Azure Minerals fame.

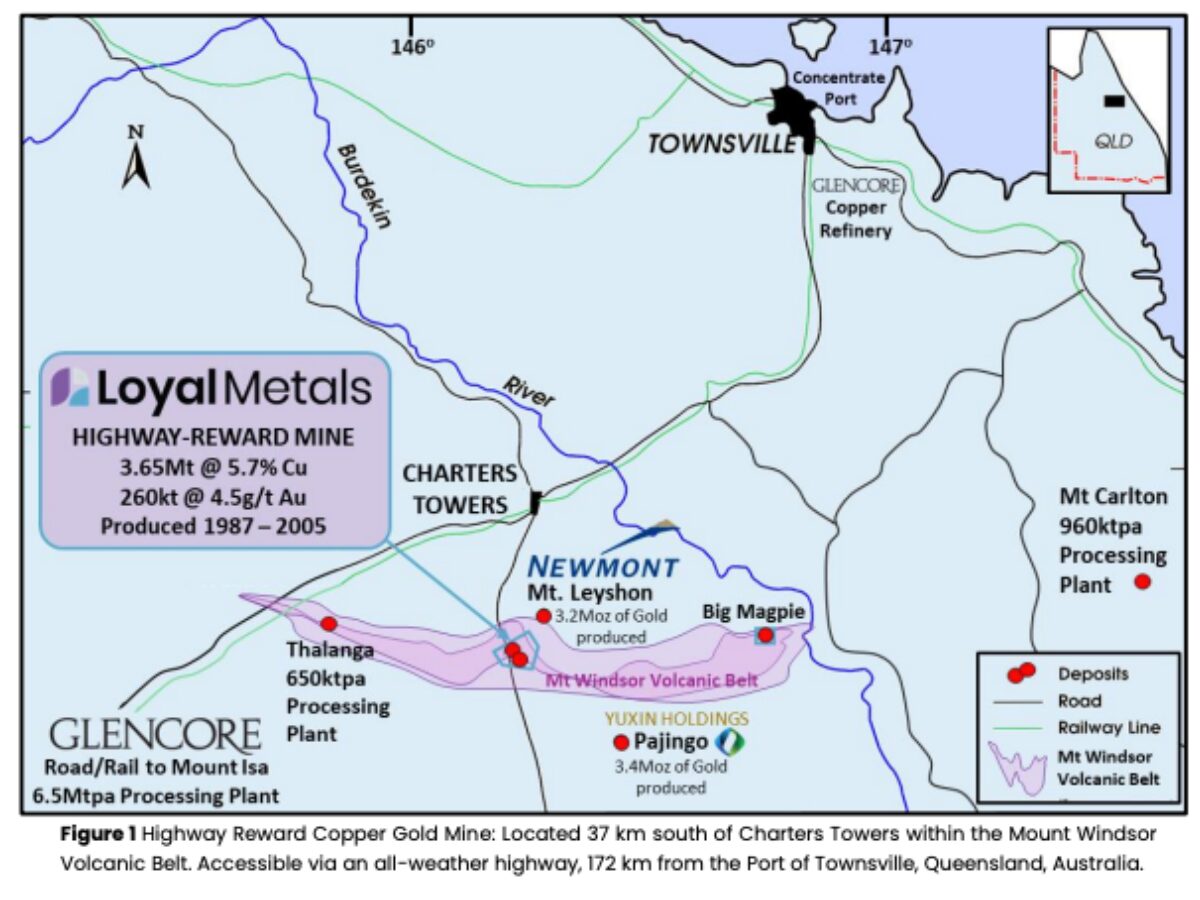

When operations ceased at the Highway Reward copper and gold mine in July 2005, copper prices have increased an astonishing 680%, while gold has run 1250% higher since the Queensland project’s 1997 feasibility study.

So the binding option to acquire the mine, which delivered 3.65Mt of ore at a ridiculous grade of 5.7% copper (1987-2005) and 260,000t of gold ore at 4.5g/t Au (1987-1989), could be a canny one.

Highway Reward is located 37km south of Charters Towers and 172km from the Glencore copper refinery and port of Townsville.

And it hasn’t been explored since 2005 or studied in 28 years, when copper was fetching $1.14/lb AUSSIE and gold A$399/oz.

