Anson stayed the course on lithium – now it’s in pole position for the new battery race

Anson is ready to race as lithium prices stage a rebound. Pic: Getty Images

- Lithium prices have been moving higher in recent weeks, with experts now tipping a recovery as early as next year

- Juniors who have maintained the pace of investment in their assets, like Anson Resources, are well placed to win big in the next cycle

- Anson’s Utah lithium brine play Green River could hold advantages over the Smackover plays of energy majors Chevron and ExxonMobil

Lithium’s revival has been foreshadowed by those in the know since early this year, when it became readily apparent energy storage demand would widely outstrip prevailing market expectations.

The revelation of this new and growing source of demand, coupled with supply discipline from Australia to China, has turned even the slow-moving mainstream bullish.

Just months after predictions a lithium winter that had seen chemical prices slide as low as ~US$7500/t could send explorers into hibernation as long as White Walkers north of the wall, investment banks have changed their tune.

As spot spodumene sales topped US$1250/t and chemicals moved towards US$13,000/t for the first time in around 18 months, Canaccord last week upped forecasts to a peak of US$25,000/t for chemicals and US$2250/t for spodumene in 2027 while Barrenjoey raised to US$3250/t for spod in 2026.

JPMorgan’s seemingly revelatory tip of US$1100/t spod in 2026 and US$1200/t in 2027, 50% increases when those predictions were announced in October, could be blown through in days.

For lithium juniors who saw through the short-term volatility and stayed the course progressing their assets when others moved into more fashionable fields like precious metals, the shift in the discourse has been vindicating.

“We do feel vindicated that the strategy is correct and there’s a lot of things happening in the lithium space,” Anson Resources (ASX:ASN) executive chairman and CEO Bruce Richardson told Stockhead.

Anson was an early mover in the American lithium space, where it is looking to extract the battery metal from brines located in wells previously drilled for oil and gas.

“This is the third wave that we’ve seen since we started working on our project in 2017, the third wave of the lithium price zooming up and then coming back again,” he said.

“It’s still an immature market. But overall, the trends are our friends.

“You look at the trend and everything is becoming electrified with batteries. There are improvements that they’re making in the technology and use of lithium batteries, new batteries coming up and new uses for them.”

Big batteries

Battery energy storage systems have been the big catalyst for the early swing of lithium into deficit.

Electric vehicles remain the key driver – upwards of 60% of demand for a metal that, despite its abundance, was largely used a decade ago in uninspiring markets like ceramics.

But BESS, around 3% of the demand picture only a couple years ago, has run to 23% of the overall market as installation costs have dropped. The rapid rollout of wind and energy has required a ramp up in back up power – driving economies of scale.

That has eaten into the surplus caused by oversupply, that sent prices tumbling 90% from 2023 to mid-2025 and chilled interest in lithium exploration.

Those who stayed the course and backed the trend are, arguably, now well-placed to lead in the next cycle.

“It was anticipated a year or so ago that that would happen,” Richardson said.

“Overall, it’s another wave and the total amount of lithium being used continues to rise and it’s predicted to keep doing that for the next decade or so.”

Anson’s Green River and Paradox lithium projects are located in Utah, arguably the best placed jurisdiction in the world for new resources developments if chatter from government figures is anything to go by.

And even before the mining-friendly Trump administration entered the fold this year, Anson held a letter of intent from the US Export-Import Bank to provide US$330m in funding for a planned direct lithium extraction plant in the Paradox Basin.

Richardson said support for critical minerals was evident in its interactions with regulators, even if EV subsidies introduced by Democrat Joe Biden have been pulled by his Republican successor.

“He’s thinking about national security issues and the need that US has to have their own supply chain. The batteries ware one of the first areas they focused on,” he said.

“Now it’s critical minerals, particularly magnets. And there’s a whole bunch of military applications for critical minerals, including lithium batteries, magnets.

“So the emphasis is still there on lithium and wanting to have domestic production of lithium.

“The project we have is a little bit different to the overall world market, China still being the main provider of batteries, electric vehicles, and also solar and wind.

“In our case, our project being in the US, it’s a little bit special where you’ve got a geopolitical change to drive domestic production within the United States, which works for us as well.”

Early mover

Anson’s big advantage is its early move into a style of lithium exploration now being championed by the world’s largest energy companies.

Chevron and ExxonMobil, keen to hedge against a potential fall in oil demand, have been drilling into fields in Arkansas and Texas seeking a new source of lithium unique to the US.

The optionality in this style of leases was demonstrated when Pantera Lithium (ASX:PFE) sold its Smackover project to Nasdaq-listed EnergyX in a $40m deal, and that was in a down market.

Richardson says Anson’s Utah leases have distinct advantages over those being explored by the majors in traditional oil and gas regions in Arkansas and Texas.

“Our brine is more pure, which means it’s easier to upgrade into an EV battery grade product … which means it’s lower cost,” he said.

Anson has connections to the big end of town. It piloted a DLE technology developed by America’s second biggest private company Koch Industries – a tech now sold to a water treatment firm called Aquatech which has patents running the entire breadth of the lithium extraction supply chain.

