Antimony’s a new market darling and its future looks bright

Antimony is the new market star. Pic: Getty Images

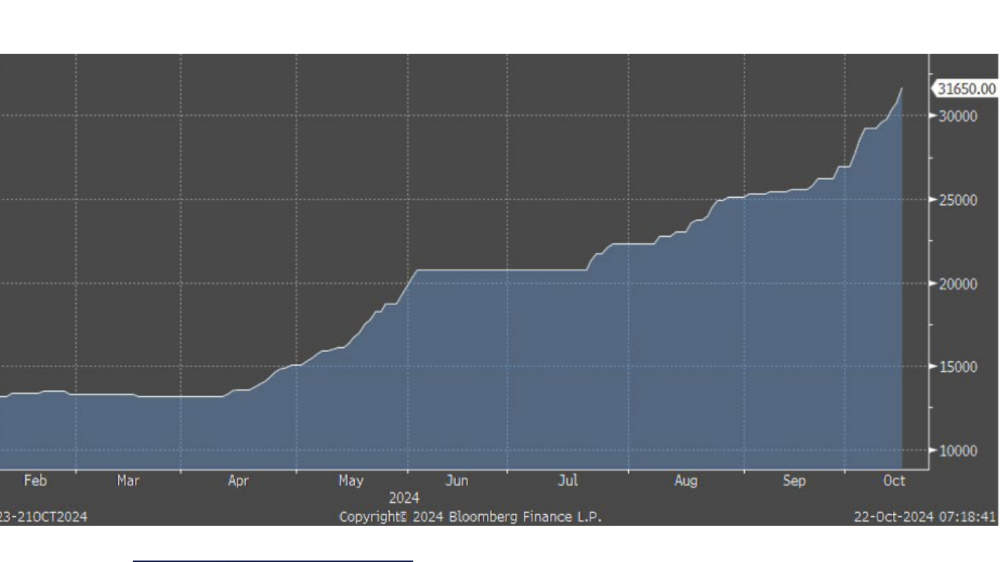

Once considered just a by-product of gold production, antimony has come into its own in recent months, having dominated headlines as prices soared.

Besides rising prices and growing investor interest, the clearest sign of how interest in the lustrous grey metal has grown is in the number of companies actively exploring for it or looking to be involved in it – increasing from six to eight players in the middle of this year up to just under 40 companies.

So why has antimony exploded?

Traditionally used to make flame-retardant materials, paints, enamels, glass, pottery, bullets and cable sheathing, prices started climbing in response to its increasing use in solar panels to increase their efficiency.

This resulted in an increasing amount of antimony going into solar panels that was coupled with an uptick of military consumption of antimony thanks to active wars in Ukraine and the Middle East depleting stockpiles – all leading prices to break the US$20,000/t mark for the first time, in May this year.

However, prices really started soaring after dominant producer China announced in August 2024 that it will place restrictions on the exports of antimony products from September, likely in part to retain its leadership in producing inexpensive yet efficient solar panels.

Antimony is currently priced at about US$33,500/t.

Speaking to Stockhead, Blue Ocean Equities analyst Carlos Crowley Vazquez said following the Chinese export ban, anecdotal evidence has traders chasing every available tonne from smaller operators that can consistently deliver antimony product.

Prices likely to stay elevated

“One of the most common questions we get is around sustainability of current price levels and while the best cure for high prices is high prices (incentivising new production), you have to consider the physical reality that many of the mines that contain antimony have some level of vertical zonation (higher-grade antimony near surface),” said Vazquez.

“These high-grade zones are or have been depleted which, in addition to growing demand, drives the need for new mines to keep up with demand.”

Larvotto Resources (ASX:LRV) managing director Ron Heeks concurs, saying that while he can’t see a reason for the market to go down, he can see several reasons for it to go up.

“The nature of these ore bodies is that you get a lot of antimony at surface, then it goes to a more even mix, which is where we sit, and below that it goes to high-grade gold like at Fosterville,” he told Stockhead.

“These deposits around the world have been mined for 30-40 years, they have taken out most of the antimony and that’s why production is falling.”

He pointed to Australian producer Costerfield as an example, noting its production has fallen from some 2500t per annum to just 300tpa.

The other factor is a lack of exploration, with Heeks adding that with little, if any, exploration for antimony in recent years in an exploration powerhouse like Australia, there would be little exploration for the metal elsewhere in the world.