“We are thrilled to secure this incredibly rare opportunity for our current and future Loyal

investors. The Highway Reward Copper Gold Mine, considered one of the highest-grade

copper mines in the world, is now primed for a revisit after 20 years of dormancy,” Loyal MD Adam Ritchie on announcing the deal.

“The granted mining leases of the Highway Reward mine provide an amazing speed to

market opportunity – especially when both copper and gold are near all-time highs.”

Mining was only conducted to 220m in the open pit and 390m for underground, with limited drilling at depth.

Located just 90km northwest of Rockhampton, QML boasts one of the most advanced undeveloped copper projects in Queensland, with 15.5Mt of ore at 0.82% copper, 0.47% zinc, 0.35g/t gold and 5g/t silver between its Mt Chalmers and Develin Creek resources.

Mt Chalmers contains the bulk of the copper and gold, 84,750t of the 126,750t copper inventory and 152,588oz of the 172,843oz gold bounty.

That’s important, with the intention to make Mt Chalmers the processing hub around which satellite mines can be developed and brought into a future mine plan.

A PFS in 2024 suggested the Mt Chalmers project, alone, could produce 65,000t copper, 160,000oz of gold, 30,600t zinc, 1.8Moz silver and 583,000t pyrite over a 10.4 year life to generate $636m of life of mine free cash flow.

A new study incorporating Develin Creek, where one standout drill hit in the Scorpion deposit struck 114m at 1.65% copper from just 11m, is in the works.

A proposed doubling of the project’s plant could increase annual production to 14,000t copper metal, 25,000oz gold, 7500t zinc and 300,000oz silver from 482,000tpa of concentrate.

On top of that, QMines has picked up the Mount Mackenzie gold and silver project, which contains 3.3Mt at 1.4g/t Au and 8.4g/t Ag for 151,000oz gold and 902,000oz silver. Drilling is planned.

One of the newest copper explorers on the ASX, LinQ is gold-focused first and foremost.

But the size of its copper inventory warrants inclusion on this list, boasting 3.7Moz of gold and 1.2Mt of copper at its Gilmore project in New South Wales.

Located in the Macquarie Arc, that includes the Gidginbung mine and adjacent Dam porphyry deposit, which contain a combined 1.2Moz of gold and 120,000t copper.

Gidginbung was last mined in 1996 when gold and copper prices sat well below today’s heady levels.

A driller has been contracted to upgrade the resource at Gidginbung at depth and along strike in the first campaign since a successful $10m IPO in July.

$75m capped Cyprium owns the Nifty copper mine, a deposit that sits among the pantheon of discoveries made and developed by legendary Aussie mining company Western Mining Corporation.

But the mine had seen better days by the time is was sold by Metals X (ASX:MLX), which failed to make it work after purchasing the Pilbara operation from India’s Aditya Birla in 2016.

A pre-feasibility study last year suggested the project had enough juice to deliver 718,000t of copper over its life, with annual production over its first ten years of 37,300tpa.

The long term concentrate operation could be preceded by a cathode project, which could extract copper cathode from oxide sitting on Nifty’s existing heap leach pads at a capital cost of just $30m.

Cyprium estimated capex of $239m to refurbish and expand the Nifty concentrator and $189m of capitalised operating costs for a total bill of $458m – roughly 2.3x the mine’s annual EBITDA for its first decade.

A phase 1 feasibility study is in the works.

Another WA-focused company, Caravel owns the copper project of the same name near the farming town of Calingiri.

Caravel is a massive porphyry deposit in the style of those found in South America with a 3.03Mt copper metal resource at a grade of 0.245% Cu. With an ore reserve containing 1.4Mt of copper metal, the $86m company claims it as Australia’s largest undeveloped copper deposit.

A study update in 2024 suggested the project, located just 150km inland from Perth, could produce 65,000tpa at steady state and 71,000tpa over its first five years but carries a capital bill of $1.7bn with a 4.9 year payback.

A definitive engineering study is ongoing.

Coda’s Elizabeth Creek project in South Australia sits 16km southwest of BHP’s Oak Dam discovery and contains 65.5Mt at 1.6% CuEq, or over 1Mt of copper equivalent.

