Anax’s Pilbara copper processing hub is not just a Whim

The creation of a copper processing hub in the Pilbara could unlock development for multiple deposits in the region. Pic: Getty Images

- Anax Metals’ reboot plans for Whim Creek include processing ore from regional partners

- Undeveloped VMS deposits can be made more attractive with processing infrastructure on hand

- Copper prices are back on the rise, climbing above US$9000/t

It’s been 15 years since the last copper processing facility in the Pilbara was mothballed. That was (now) Anax Metals’ (ASX:ANX) Whim Creek operation, which was built by Straits Resources in 2005.

When the copper price tanked in 2009 on the back of the global financial crisis, Whim Creek became uneconomical and was sold to Venturex.

Aurora Minerals (which is now ANX) bought an 80% stake in the project in 2020 and Venturex has been reinvented as WA resources celebrity Bill Beament’s ‘green’ mining and underground mining services business Develop Global (ASX:DVP).

ANX’s 80%-owned Whim Creek (DVP:20%) boasts a high-grade polymetallic and open-pittable copper-rich orebody, with a processing hub that is scoped to be a low-cost, 20,000tpa copper concentrate development up in WA’s Pilbara.

An April 2023 DFS showed the project could spit out $340m in free cash flow, with a pre-tax NPV7 of $224m and an IRR of 54% based on projected prices of gold at US$1800/t, silver at US$22/oz and copper at US$8800/t.

Those commodity prices have since risen substantially, with gold sitting at US$2553/oz, silver at $29/oz and copper at US$9204/t at the time of writing.

With all permits and mining licenses already in place, it’s ready to go, and with rebounding copper prices and long-term demand for the red metal – Deutsche Bank last month said prices of US$10,000/t or above were needed to stimulate the investment required to meet demand forecasts – these types of projects are putting themselves in the shop window.

Copper hub potential

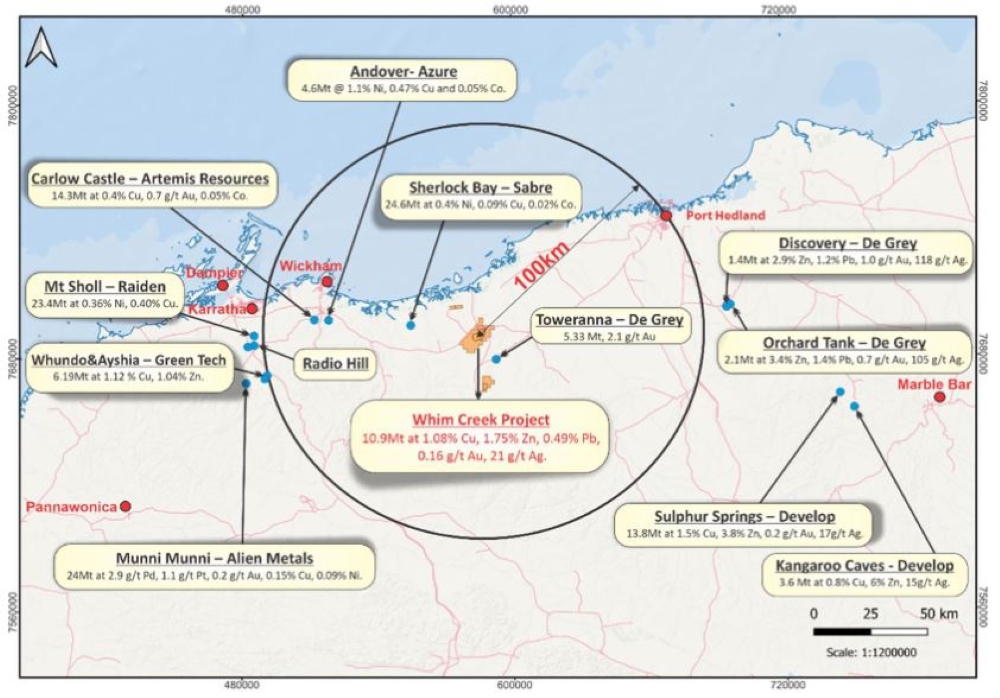

The Whim Creek development is one thing, but ANX has even bigger plans. It’s created a copper alliance that envisages feeding copper and base metal ore from surrounding projects through Whim Creek’s processing hub.

Nearby GreenTech Metals (ASX:GRE) recently signed a memorandum of understanding with ANX to assess the potential to treat its 6.19Mt Whundo & Ayshia resources and other suitable assets through the Whim Creek Processing Hub.

Dubbed the ‘Pilbara Base Metal Alliance’ the two ressies are targeting production of more than 20,000tpa of copper equivalent to start with.

The hub would contain a new 400,000tpa concentrator and a refurbished heap leach facility that can treat oxide, transitional and supergene ores from surrounding projects.

A key drawcard is that development timelines for the Whim Creek project and hub aren’t subject to waiting for green tape to be cut, as ANX has all mining and environmental permits in place already.

For ANX, the alliance increases its exposure to external resources and provides an opportunity for GreenTech to monetise Whundo’s ore in the near-term, whilst progressing exploration.

There’s also the potential for DVP to transport ore to the plant from its Sulphur Springs VMS copper project for heap leaching into saleable copper and zinc products.

These additional oxide and transitional ores are outside DVP’s current mine plan and could represent a new material revenue stream to both DVP and the alliance.

ANX managing director Geoff Laing told Stockhead heap leaching of copper oxide and transitional ores is commonly practiced.

“The Sulphur Springs ore has demonstrated excellent amenability to the process conditions we have applied,” Laing says.

“We’re excited to have demonstrated the excellent response of zinc dissolution to the process as this may facilitate the production of zinc sulphate, a key additive to fertilisers.”

There’s a bunch of other deposits in the surrounding region too, and with a processing hub nearby, capital investment is further de-risked.

A hub for one and a hub for all

“VMS deposits in the Pilbara tend to be reasonably high grade but modest in size. To be building a plant at every mine site is non-sensical, but to have a central facility that’s bringing in high-grade ore from satellite deposits is the obvious way to go,” Laing says.

“It just requires someone to make it happen. Adding to that, it could help stranded assets to be monetised and companies struggling to get development capital to become more attractive.”

Processing hubs are not new. Saracen Minerals did it with Carosue Dam gold mine north of Kalgoorlie, bringing in regional deposits to process through its 4Mtpa CIL plant.

Artemis Resources (ASX:ARV), Azure Minerals, Raiden Resources (ASX:RDN), De Grey Mining (ASX:DEG) and others, all have undeveloped copper and base metals deposits waiting to be tapped into.

Testing of Whim Creek’s Evelyn deposit is currently underway in the form of a 1700m diamond drilling campaign and has so far intersected massive sulphide zones that could be key to growing the already high-grade 10.9Mt at 1.08% copper and base metals resource.

“We’ve got a solid platform to get going and the way things are going, if we have to expand the deposit before the processing plant development, that can be done too,” Laing says.

“That would give us a better and further de-risked project to attract funding.”

At Stockhead, we tell it like it is, while Anax Metals is a Stockhead advertiser at the time of publishing, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.