Well-known exploration and processing

With the high prices, growing demand and falling supplies, this lack of exploration will change quickly with Octava Minerals (ASX:OCT) managing director Bevan Wakelam noting that exploration for antimony is similar to that for gold – unsurprising given how often antimony has been found in the exploration for the precious metal.

“Antimony deposits are typically formed in structural settings – movements of the earth like faulting create opportunities for mineralised fluids to enter the cracks caused by the faulting. That occurs with gold as well,” Wakelam told Stockhead.

Processing is also uncomplicated, requiring crushing, grinding and flotation.

“It’s a very well known route for processing – it’s not hard at all,” he added.

This typically leads to the production of a concentrate that will then be sent to China for processing.

Wakelam acknowledged that while processing to a final product would be ideal, it would also result in much steeper capital requirements.

Australia poised to benefit

With China, Russia and Tajikistan responsible for about 80% of current antimony supply and Chinese export restrictions on critical metals likely to increase in response to additional tariffs imposed by the incoming Trump administration, Vazquez believes Australia should benefit from its close commercial and defence ties with the US as well as its geological endowment, particularly in antimony.

This might become a reality sooner than most would think.

LRV’s advanced Hillgrove antimony-gold project has an existing 1.7Moz gold equivalent resource – including the largest antimony resource in Australia, existing infrastructure and mine development – so it is not surprising that Heeks has the ambitious goal of bringing it back into production by the end of 2025.

What’s even more remarkable is that the project is expected to churn out 7% of the world’s antimony once it is up to speed, an undertaking that will take a paltry $80m to achieve.

Indeed, Heeks said the hardest part of convincing investors is that the company managed to land the resource, >$200m worth of on-site infrastructure and $150m worth of underground development for just $3m in cash and $5m for replacement of government bonds.

“It would be interesting to see what the asset is worth now if someone were selling it – it wouldn’t be $3m,” he added.

Hillgrove certainly tracks well against Perpetua in the US, whose resource has a grade of just 0.06% antimony compared to the 1.6% grade contained within Hillgrove’s measured and indicated numbers, while Southern Cross Gold’s (ASX:SXG) Sunday Creek gold-antimony project still possesses just a conceptual exploration target of 1-1.6Moz gold equivalent at a grade range of between 7.2g/t to 9.7g/t gold equivalent.

Juniors in the space

However, even Hillgrove wouldn’t be enough to diversify the world’s sources of antimony away from China on its own and, as Vazquez noted, the rush to pick up ground prospective for antimony has already started “as night follows day”.

He called for caution, though, as it’s still early days and some companies might not even make it to a resource or have ground too close to areas that would preclude mining approvals.