Most of that sits in Emmie Bluff, a flat-lying underground copper and cobalt deposit running at a depth depth of around 400m.

A scoping study suggested a future mine could deliver 26,700tpa of copper, 1300tpa cobalt and 1.13Moz of silver, with pre-production capex oc $331m and AISC of US$1.80/lb.

Hammer Metals (ASX:HMX) and Carnaby Resources (ASX:CNB)

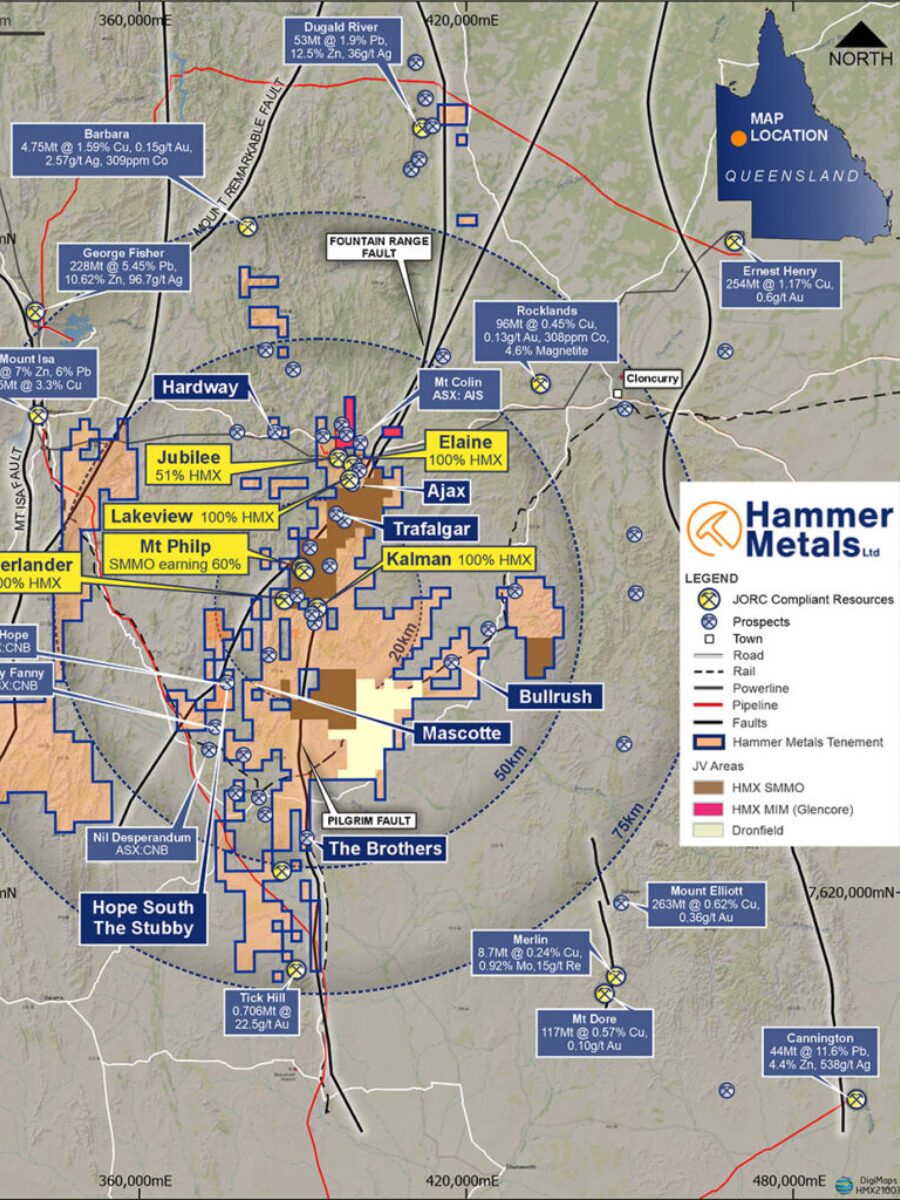

Hammer is one of the best endowed copper juniors on the ASX, hosting more than 530,000t of copper equivalent metal across a host of partly or 100% owned deposits next door to Mt Isa.

