Arizona Lithium delivers some of the world’s lowest operating costs for its Prairie DLE project

The world is in Arizona Lithium’s hands after its PFS delivered extremely low operating cost for its Prairie lithium brine project. Pic: via Getty Images

- Arizona Lithium’s pre feasibility study (PFS) for its Prairie lithium project outlines low operating cost of US$2,819/t

- Modelled 6,000tpa production module covers less than 3% of the 4.5Mt LCE indicated resource

- Production modules can be easily replicated allowing quick output boosts with the potential to boost economics

Special Report: Arizona Lithium has released a pre feasibility study for its Prairie brine project in Saskatchewan, Canada, that sketched out operating costs of US$2,819/t – amongst the lowest globally.

It follows the recent upgrade in resources by 10.5% to 6.3Mt of contained lithium carbonate equivalent – including 4.5Mt in the higher confidence indicated category – after expanding its project acreage.

Additionally, direct lithium extraction (DLE) pilot testing has successfully produced more than 6,000l of lithium concentrate grading an impressive 1,328 mg/L lithium while establishing an attractive baseline steady-state lithium extraction rate of 95.6%.

To top it off, Prairie benefits from being in one of the world’s top mining friendly jurisdictions with easy access to key infrastructure including electricity, natural gas, fresh water, paved highways, and railroads.

Low cost DLE production

The large indicated resource and successful DLE pilot testing has allowed Arizona Lithium (ASX:AZL) to release a PFS outlining robust economics for a Phase 1 production of 6,000tpa of LCE from the Prairie lithium project.

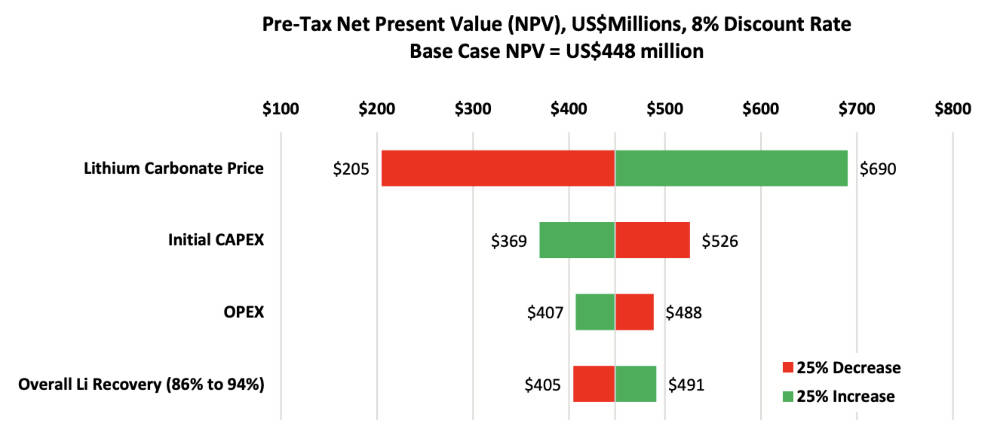

Besides annual operating costs of US$2,819/t over its operating life, the PFS also calculated base case net present value and internal rate of return – both measures of a project’s profitability – of US$448m and 23.9% respectively while Capex is a palatable US$290m.

This assumes a discount rate of 8% and a conservative long-term lithium carbonate price of US$21,000/t.

Adding interest – and highlighting massive potential for expansion – the modelled 20-year commercial operating life represents less than 3% of the indicated resource.

The PFS economics for the 6,000tpa module can also be easily replicated, allowing AZL to use additional modules to bring production up to 20,000-25,000tpa under Phase 2 after bringing Phase 1 online as early as 1H 2025 and multiples of that in Phase 3.

“We are delighted to be able to present the market with the PFS for our 100% owned Prairie lithium project. We have a world class Lithium resource that will produce a quality product at an extremely low operating cost of USD $2,819 per tonne,” managing director Paul Lloyd said.

“The PFS applies a realistic discount rate of 8% and a conservative lithium price of USD 21,000 per tonne. This PFS will stand up to any evaluation by shareholders and industry participants and I am very proud of the team’s confidence and professional integrity to put these realistic and robust numbers out into the public domain.

“Our initial production target is 6,000tpa for our first module, which is just the beginning. We believe we will be able to replicate this, with even lower costs.

“After we have delivered the first module, the company aims to sanction further modules at the same or better economics to the first module. We are now ready to begin drilling the production and disposal wells and ordering equipment for production starting in 2025.”

Chief technology officer Brett Rabe added that the company was comfortable from a technology standpoint to bring the project into production.

“From an economics standpoint the PFS proves the exceptional potential of the greater Prairie Project,” Rabe added.

“Now we will look to replicate and improve on these results for our commercial modules”.

This article was developed in collaboration with Arizona Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.