Antipa’s numbers write compelling story for standalone gold development at Minyari Dome

Antipa’s scoping study has identified Minyari Dome as a very attractive gold development. Pic: Getty Images

- Antipa Minerals’ updated Minyari Dome scoping study delivers extremely attractive economics for standalone development

- Project could deliver post-tax NPV of $598m and IRR of 46% using a conservative $3000/oz gold price

- AISC estimated at $1721/oz while Capex of $306m could be paid back just two years from the start of production

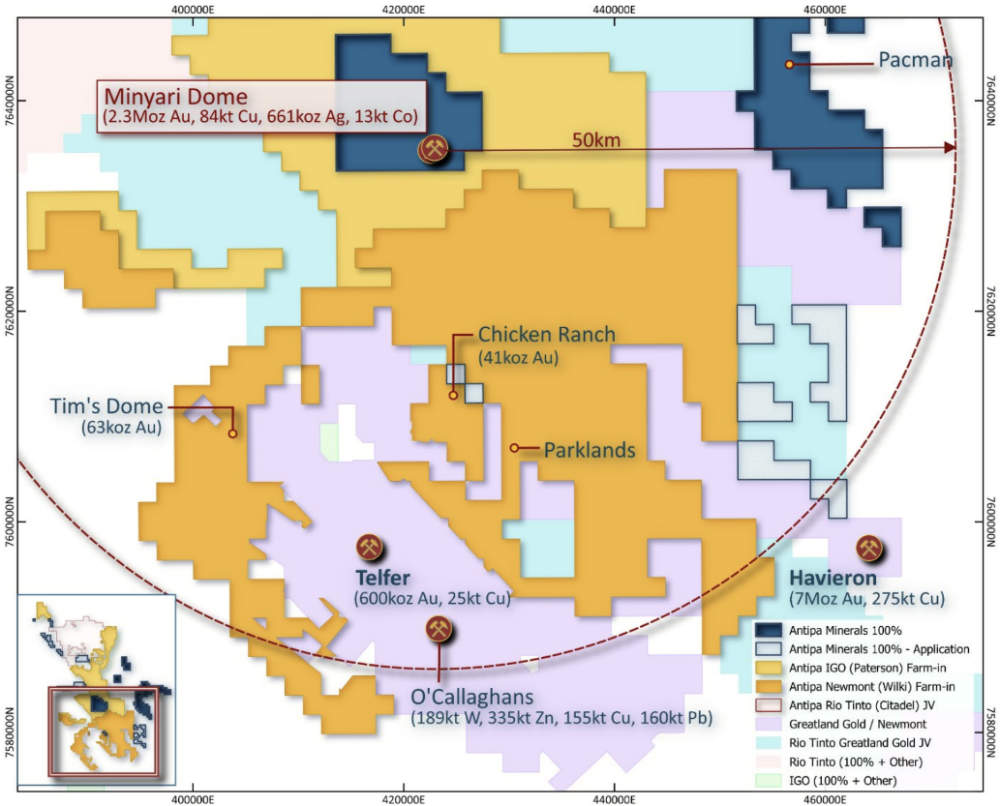

Special Report: Antipa Minerals’ updated scoping study has clearly outlined the attractiveness of a standalone development of its flagship Minyari Dome gold project in WA’s Paterson Province.

Using a conservative assumed Australian gold price of $3000/oz, the study found the project could deliver post-tax net present value (NPV) and internal rate of return (IRR) – both measures of profitability – of $598m and 46% respectively from the production of 1.3Moz of gold over an initial 10-year mine life (an average rate of 130,000ozpa).

These numbers jump significantly to NPV of $1.2bn and IRR of 79% using a $4000/oz gold price, hardly unrealistic given the precious metal has been commanding more than that on the spot market for the past week or so.

Antipa Minerals’ (ASX:AZY) updated study also forecast an all-in-sustaining cost of $1721/oz and estimated pre-production capital – including $90m for pre-production mining – at $306m with payback in about two years from production commencement.

This is thanks to a combination of the high gold price, the 33% increase in resources to 30.2Mt at 1.5g/t since the initial scoping study, and Minyari Dome’s simple non-refractory metallurgy that allows for processing through a standard carbon-in-leach plant capable of delivering 90% gold recovery.

“This updated scoping study has reaffirmed the technical robustness and commercial attractiveness of a stand-alone gold mining and processing operation at our flagship 100%-owned Minyari Dome project,” managing director Roger Mason said.

“Over the past 18 months, Antipa has further unlocked the potential of Minyari Dome, delivering a 33% increase in the mineral resource estimate, along with a pipeline of new high-prospectivity gold-copper targets.

“With significant potential for further value to be added via success with the drill bit, we remain committed to a substantial exploration programme through 2024 and 2025 across our 100%-owned Minyari Dome Project.

“Strategically, Minyari Dome’s location – just 35km from Newmont’s (soon to be Greatland Gold’s), Telfer 22Mtpa processing facility – adds further optionality.

“While the base case remains a stand-alone operation, as outlined in this scoping study update, we will naturally continue to assess in parallel any potential third-party pathways that may offer greater risk-weighted value for our shareholders.”

Potential for growth

The Minyari Dome gold-silver-copper-cobalt project sits about 35km from the Telfer gold-copper-silver mine and mineral processing facility, and 450km east of Port Hedland.

Importantly, this allows it to benefit from proximity to existing infrastructure including access to bitumen and gravel roads, the Telfer Mine gas pipeline, the planned Asian Renewable Energy Hub that is proposed to generate up to 26 gigawatts of electricity using solar and wind power, port facilities at Port Hedland and airports.

AZY’s updated scoping study was completed by Snowden Optiro and Strategic Metallurgy to provide a revised preliminary technical and economic study of the project’s potential viability.

It is underpinned by the Minyari deposit, which accounts for 95% of the estimated gold ounces, with the remaining 5% sourced from the GEO-01 and WACA deposits.

While two processing facility options – a gold-silver case and a polymetallic scenario – with multiple throughput rates of 1Mtpa to 3Mtpa were assessed, the study identified a gold-focused development with a plant throughput rate of 3Mtpa as the optimal approach to deliver highly attractive returns at this stage.

However, the company has also outlined numerous opportunities to extend the mine schedule and operating life.

These include:

- Targeted down-plunge extensional drilling success at Minyari and WACA

- Drill-out of the recent discoveries at Minyari Southeast, GEO-01, GP01, and WACA East

- Further delineation and incorporation of existing satellite resources; and

- New discoveries across the broader Minyari Dome project area.

Contributions from copper and cobalt by-products could further enhance the project’s potential.

The road forward

AZY recently started an aggressive 2024 Phase 2 drilling program that will run through the December 2024 quarter.

The program of 66 reverse circulation holes totalling 10,000m and four diamond holes for up to 1000m is aimed growing existing resources at the GEO-01 deposit and Minyari Southeast.

It will also pursue new gold discoveries within multiple high-priority areas such as GEO-01 South and North, the Minyari Southeast extension target and the Minyari Plunge target.

The company is also planning multiple growth-focused drilling programs for 2025 and will continue to advance – in parallel – various technical work streams designed to further de-risk and refine the development opportunity.

This article was developed in collaboration with Antipa Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.