As uranium spot price surpasses 12-year highs, Basin Energy turns up unconformity targets in the world-class Athabasca Basin

Mining

Mining

Basin Energy has identified priority uranium targets at its North Millennium project in Canada’s world-class Athabasca Basin.

Uranium prices continue to surge approaching their highest levels in nearly a decade. This surge follows a steady upward trend that has made it the only commodity on Stockhead’s Up, Up, Down, Down list to be a winner in every month since April.

According to price monitor Numerco, U3O8 – or yellowcake – is trading at ~US$65.5/lb.

That is close to the highest spot price in a decade, and experts believe there is more to come.

“The uranium sector has had multiple positive catalysts in recent weeks, which is being reflected in the U3O8 spot price. As momentum continues to build, our aim is to position Basin as the preferred ASX listed explorer for high-grade uranium discoveries,” BSN MD Pete Moorhouse said.

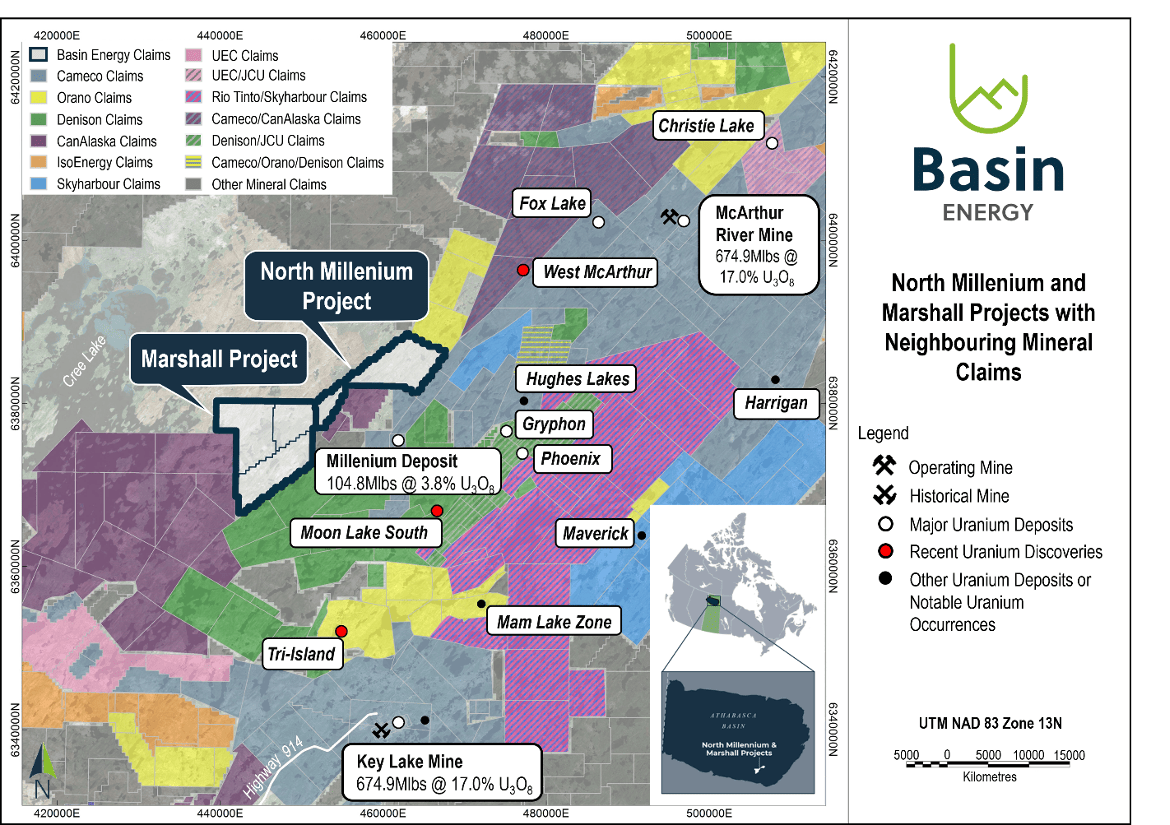

This surge in uranium prices is great news for juniors like Basin Energy (ASX:BSN), which has interests in three projects in the world renowned uranium district of the Athabasca Basin. This includes the North Millennium project, strategically located just 7km from Cameco’s high-grade 104.8Mlb Millennium deposit.

The $17bn capped Cameco is a major player in the Athabasca Basin, a top-three global uranium producer for over 45 years.

Cameco’s world-class McArthur River mine, also in the Athabasca, contains 674.9Mlb at an eyewatering resource grade of 16.99% uranium.

Basin is confident that there are plenty more discoveries to be made in the promising region, especially as the positive uranium market sentiment continues to build.

“Recent discoveries in the area from projects such as West McArthur and Moon Lake South demonstrate the discovery potential for high-grade uranium mineralisation in this part of the Athabasca Basin,” Moorhouse said.

“The results from Basin’s study show the exploration prospectivity that North Millennium holds.”

As part of a detailed study, a new 3D inversion of historical geophysical data confirms the exploration prospectivity that the North Millennium project holds, Basin says.

Significantly, it supports the interpretation of a 5km target corridor located along an interpreted fault extension, host of Cameco’s Millennium deposit just 7km to the south.

The identification of where this corridor intersects basement conductor anomalies is “highly encouraging” given that no exploration drilling has ever been conducted within this property, Basin says.

The company will utilise these new interpretations as a basis for future exploration.

Work continues at the Geikie project, with final assay results from maiden drilling expected imminently and preliminary gravity results expected in September.

“Whilst our short-term focus will be the follow-up of shallow targets identified through phase one drilling at Geikie, we are actively preparing the Marshall and North Millennium projects for upcoming drill testing,” Moorhouse said.

A review of the Marshall project is also underway. Next steps for the Marshall and North Millennium projects could include Stepwise Moving Loop Time-Domain Electromagnetic (SWML TDEM) surveys combined with Direct Current Resistivity and Induced Polarisation (DCIP) – common methods used in the Athabasca region to detect subsurface geological targets often in association with uranium mineralisation.

Following the completion of the ground geophysical surveys, drill targeting will prioritise areas of conductivity high anomalies along zones of magnetic transition with associated DCIP resistivity low.

This article was developed in collaboration with Basin Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.