Arizona Lithium prepares for take-off at Prairie with 95.6% recovery rate

Arizona Lithium has reported more encouraging results from its Prairie pilot plant. Pic via Getty Images

- 80,000L has been processed for 6,000L of LCE from the Prairie pilot plant

- Lithium extraction from brines averages 95.6% with 99.9% of impurities removed

- A pivotal PFS is due before the end of the month

- Commercial-scale production pegged for 2025

Special Report: Arizona Lithium’s pilot plant has produced more than 6,000L at a steady extraction state of 95.6% lithium recovery rate and shown it can remove 99.9% of impurities from the brines at its Prairie project in Saskatchewan, Canada.

There are only a handful of lithium producers across North America, including Sayona Mining (ASX:SYA) and Piedmont Lithium’s hard rock NAL project in Quebec and Albemarle’s Silver Peak brine operations in the US.

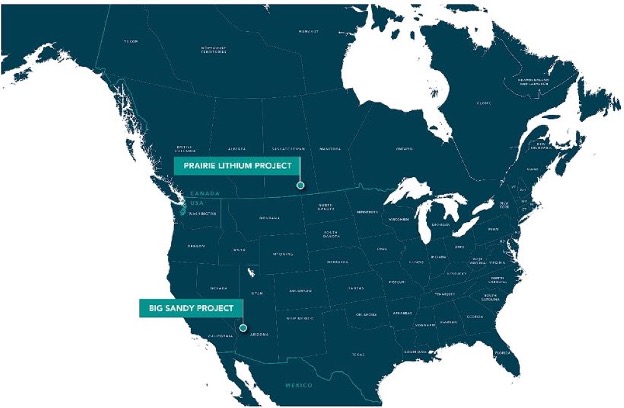

On top of its 5.7Mt Prairie brine resource and pilot plant, Arizona Lithium (ASX:AZL) is also progressing its Big Sandy lithium project in Arizona where it also stations its Lithium Research Centre for testing of brine recoveries.

High recoveries and low impurities

At the one-third point of the scheduled test duration of extraction from Prairie, the pilot plant has processed +80,000L of brine and produced +6,000L of lithium concentrate at an impressive 1,328 mg/L lithium.

Following the completion of a tuning period to exploit the advantages associated with Prairie’s high-quality brine, a baseline steady-state lithium extraction rate of 95.6% was established with excellent stability.

To put this in perspective, Goldman Sachs believes that direct lithium extraction (DLE) tech is expected to average recovery rates of between 70-90% across evaluated brine projects.

Perhaps the most noteworthy achievement to date is the rejection of impurities, which AZL reckons will have a far-reaching impact to downstream operations.

Rejection rates of impurities in the brine showed 99.9%, with the most concentrated cation (sodium) being reduced from 95,640 mg/L in the feed to just 61 mg/L in the concentrate.

This result is nearly 3x lower than previous testing, which AZL says has the potential to have a considerable impact on reducing downstream processing and conversion costs as well as improving product quality.

“When results like these come in way beyond our team’s optimistic expectations, it empowers and motivates the highly skilled lithium team to push the boundaries and take it to another level. These results tell us why we work in the rapidly evolving lithium industry and love everyday,” AZL MD Paul Lloyd says.

What’s next?

The brine developer says the focus for the remainder of the test schedule – which will conclude in February – is on developing control limits and process capability indexes for lithium recovery and rejection of impurities and will be used as the basis for design and economic evaluation for the commercial-scale facility which is scheduled for production in 2025.

The lithium concentrate produced over the duration of the pilot run time will be transported to AZL’s Lithium Research Centre in Tempe, Arizona, where it will be processed and converted to ~100kg of lithium carbonate (or other lithium chemicals) using AZL’s new cross flow reverse osmosis (CFRO) and crystallisation equipment scheduled for installation early next year.

The PFS is on track to be delivered by the end of the December and early indications show Prairie to be an economically robust project.

Lloyd says the high recovery pilot results gives the company further confidence in the process and economics – both of which are due to be released in an upcoming preliminary feasibility study (PFS) – with an eye on commercial production in 2025.

“This pilot is the final step prior to commercialisation and the results of the pilot plant continue to exceed my expectations in terms of both the concentration of lithium and the impurity rejection,” Lloyd says.

“This is all good news as we look to sanction a commercial facility following the PFS.”

This article was developed in collaboration with Arizona Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.