While it is also drilling for gold in the Yandal Belt of WA, Hammer has a host of prospects to test in Mt Isa, including Bullrush where maiden drilling with its Japanese JV partner Sumitomo has detected a potential iron-oxide-copper-gold system, the style of mineralisation at EVN’s nearby Ernest Henry mine.

We’ve grouped it here with Carnaby, which owns the Greater Duchess project, boasting 26.9Mt at 1.3% copper and 0.2g/t gold. The largest project held by Hammer, Kalman, holds 39.1Mt at 1.07% CuEq.

Grouped together why? Well, Ross and Donovan from Argonaut view them as a likely merger combination.

“The majority of HMX and CNB’s deposits are within a 25km window. While both contain respectable inventories in their own right, combined, the two entities would host deposits aggregating to ~66mt grading 1.25% CuEq,” they said.

“There is a strong argument for consolidation of these deposits under one banner, enabling construction of a significant scale central plant (3-4mtpa) amongst this hub of deposits. An operation of this scale would be capable of producing ~40kt of CuEq metal per annum.

“CNB’s current market capitalisation is currently ~$102m, while HMX’s is only ~$25m, making CNB the likely leader in a merger. Otherwise, perhaps a larger company could enter the fray as part of a larger regional consolidation strategy.”

CuFe owns 55% of the Orlando copper deposit, an historic brownfields mine near Tennant Creek in the Northern Territory containing 5.95Mt at 1.16% copper and 1.5g/t gold for 69,000t copper metal and 287,300oz of gold.

It’s part of a larger resource across Tennant Creek of 10.35Mt at 1.53% Cu and 0.92g/t Au for 160,000t copper and 302,000oz gold.

A scoping study on Orlando is due soon, with CuFe progressing plans for share plant infrastructure and operations synergies with fellow NT explorers Emmerson Resources (ASX:ERM) and Tennant Minerals (ASX:TMS).

Orlando has been mined both as an underground operation up to 1975, when it produced 121,282oz of gold and 4852t of copper, and as an open pit before Normandy Gold closed the mine in the 1990s with copper trading below US$1/lb.

“Even though it’s been mined previously, we do need to still get some further approvals,” CuFe executive director Mark Hancock told Stockhead last month.

“But in terms of the complexity of construction and in our case in particular, being a cutback of an existing open pit, the lead times on that should be pretty short once we can get all those necessary approvals in place.”

Staying in the NT and KGL holds the Jervois copper project, the subject of a feasibility study update earlier this year.

Based off a 510,000t resource and reserve of 14.38Mt at 1.77% Cu for 265,000t copper, 9.4Moz silver and 76,100oz gold, the company suggested it could be in production as soon as 2027.

The mine would deliver average annual production of ~30,000tpa copper, 1.016Moz silver and 8900oz gold, with a capital estimate of $362m.

That would be paid back in 3.4 years of a 10-year mine life, with C1 costs of US$1.95/lb over the seven years of steady state production, at which point KGL believes it would be raking in $208m of operating cash flow per annum.

KGL in April appointed Cutfield Freeman and amicaa Advisors to lead its financing efforts for what could be one of Australia’s largest copper operations, though its $61m market cap could be a hurdle.

Rescued from administration via a deed of company arrangement effected at the start of this year, TNC owns the Cloncurry project in Queensland, which includes the Great Australia Mine.

With Tembo Capital and Glencore as major shareholders, the company’s attention has turned to exploration near the Vero resource at its Mt Oxide project.

Vero contains 15.03Mt at 1.46% copper, 10.59g/t silver and 9.15Mt at 0.23% cobalt.

MD Bevan Jones claimed a new discovery this month at Aquila, 140km north of Mt isa, as a “game changer”.

Ross and Donovan see it as a potentially attractive takeover prospect for 29M if Aquila continues to deliver exploration success, with Capricorn Copper just 20km to the south.

Another potential takeover target, according to Ross and Donovan, they view Havilah’s Kalkaroo in South Australia as one of a handful of large open pit copper opportunities in Oz after the sale of Rex Minerals and its Hillside project to MACH in 2024 and the Eva project’s sale to Harmony Hold in 2022.

