Antipa in pole position as Paterson exploration hots up

Pic: Via Getty Images

The majors are getting serious in WA’s Paterson Province, most recently with Newcrest throwing millions of dollars at an expansion of its Telfer gold-copper-silver mine and speeding ahead with the development at the Havieron gold project.

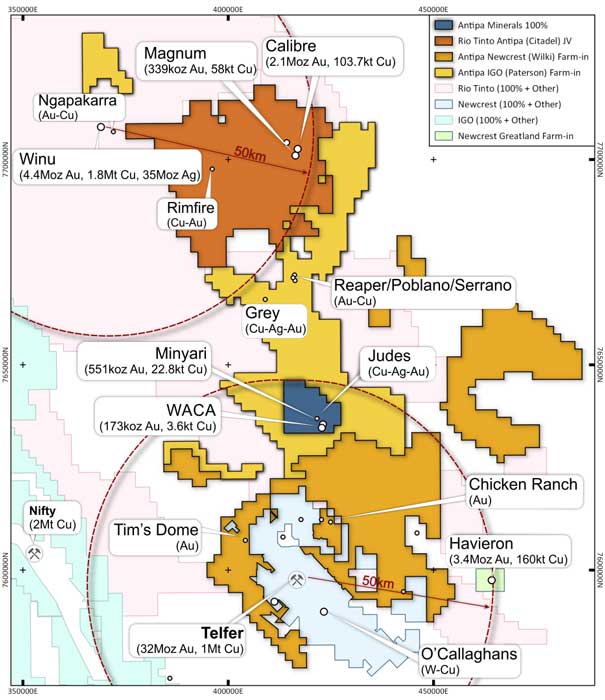

This makes for an interesting story for junior gold explorer Antipa Minerals (ASX:AZY), which not only counts Newcrest Mining (ASX:NCM) as a JV partner in the Paterson, but also Rio Tinto (ASX:RIO) and IGO (ASX:IGO).

And Antipa also has a wholly owned high-grade discovery in the Paterson, Minyari, that sits within 35km of the Telfer mine and processing facility and 54km along strike from Newcrest’s and Greatland Gold’s Havieron project.

The Paterson shot to fame in 2018 following rumours Rio had made itself a major copper find in the region.

Subsequent confirmation of the Winu copper-gold-silver find by Rio and the discovery of Havieron by AIM-listed Greatland Gold in the same year only intensified the interest.

Antipa already held a commanding Paterson land position and so hit the ground running.

A mammoth drilling blitz is underway at the company’s four Paterson Province precious and base metals projects, with nine rigs in operation undertaking 62,000m of drilling.

Exploration at three of the projects is largely funded by Newcrest, Rio and IGO. This equates to a cumulative potential free-carried exploration spend of up to $115m.

On top of that, Antipa is very flush with cash with nearly $31m at the end of the June quarter.

So, it’s not surprising the big guys are watching the company very, very closely. Especially as the gold price stages a rebound and heads back up towards $US1800 ($2,486) an ounce.

Newcrest is undoubtedly interested in Antipa’s Wilki Project, which comes within 3km of Telfer surrounding the mine on three sides, as a potential source of fresh ore for the ageing mine.

While Rio made sure it got into the company’s Citadel Project to lock up any potential new discoveries close to its 4.4Moz gold, 1.8Mt copper and 35Moz silver Winu project that is scheduled for first production in 2025.

Demonstrating just how serious Rio is, the heavyweight expanded its 2021 exploration budget for the Citadel JV to $24.5m.

Of course, IGO also wanted a piece of the action, striking a $30m farm-in deal with Antipa over the Paterson Project.

Most recently, drilling by Antipa on its 100% owned Minyari Dome Project has been delivering the goods, with results confirming significant zones of very high-grade gold-copper mineralisation outside the current Minyari resource.

Drilling has also further proven that the high-grade mineralisation is commonly associated with sulphide matrixed breccia zones similar to the 3.4Moz gold and 160,000t copper Havieron project.

High-grade gold-copper mineralisation has so far been intersected along 500m of strike and down to 600m below surface. But demonstrating there is still plenty of exploration upside, the Minyari mineralisation remains open in several directions.

“Resource definition drilling continues to intersect strong gold mineralisation over wide intervals which will support a revised resource estimate and development studies,” Managing Director Roger Mason said.

Minyari Dome Project currently hosts a total resource of 723,000 ounces of gold at 2 grams per tonne (g/t) and 26,000 tonnes of copper at 0.24% within the Minyari and WACA deposits.

The phase two drilling programme at Minyari Dome is due to be completed in October, with a resource update slated for release before the end of the year.

This article was developed in collaboration with Antipa Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.