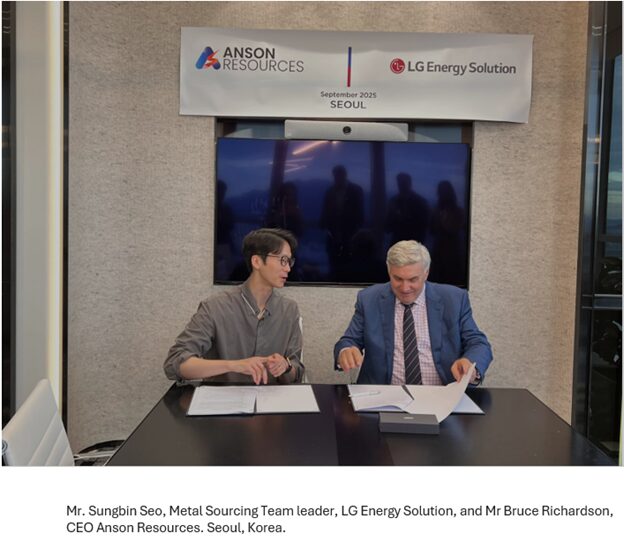

Now, Anson has a non-binding memorandum of understanding with Korea’s POSCO to develop a demonstration DLE plant, with due diligence required to make an investment decision expected to be complete by December this year.

Historically known as a steel producer, the Asian industrial giant is one of the most aggressive lithium and EV battery players outside China, recently paying Mineral Resources (ASX:MIN) $1.2bn for a 15% share in each of its Mt Marion and Wodgina lithium mines in WA.

Infrastructure advantage

Anson first trained its drills on the Paradox project, where oil drilling in the 1960s returned high grades of lithium for which there was, at the time, no economic use.

It contains a resource of 1.5Mt of lithium carbonate equivalent – equivalent to around a year’s supply globally of battery-grade lithium – and 7.6Mt of bromine.

But the decision to move on the Green River project in 2023, around 80km up the road, delivered a second site that has quickly become the priority.

In June, Anson reported a maiden JORC resource estimate from drilling in the Bosydaba #1 well of 3.474km3 at an average of 93.5mg/L Li for 20,000t of lithium metal or 103,000t on a lithium carbonate equivalent basis.

Of that, around one-fifth is indicated, a level of confidence high enough to convert to reserves.

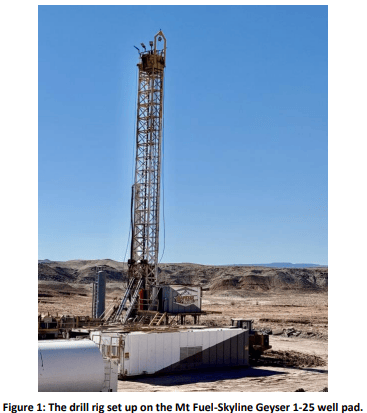

That will get bigger: the well represents just 24% of the property area and Anson has approval to re-enter the historic Mt Fuel-Skyline Geyser well, which it started in late October.

An internal exploration target has been set of 1.2-1.5Mt of brine at 100-150ppm Li, equating to LCE of 623,095t-1.18Mt, as much as 11x the current resource estimate.

Richardson says Green River stands out for the quality of its infrastructure, decreasing the cost of getting product to market.

“Green River has existing infrastructure and it has a workforce. (That includes) things like roads, the I-70, part of the highway network, rail, electricity so a lot of power going through that area and water,” he said.

“The Green River goes right next to the property that we selected and the final bit is the properties that we could purchase.”

In Utah most resource-rich ground is owned by the federal and state governments, meaning Anson does not suffer delays from negotiations with land-owners.

Unlike at Paradox, Green River is leased by the State of Utah, cutting out the lengthier federal approval process.

“It makes everything a lot easier,” Richardson said.

“So it’s a very big formation, containing a lot of brine, which would last – literally – thousands of years for lithium production.

“To maximise our returns on investment, we chose the second project as being our priority. We were able to use existing infrastructure, saving capex and lowering our costs in production as well.”

Anson has restocked its coffers to accelerate work at Green River just as the lithium market begins to turn, raising $14m from investors at 8c after seeing its shares run more than 40% higher in 2025 before the raise.

Having hit a high of 39c in the last boom, there should be more room to grow as the lithium price rebound progresses.

While Anson has well and truly maintained its focus on lithium, it has some handy second stringers in its Yellow Cat uranium and vanadium project in the Thompson District of Grand County in Utah and its Ajana polymetallic project in WA, which contains a resource at the Surprise deposit of 103,000t at 2.7% lead, 0.45% Zn and 1.3g/t Ag.

Richardson said Anson would be looking to progress both in the background next year, with the $14m raising expected to fund the resource upgrade at Green River and associated engineering studies as well as low-cost maiden drilling at Yellow Cat.

At Stockhead, we tell it like it is. While Anson Resources is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.