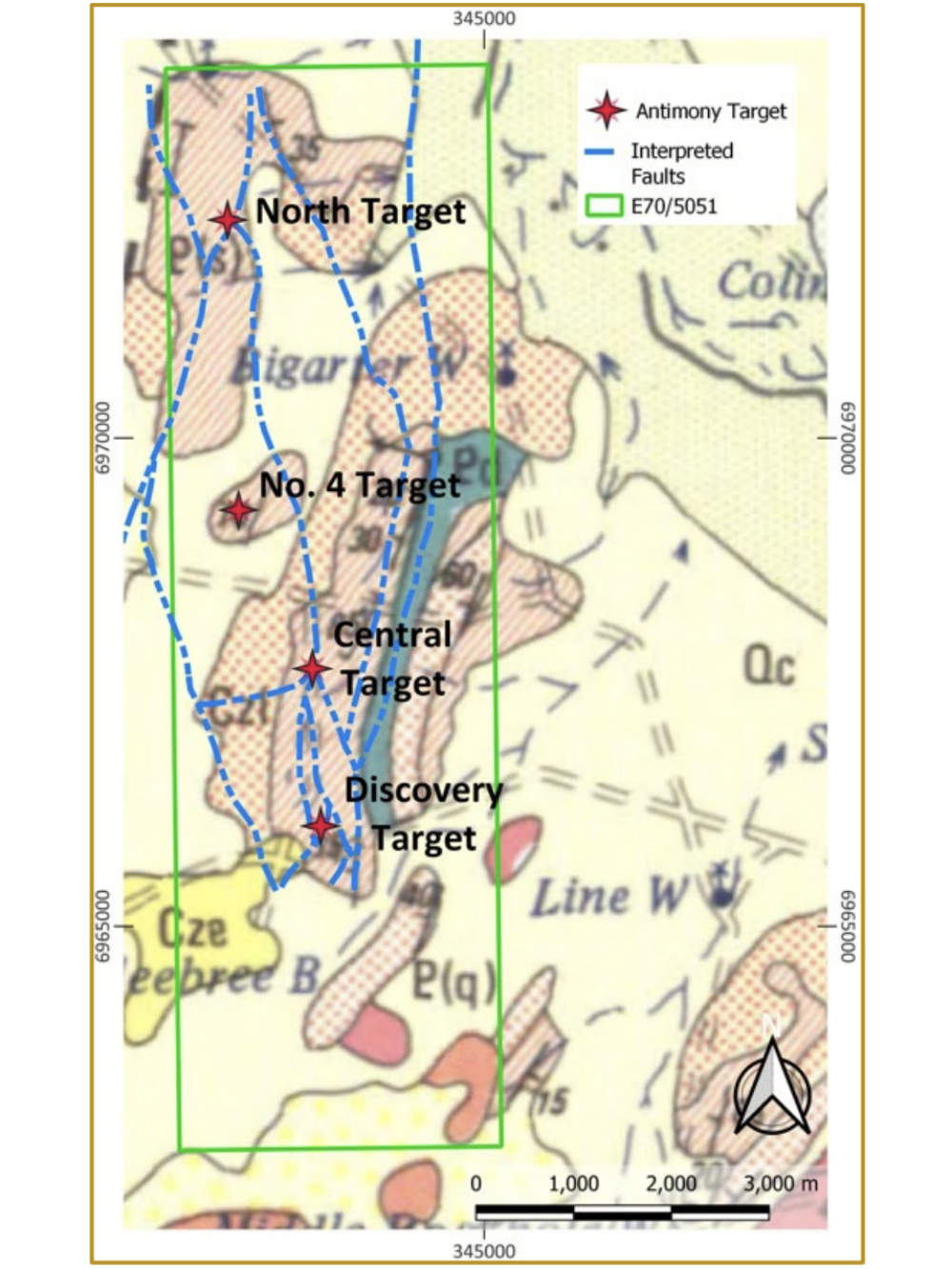

Wakelam’s OCT is one of the juniors looking to make waves in the sector with its Yallalong project in WA’s Midwest region, which benefits from historical exploration that has already established the presence of antimony.

In mid-November 2024, the company mobilised a rig to carry out a 3000m reverse circulation program to test lateral extensions of existing, known high-grade antimony mineralisation at the Discovery prospect, where historical drilling returned hits of up to 7m at 3.27% antimony from 12m over a strike of ~300m.

Drilling will also be carried out at the undrilled Central antimony prospect about 2km north along strike, while another two targets will be tested at a later date.

Meanwhile, Trigg Minerals (ASX:TMG) has built up its inventory of targets at the recently acquired Achilles project in NSW with multispectral analysis adding another 30 targets.

Achilles includes several historical high-grade antimony mines across a substantial 6km strike that have not undergone systematic exploration. It also includes the Wild Cattle Creek deposit that features intersections such as 10.7m at 14.24% antimony.

In September, Legacy Minerals Holdings (ASX:LGM) dusted extensive high-grade antimony and gold rock chips over the Lunatic Field that are indicative of mineralisation similar to that found at LRV’s Hillgrove Mine – a top-10 global antimony deposit – about 190km to the south.

Across the Tasman Sea, New Age Exploration (ASX:NAE) has defined nine high-priority gold, antimony and tungsten drill targets at its Lammerlaw permit in New Zealand. Part of the proceeds from a recent $1.75m placement will fund drilling in Q1 2025.

Over in Nevada, Sun Silver’s (ASX:SS1) inaugural drilling at its Maverick Springs project intersected not only silver, it also struck antimony, leading the company to say it would continue to assess its potential.

Meanwhile, Equinox Resources (ASX:EQN) rock chip sampling at the Alturas project in British Columbia, Canada, has returned up to 69.98% antimony.

At Stockhead, we tell it like it is. While Equinox Resources, New Age Exploration, Octava Minerals, Sun Silver and Trigg Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.