Ardiden’s 48pc share price spike proves investors still love lithium

Mining

Mining

Investors are still stupid in love for battery metals, creating a minor problem for junior lithium explorer Ardiden when the ASX issued a ‘please explain’ over its share price.

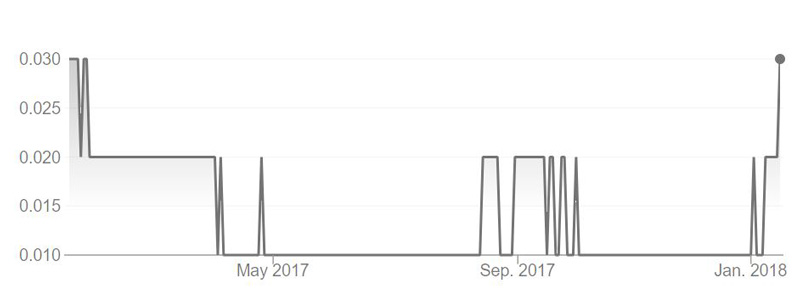

Its shares spiked 48 per cent on Tuesday to a new 52-week high of 3.7c on no news.

This is the second speeding ticket the company has received in less than two weeks.

Ardiden (ASX:ADV) told the bourse it was not aware of any information that had not been announced that could explain the sudden spike in trade.

Over 165 million shares changed hands on Tuesday.

Players in the battery metals space have enjoyed spectacular share price gains recently, the most notable being lithium AVZ Minerals which in the past year has gone from a penny stock to a now nearly $600 million company.

AVZ has rocketed over 1800 per cent since this time last year as it closes in on a maiden resource at its 60 per cent-owned Manono lithium project in the Democratic Republic of the Congo.

There has been “widespread market acknowledgement that lithium will be in short supply”, Ardiden told investors.

“And this is affecting the price of lithium producers and explorers generally, particularly for lithium projects in stable tier one geographical regions such as Ontario Canada.”

Lithium has attracted the interest of many junior explorers due to the anticipated growth in demand, led by the expanding next generation battery market and electric vehicles.

Market intelligence firm Roskill estimates that by 2026 the transportation market for lithium ion batteries will have grown 40 per cent on 2016 levels.

Ardiden previously announced that it was planning to fast track its Seymour Lake lithium project in Ontario.

The company expanded its flagship project in December with the granting of two new claims on the southern edge.