Kalkaroo hosts a 100Mt reserve at 0.47% Cu and 0.44g/t gold for 474,000t copper and 1,4Moz gold, with annual production on a now ageing PFS of 30,000tpa copper and 72,000ozpa gold.

OZ Minerals and later BHP conducted some work on Kalkaroo but left HAV heading back to the drawing board after The Big Australian pulled out.

Havilah also owns the large Mutooroo resource near the SA-NSW border, containing 195,000t copper and 20,200t cobalt.

Alma last year moved to 51% ownership in its farm-in to the Briggs copper project in Queensland with the project’s original owner Canterbury Resources (ASX:CBY).

A favourite of John Forwood’s Lowell Resources Fund, which took a ~8% stake according to a substantial shareholder notice in early July, Briggs is a massive low grade porphyry near Gladstone containing over 2Mt of copper metal.

The current resource sits at 439Mt at 0.25% copper and 36ppm molybdenum, including 110Mt in indicated resources and a small oxide resource, with a scoping study under way.

A pre-feasibility study is in the works for the South Cobar project, which contains a string of deposits discovered by Peel across the NSW basin.

The plan is to supply a 1.1Mtpa plant with polymetallic material lead by copper dominant ore from the Mallee Bull and Wirlong deposits, around 100km south of Cobar.

The South Cobar project contains a total of 235,000t copper, 271,000oz fold, 25,400oz silver, 166,000t lead and 331,000t zinc, with a new resource at the Wagga Tank deposit contributing 21,100t of copper, 72,500oz gold, 3.77Moz silver, 22,900t lead and 24,900t zinc to that total.

A hot stock around 2017 as it made a string of discoveries, the Lassonde Curve has not been kind to Peel, with the $43m company’s shares ~63% lower over the past five years.

But the location of the South Cobar project and grade of the copper deposits at Mallee Bull and Wirlong means it’s well placed to benefit from consolidation in the region.

Horseshoe owns the historic Horseshoe Lights mine, located just 60km west of Sandfire Resources’ (ASX:SFR) legendary, mothballed, DeGrussa copper and gold mine.

It was nowhere near as spectacular as DeGrussa, but still produced a tidy 316,000oz gold and 55,000t copper metal.

And the original Bryah Basin copper volcanogenic massive sulphide discovery still has some tasty dirt left, a. in situ resource of around 128,000t copper metal at 1% Cu, along with 36,000oz of gold.

A plan to begin DSO mining was approved by the WA mines department, with the operation expected to start up this quarter.

“As well, given the strengthening copper price, we plan to update our last Scoping Study based on an optimised pit shell that will encompass part of the 134,000 tonnes of contained copper at HSL, and we will also undertake some additional drilling this quarter to test new areas of interest which we are confident will define more ounces,” executive director Kate Stoney said this month.

“In our view HSL is still vastly underdeveloped and underexplored now is the right time at in the cycle to unlock the project’s considerable value.”

Anax Metals (ASX:ANX), GreenTech Metals (ASX:GRE) and Artemis Resources (ASX:ARV)

Anax owns 80% of the Whim Creek project in the Pilbara, where it boasts a resource of 11Mt at 1.1% Cu and 1.7% zinc, the other 20% geld by Bill Beament’s Develop, the operator of the nearby Sulphur Springs project (13.8Mt at 1.1% Cu, 5,7% Zn).

While its completed a DFS on a standalone project, the true benefits of Whim Creek could come by using its plant as a centralised processing hub for projects in the region, which could create a 20,000tpa copper operation.

To that end, ANX has formed a base metal alliance with other deposit holders in the region.

They include GreenTech, which has a resource of 6.2Mt at its Whundo-Ayshia project of 6.2Mt at 1.12% copper and 1.04% zinc.

An exploration target compiled in June suggests it could get much larger – 15-23Mt at 0.9-1.4% copper and 0.2-0.4% zinc for 176,500-264,800t copper and 46,000-69,000t zinc.

Nearby, Artemis Resources has taken a more gold-forward focus at its Carlow project, but has around 64,000t of copper among the resource, which also includes 374,000oz gold and 8000t cobalt.

At Stockhead, we tell it like it is. While Hillgrove Resources, Cannindah Resources, Loyal Metals, LinQ Minerals, QMines, Horseshoe Metals, Artemis Resources and CuFe are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.