Antipa adds $17m to the kitty as Rio splashes cash on Citadel gold project

M&A in the prolific Paterson Province in WA has seen hundreds of millions of dollars changing hands this week. Pic: Getty Images.

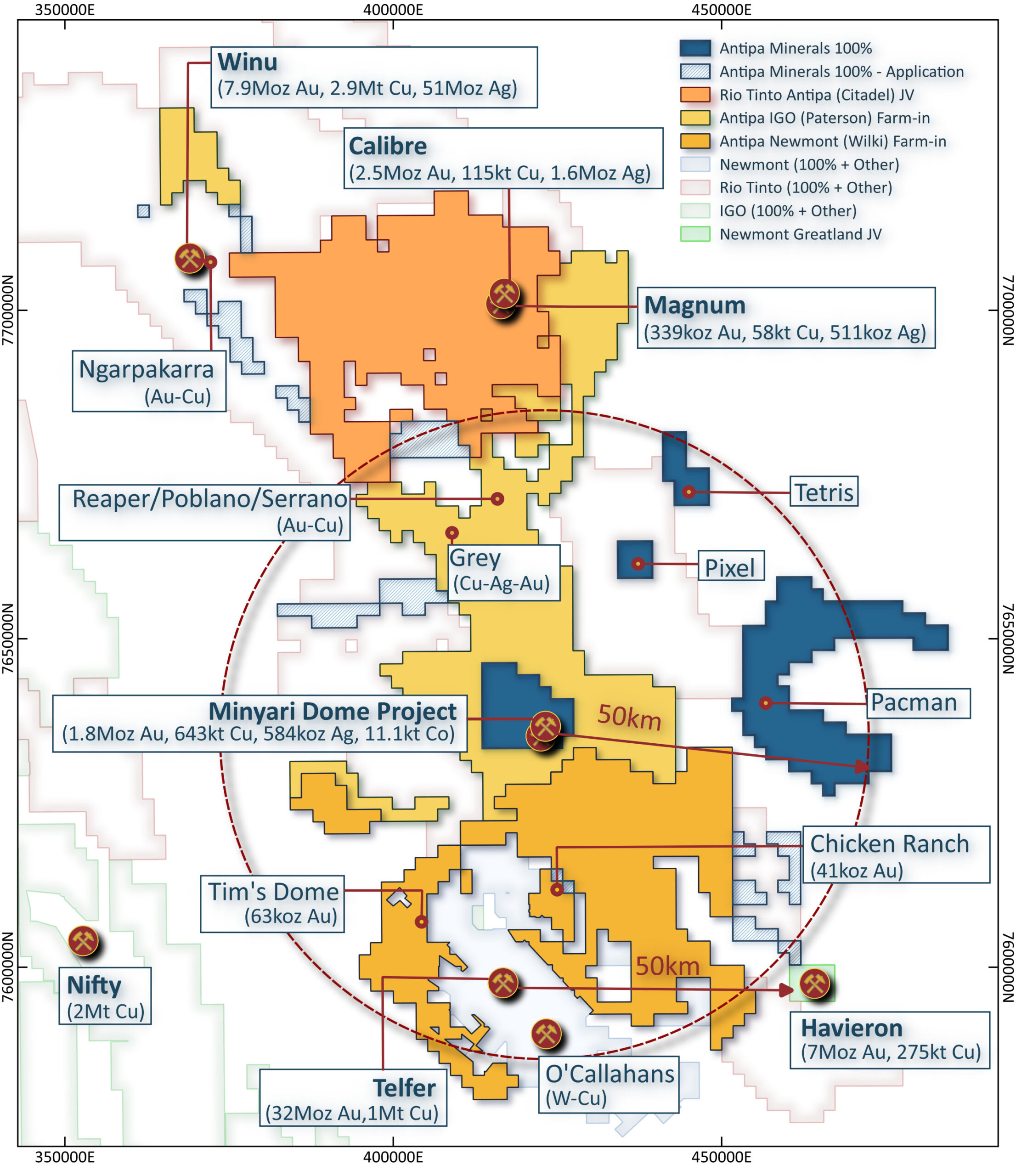

- Rio buys Antipa’s 32% interest in the Citadel gold-copper project in WA’s Paterson Province for $17m cash

- Cash injection will be used by Antipa to fund drilling programmes and development appraisal activities across its 100%-owned Minyari Dome Project

- Move comes right after Greatland Gold buys out Newmont assets in region for $475m

Special Report: Antipa Minerals has agreed to sell its 32% non-controlling interest in the Citadel JV gold-copper project in WA’s Paterson Province to Rio Tinto for $17m in cash, boosting its cash reserves to ~$23m.

This substantial cash injection will allow Antipa Minerals (ASX:AZY) to realise a range of exploration plans for its 100%-owned Minyari Dome gold-copper project, in the same region where M&A activity has been heating up.

And by hot, we mean sizzling. The consolidation of Citadel by Rio Tinto (ASX:RIO) comes right off the back of Greatland Gold’s $475m purchase of the historic Telfer gold mine and remaining 70% stake in the nearby Havieron from Newmont (ASX:NEM), which marked the half-century old gold-copper mine as non-core after its multi-billion dollar acquisition of Newcrest last year.

Citadel is comprised of the Calibre and Magnum deposits, which boast a combined 2.8Moz gold at 0.7g/t, 173 kt copper at 0.13% and 2.1Moz at 2.1 g/t silver resource.

Rio, which owns the massive 7.9Moz gold and 2.9Mt copper Winu deposit nearby, has spent in excess of $47m over the years on exploration at Citadel to earn its 68% interest and the transition to full ownership is expected to be completed by November.

Antipa CEO Roger Mason says cash from the Citadel sale will provide solid financial support to accelerate development at Minyari Dome, with updates to resource estimates and a revised Scoping Study also expected this month.

“Rio Tinto was the natural buyer for Citadel, and the $17m all-cash consideration fully reflects current value of our interest in the asset, positioning us to focus on unlocking the full potential at Minyari Dome,” Mason said.

“Our team is busy finalising an update to the existing Minyari deposit Mineral Resource including simultaneously preparing a maiden Mineral Resource for GEO-01.

“Together, these deposits will form the basis for a revised Minyari Dome Scoping Study and we look forward to sharing the outcomes from these project advancement milestones in the coming weeks.”

As part of this week’s announced Telfer and Havieron acquisition, Greatland will also pick up Newmont’s 8.6% stake in Antipa, with assignment of Newmont’s Wilki Farm-in with AZY requiring AZY’s consent, validation of the important role AZY’s Minyari Dome potential gold production will play in the Paterson Province’s future.

What’s next for Minyari?

AZY plans to update the Minyari Dome resource estimate and its Scoping Study, as well as deliver the GEO-1 maiden resource in September 2024.

A Phase 2 drilling programme is in the final stages of development, which will be comprised of RC and diamond core drilling focused on resource expansion at Minyari and GEO-1 and has been pegged to kick off in Q4 this calendar year.

This article was developed in collaboration with Antipa Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.